424B5: Prospectus filed pursuant to Rule 424(b)(5)

Published on July 19, 2021

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-256216

PROSPECTUS SUPPLEMENT

(to Prospectus dated June 14, 2021)

13,333,334 Shares

Common Stock

Red Cat Holdings, Inc.

We are offering 13,333,334 shares of our common stock. The purchase price for each share is $4.50.

Our common stock is listed on The Nasdaq Capital Market under the symbol “RCAT.” On July 16, 2021, the last reported sale price of our common stock on The Nasdaq Capital Market was $7.10 per share.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-6 of this prospectus supplement and the documents incorporated by reference into this prospectus supplement for a discussion of information that you should consider in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | 4.50 | $ | 60,000,003 | ||||

| Underwriting discounts and commissions (1) | $ | 0.315 | $ | 4,200,000 | ||||

| Proceeds to us, before expenses | $ | 4.185 | $ | 55,800,003 | ||||

| (1) | We refer you to “Underwriting” beginning on page S-26 of this prospectus supplement for additional information regarding underwriters’ compensation. |

The underwriters expect to deliver the shares to purchasers on or about July 21, 2021.

ThinkEquity

a division of Fordham Financial Management, Inc.

The date of this prospectus supplement is July 18, 2021.

TABLE OF CONTENTS

Prospectus Supplement

| Page | |

| About this Prospectus Supplement | ii |

| Where You Can Find More Information | ii |

| Incorporation of Certain Documents By Reference | iii |

| Cautionary Statement Regarding Forward-Looking Statements | iii |

| Prospectus Supplement Summary | S-1 |

| Summary of the Offering | S-5 |

| Risk Factors | S-6 |

| Use of Proceeds | S-25 |

| Dilution | S-25 |

| Underwriting | S-26 |

| Legal Matters | S-33 |

| Experts | S-33 |

Prospectus

| Page | |

| About this Prospectus | 3 |

| Cautionary Statement Regarding Forward-Looking Statements | 3 |

| About Red Cat Holdings, Inc. | 3 |

| Risk Factors | 5 |

| Use of Proceeds | 5 |

| Description of Common Stock | 5 |

| Description of Preferred Stock | 6 |

| Description of Warrants | 7 |

| Description of Units | 8 |

| Plan of Distribution | 8 |

| Experts | 11 |

| Where you can find more information | 11 |

| Incorporation of Certain Documents by Reference | 11 |

You should rely only on information contained in this prospectus. We have not, and the underwriter has not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful or in any state or other jurisdiction where the offer is not permitted.

For investors outside the United States: Neither we nor the underwriter has taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby and the distribution of this prospectus outside of the United States.

The information in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

| i |

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is the prospectus supplement, including the documents incorporated by reference, which describes the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. Before you invest, you should carefully read this prospectus supplement, the accompanying prospectus, all information incorporated by reference herein and therein, as well as the additional information described under “Where You Can Find More Information” on page ii and “Incorporation of Certain Information by Reference” on page iii of this prospectus supplement. These documents contain information you should consider when making your investment decision. This prospectus supplement may add, update, or change information contained in the accompanying prospectus. To the extent that any statement that we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus or any documents incorporated by reference, the statements made in this prospectus supplement will be deemed to modify or supersede those made in the accompanying prospectus and such documents incorporated by reference.

You should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free writing prospectuses we authorize for use in connection with this offering. Neither we nor the underwriter have authorized any other person to provide you with any information that is different. If anyone provides you with different or inconsistent information, you should not rely on it. We are offering to sell, and seeking offers to buy, the securities offered hereby only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the offering of the securities offered hereby in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering of the securities offered hereby and the distribution of this prospectus supplement outside the United States. This prospectus supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

The information appearing in this prospectus supplement, the accompanying prospectus or any related free writing prospectus that we authorize for use in connection with this offering is accurate only as of the date on the front of the document and any information we have incorporated by reference is accurate only as of the date of such document incorporated by reference, regardless of the time of delivery of this prospectus supplement or any related free writing prospectus, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein contain summaries of certain provisions contained in some of the documents described herein and therein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus supplement and the accompanying prospectus are a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find More Information.”

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our file number with the SEC is 001-40202. Our SEC filings are available to the public over the Internet on the SEC’s website at http://www.sec.gov. Our website address is https://www.redcatholdings.com. Information appearing on our website (other than the documents expressly incorporated by reference as described below) is not incorporated by reference into this prospectus supplement and you should not consider such information a part of this prospectus supplement.

| ii |

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

This prospectus is part of a registration statement filed with the SEC. The SEC allows us to “incorporate by reference” into this prospectus the information that we file with them, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. The following documents are incorporated by reference and made a part of this prospectus:

| · | our Annual Report on Form 10-K for the year ended April 30, 2020 filed with the SEC on August 13, 2020; |

| · | our Quarterly Report on Form 10-Q for the quarterly period ended July 31, 2020 filed with the SEC on September 21, 2020; |

| · | our Quarterly Report on Form 10-Q for the quarterly period ended January 31, 2021 filed with the SEC on March 22, 2021; |

| · | our Quarterly Report on Form 10-Q for the quarterly period ended October 31, 2020 filed with the SEC on December 21, 2020; |

| · | our Current Reports on Form 8-K filed with the SEC on October 5, 2020; October 9, 2020; November 6, 2020; December 4, 2020; January 13, 2021; January 28, 2021; February 17, 2021; February 19, 2021; March 24, 2021; April 6, 2021; April 30, 2021; May 13, 2021; June 4, 2021; July 2, 2021; July 8, 2021; and July 14, 2021; and |

| · | the description of our common stock contained in our Registration Statement on Form 8-A filed with the SEC on March 11, 2021, including any amendment or report filed for the purpose of updating such description. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement contains forward-looking statements. Such statements include statements regarding our expectations, hopes, beliefs or intentions regarding the future, including but not limited to statements regarding our market, strategy, competition, development plans (including acquisitions and expansion), financing, revenues, operations, and compliance with applicable laws. Forward-looking statements involve certain risks and uncertainties, and actual results may differ materially from those discussed in any such statement. Factors that could cause actual results to differ materially from such forward-looking statements include the risks described in greater detail in the following paragraphs. All forward-looking statements in this document are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statement. Market data used throughout this prospectus supplement is based on published third party reports or the good faith estimates of management, which estimates are based upon their review of internal surveys, independent industry publications and other publicly available information.

Industry and Market Data

This prospectus supplement contains estimates made, and other statistical data published, by independent parties and by us relating to market size and growth and other data about our industry. We obtained the industry and market data in this prospectus supplement from our own research as well as from industry and general publications, surveys and studies conducted by third parties. This data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the industries in which we operate that are inherently subject to a high degree of uncertainty and actual events or circumstances may differ materially from events and circumstances reflected in this information. We caution you not to give undue weight to such projections, assumptions and estimates. While we believe that these publications, studies and surveys are reliable, we have not independently verified the data contained in them. In addition, while we believe that the results and estimates from our internal research are reliable, such results and estimates have not been verified by any independent source.

| iii |

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information contained elsewhere in this prospectus supplement. This summary is not intended to be complete and does not contain all of the information that you should consider in making your investment decision. You should carefully read this entire prospectus supplement, including our consolidated financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in this prospectus supplement before making an investment decision.

Unless the context otherwise requires, references to “we,” “our,” “us,” or the “Company” in this prospectus supplement mean Red Cat Holdings, Inc. on a consolidated basis with its wholly-owned subsidiaries, Red Cat Propware, Inc., Rotor Riot, LLC, and FS Acquisition Corp. as applicable.

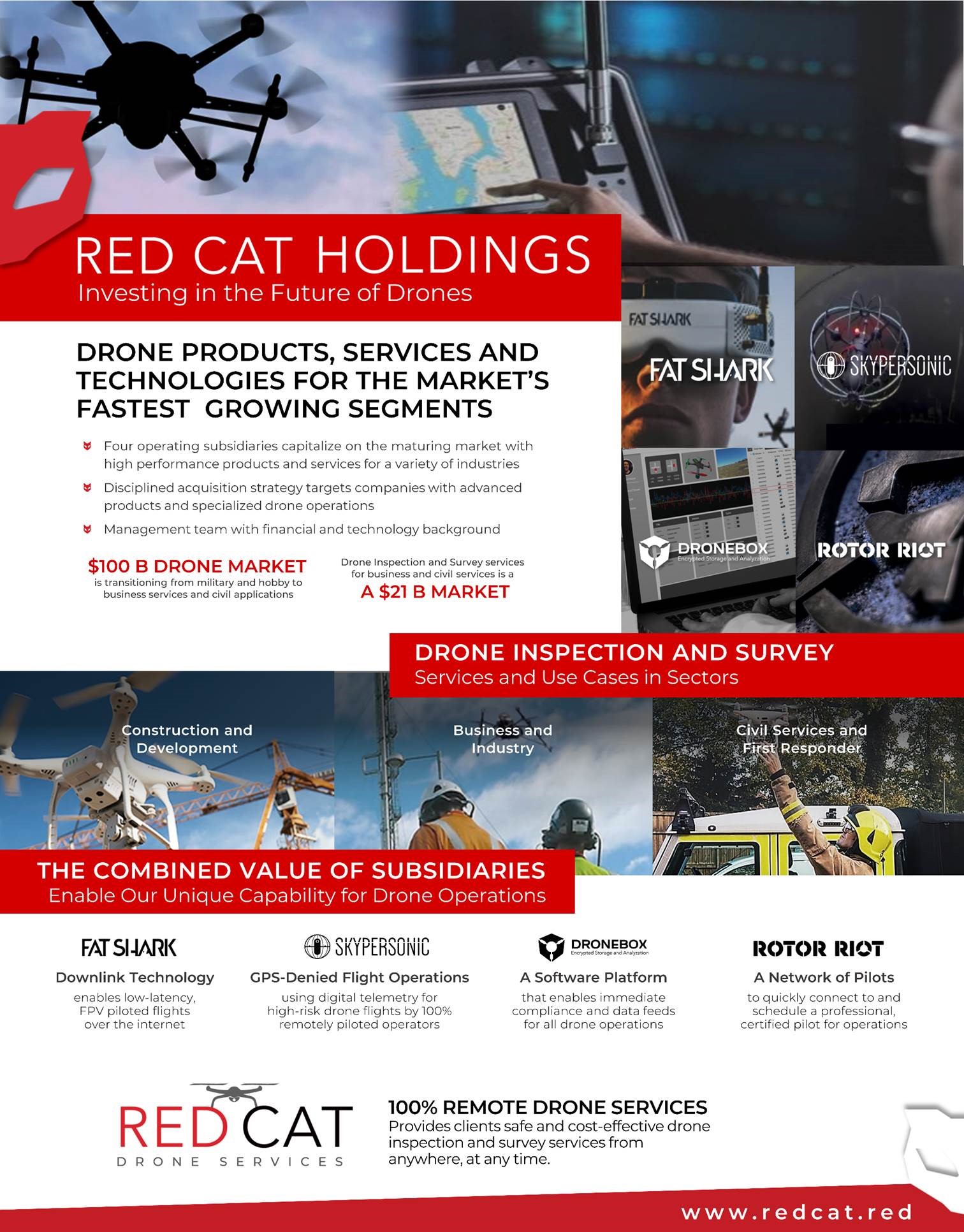

Business Overview

The Company’s business is to provide products, services and solutions to the drone industry. We design, develop, market, and sell drone software and products. Our business emphasis focusses on drones piloted with wearable display devices. These are head mounted displays (“HMDs”) for pilots. HMDs give pilots “first person view” (“FPV”) perspective to control their drone in flight. This is a unique experience where the pilot is interacting with an aircraft through visual immersion. In this augmented virtual reality, the pilot sees only what the drone sees, as if sitting in the pilot seat. This experience is accomplished by live streaming footage from a camera mounted on the nose of the drone directly into specially-designed goggles worn by the pilot. The image is transmitted via radio (traditionally analog but increasingly digital) to the pilot. The drone remote control unit, the drone device, and the FPV goggles are all inter-connected via radio. This effect requires sophisticated electronics that transmits visual information with sufficient speed and reliability to allow pilot control over the drone in real-time. Pilots routinely achieve speeds of over 90 mph in racing and other mission critical applications. An FPV pilot must experience a near complete transfer of their visual consciousness into the body of their piloted device.

There are three common categories of FPV flight – freestyle flight, racing and aerial photography. In freestyle the pilot navigates around obstacles, focused on acrobatics and exploring the environment around the aircraft through the HMD. This type of flight includes remote utility and crop inspection with onboard navigation and special equipment, such as moisture or heat sensors, and package delivery. FPV racing describes a growing spectator sport where pilots fly their drones in competitions through a series of obstacles, flags, and gates in a racetrack. Aerial photography is the process of viewing and recording a subject matter from the air from the viewpoint of the pilot.

We sell flight design cameras, video transmitters, goggles, as well as the mounts, airframes and accessories to build or operate drone aircraft. We design, develop, assemble and sell each of these FPV components individually and in packages. We believe that our products have become favorites in FPV racing and we sponsor several racing teams and pilots. We purchase and resell drones and components from leading manufacturers, including the industry leader Da Jiang Innovations (“DJI”) and custom design and build our own line of branded products. Approximately 50% of our revenue has historically been generated as a reseller and the balance from sale of branded products prior to our recent acquisition of Fat Shark Holdings, Ltd. (“Fat Shark”). In addition, we are developing a blockchain-based black box to enhance reliability and reporting of drone performance and operations as software as a service (“SaaS”). Red Cat’s Dronebox software and platform enable an easy-to-use flight log system that keeps clients compliant with regulators and helps track and collect critical drone data and feed the data to various applications. The software and platform use a patent-pending blockchain-based cloud architecture. To keep the data secure, we hash each log file on our private block chain, proving that the data is immutable and reliable. Reliable data is mandatory for regulators and insurance companies and is essential for analyzing drone flights and effective drone fleet management. Through our blockchain-based black box for drones, we can offer one easy to use system for analytics and services. By applying machine learning to the log files, we can prevent drone flight problems before they happen through artificial intelligence. We charge a monthly recurring fee for each drone in the customer’s drone fleet. We store all flight logs, photos, and videos from the black box service, which allows detailed flight replay.

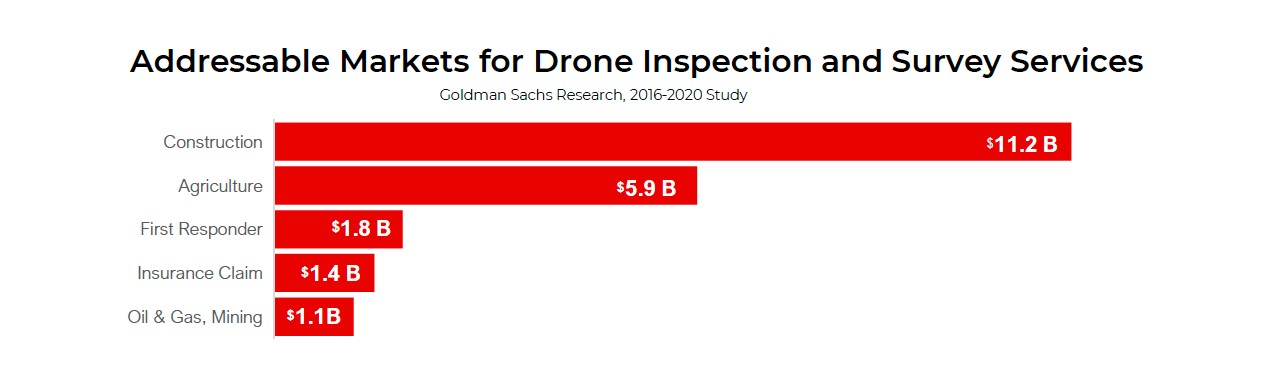

The target market for drone services in the commercial and civil markets is focused on the need to inspect and/or survey equipment, structures, insurance claims, land areas, jobsites and emergencies.

Inspection and survey drone services for the industry is estimated to be a $21 billion market.

| S-1 |

We market through social media and attract buyers to our ecommerce platforms. We maintain a robust presence on Facebook and YouTube where we sponsor competitions and provide education. Sports networks, and sponsors such as NBC, Sky, Liberty Media, Fox Sports, MGM, Hearst, Twitter, ProSieben, Groupe AB and Weibo broadcast and sponsor global events where professional pilots and amateurs compete for prizes and sponsorships. Drone racing is a global sport with chapters, leagues, and pilots and established guidelines, rules and regulations for participation adopted by organizations such as MultiGP, Drone Racing League (“DRL”), IUDRO, DR1 Racing, Rotomatch League, FPVR, and Freespace Drone Racing. Pilots specially design their custom-built aircraft, selecting and customizing frames, motors, propellors and controllers for speed and maneuverability from Rotor Riot. Rotor Riot sponsors a team of six of the leading pilots on the competitive FPV racing circuit, including the 2019 and 2018 Drone Racing League champion. Drone pilots and spectators alike experience real-time flight through their own HMD. In 2015 Fat Shark sponsored the first annual US National Drone Racing Championships held at the California State Fair with a prize of $25,000. Subsequent events featured prizes of up to $1 million. Rotor Riot has a social network of over 215,000 YouTube subscribers, 68,000 Instagram followers. This gives us quick access to a large number of commercial pilots for beta testing, product enhancements, and remote drone piloting.

On November 2, 2020 we acquired Fat Shark Holdings, Ltd., a Cayman Islands Exempted Company. The Company believes Fat Shark and its subsidiaries are leaders in the design, development, marketing and sale of HMDs for pilots.

The operations of Fat Shark constitute a significant majority of our revenue and results of operations and position us to become a fully-integrated drone business with a strong supply chain while we continue to develop and promote industry standards through our blockchain-based distributed network that provides secure data storage, operational analytics, reporting, and SaaS solutions for the drone industry. We are also developing the means to accurately track, report and review flight data, which we believe will be the mainstay of future regulatory specifications and insurability. We maintain a commitment to deliver unparalleled innovation to make drones, pilots, and products accountable and the sky a safer place.

In May 2021, we acquired Skypersonic, Inc., a provider of drone products and software solutions that enable drone inspection flights that can be executed by pilots anywhere in the world. Skypersonic powers drones to “Fly Anywhere” and “Inspect the Impossible”. Its patented software and hardware solutions allow for inspection services in restricted spaces where GPS is not allowed or available. Skycopter is a miniature drone fitted into a cage to avoid damage to inspected areas and the drone. Skyloc is a stand-alone, real time, software system which enables the drone to record and transmit inspection data while being operated from thousands of miles away. Skypersonic’s intellectual property portfolio includes eight US and European patents.

On July 13, 2021, we signed a definitive agreement to acquire Teal Drones, Inc., a leader in commercial and government unmanned aerial vehicle technology. Teal Drones, a company founded by Thiel Fellow George Matus in 2015, launched with its Teal Sport and Teal One consumer drones, the first of their kind to be manufactured in the United States. A Utah-based operation, the company has since grown into the enterprise and government sectors with Golden Eagle, a U.S. government-approved drone designed for reconnaissance, public safety, and inspection applications. Teal’s open and modular platform allows a critical mass of applications to be developed and integrated for next-generation capabilities. Partners actively integrating technologies with Teal include Autonodyne, Tomahawk Robotics, Dronelink and Skyward. With its Golden Eagle, Teal is one of only five companies that were recently selected by the Department of Defense in 2020 as approved small unmanned aerial system vendors for the U.S. government.

| S-2 |

Company Background

We are a Nevada corporation, originally incorporated in 1984 under the name Oravest International, Inc. in the state of Colorado and subsequently renamed TimefireVR, Inc. in November 2016 and thereafter renamed Red Cat Holdings, Inc. in July 2019. Our principal corporate office is located at 370 Harbour Drive, Palmas del Mar, Humacao, PR 00791 and our telephone number is (833) 373-3228. On May 15, 2019, we acquired Red Cat Propware, Inc. in a share exchange. On January 23, 2020, we acquired Rotor Riot, LLC, in a merger in which our subsidiary Rotor Riot Acquisition Corp. merged with and into Rotor Riot, LLC (“Rotor Riot”) with Rotor Riot surviving as our wholly owned subsidiary. On November 2, 2020, we acquired Fat Shark Holdings, Ltd. through a share purchase agreement with our wholly-owned subsidiary FS Acquisition Corp. On May 7, 2021, we acquired Skypersonic, Inc. through Share Purchase and Liquidity Event Agreements with our wholly-owned subsidiary Red Cat Skypersonic, Inc. Our internet address is w ww.redcatholdings.com. Information on our website is not incorporated into this prospectus supplement.

Recent Developments

Estimated Results of Operation for Fiscal Year Ended April 30, 2021

Set forth below are certain preliminary estimates of our results of operations that we expect to report for our fiscal year ended April 30, 2021.

• Our total revenues are expected to be approximately $5.0 million in fiscal 2021, or $4.6 million greater than $0.4 million in fiscal 2020;

• Our operating loss is expected to be approximately $4.9 million in fiscal 2021, or $3.2 million greater than $1.7 million in fiscal 2020; our operating loss, net of non-cash charges associated with stock based compensation, is expected to be approximately $1.5 million in fiscal 2021, or $0.1 million greater than $1.4 million in fiscal 2020;

• Our net loss is expected to be approximately $13.2 million in fiscal 2021, or $11.6 million greater than $1.6 million in fiscal 2020; our net loss, net of non-cash expenses associated with derivative liabilities, stock based compensation and the amortization of debt discount, is expected to be approximately $1.6 million in fiscal 2021, or $0.3 million greater than $1.3 million in fiscal 2020.

We have provided estimates for our preliminary results described above because our financial closing procedures for our fiscal quarter and our fiscal year ended April 30, 2021 are not yet complete. We currently expect that our final results will be approximately as described above. However, the estimates described above are preliminary and represent the most current information available to management. Therefore, it is possible that our actual results may differ materially from these estimates due to the completion of our financial closing procedure, final adjustments and other developments that may arise between now and the time our financial results for our fiscal year 2021 are finalized. Accordingly, you should not place undue reliance on these estimates. The preliminary financial data for our fiscal year 2021 included in this prospectus supplement have been prepared by, and is the responsibility of, our management and has not been reviewed or audited or subject to any other procedures by our independent registered public accounting firm. Accordingly, our independent registered public accounting firm does not express an opinion or any other form of assurance with respect to this preliminary financial data.

Closing of Underwritten Public Offering on May 4, 2021

On May 4, 2021, we closed an underwritten public offering of 4,000,000 shares of our common stock at a public offering price of $4.00 per share, for gross proceeds of $16,000,000, before deducting underwriting discounts and offering expenses.

Skypersonic Acquisition Closed

On May 7, 2021, we closed on the acquisition of Skypersonic, Inc., (“Skypersonic”) a Michigan corporation. As previously disclosed in our Current Report on Form 8-K filed February 17, 2021, our acquisition of Skypersonic was made pursuant to Share Purchase and Liquidity Event Agreements (the “Agreements”) among us, Red Cat Skypersonic, Inc., a Nevada corporation (“Acquisition”) and wholly-owned subsidiary of ours, Giuseppe Santangelo the founder and majority shareholder of Skypersonic, and certain holders of common stock and SAFE agreements representing 97.46% of Skypersonic (the “Sellers”) and Wayne State University Anderson Engineering Ventures Institute. Pursuant to the Agreements, we acquired all of the issued and outstanding share capital of Skypersonic in exchange for issuance of $3,000,000 of our common stock, at the Volume Weighted Average Price (VWAP) of our common stock on May 7, 2021 of $4.0154 per share. At closing, we issued 857,124 shares common stock to the Sellers (the “Share Consideration”). Fifty percent of the Share Consideration (the “Escrow Shares”) was deposited in an escrow account for a period of twelve (12) months as security for indemnification obligations and any purchase price adjustments due to working capital deficiencies and any other claims or expenses arising under the Agreements.

| S-3 |

Appointment of Allan Evans as New Chief Operating Officer

Effective June 3, 2021, our Board of Directors appointed Allan Evans to serve as our new Chief Operating Officer. Dr. Evans also serves as the Chief Executive Officer of our subsidiary, Fat Shark Holdings, Ltd., under an Employment Agreement dated January 11, 2021.

Agreement to Acquire Teal Drones, Inc.

On July 13, 2021, we and our wholly-owned subsidiary Teal Acquisition I Corp. (“Acquisition”), entered into an Agreement and Plan of Merger (the “Agreement”) with Teal Drones, Inc., a Delaware corporation (“Teal”). Under the terms of the Agreement, subject to the satisfaction of certain closing conditions, Acquisition will acquire Teal by merger of Acquisition with and into Teal, with Teal as the surviving corporation (the “Merger”). At the Effective Time of the Merger, all of the issued and outstanding share capital of Teal will be exchanged for an aggregate of Fourteen Million Dollars ($14,000,000) of Company common stock, par value $0.001 per share, (the “Common Stock”) and Series C Convertible Preferred Stock, par value $0.001 per share (the “Series C Preferred”, and together with the Common Stock, the “Share Consideration”). The Company will at closing issue such number of shares as shall be equal to the Share Consideration divided by the VWAP of the Company (the “Closing Date VWAP”) which shall be equal to the average of the Daily VWAP for the twenty (20) trading days ending on and including the Closing Date. “Daily VWAP” means, for any trading day, the per share volume-weighted average price of the Parent Common Stock as displayed on Bloomberg, L.P. (or its equivalent successor if such service is not available) in respect of the period from the scheduled open of trading until the scheduled close of trading of the primary trading session on such trading day on the Nasdaq Capital Market or, if unavailable, on the OTC Markets. The Daily VWAP will be determined without regard to after-hours trading or any other trading outside of the regular trading session trading hours. Fifteen (15%) percent of the Share Consideration (the “Escrow Shares”) is required to be deposited in an escrow account pursuant to the Agreement for a period of eighteen (18) months as security for indemnification obligations and any purchase price adjustments due to working capital deficiencies and any other claims or expenses arising under the Agreement.

In addition, the Share Consideration may be increased upon the achievement of certain milestones set forth in the Agreement (the “Earn-Out Consideration”). Additional Shares of Common Stock may become issuable by the Company in the event that within twenty-four (24) months following closing of the Merger, Teal realizes revenues of at least Eighteen Million Dollars ($18,000,000). A total of Sixteen Million Dollars ($16,000,000) in Earn Out Consideration may become issuable in the event that sales and services of Teal’s Golden Eagle drones shall have equaled at least $36 Million Dollars ($36,000,000). A total of Ten Million Dollars ($10,000,000) in Earn Out Consideration may become issuable in the event that sales and services of Teal’s Golden Eagle drones shall have equaled at least $24 million ($24,000,000) but less than $36 million ($36,000,000). A total of Four Million Dollars ($4,000,000) in Earn Out Consideration may become issuable in the event that sales and services of Teal’s Golden Eagle drones shall have equaled at least Eighteen Million Dollars ($18,000,000) but less than Twenty-Four Million Dollars ($24,000,000). Additional Share Consideration, if earned, is issuable at the VWAP of the Company within thirty (30) days of the determination that Earn-Out Consideration is payable.

Under the Agreement, the Share Consideration to be paid on the Closing Date shall be reduced by any indebtedness of Teal, including up to Two Million Dollars ($2,000,000) of senior secured debt to be assumed by the Company (the “Assumed Debt”) and any working capital deficit, on a dollar of dollar basis. In addition, it is anticipated that One Million Dollars ($1,000,000) of the Share Consideration payable to the shareholders of Teal in connection with the Merger, has been agreed to be paid to the Assumed Debt holder to secure consent to the Merger and the transactions contemplated thereby.

The Company and stockholders of Teal have agreed to indemnification obligations, on a pro-rata basis, subject to certain limitations, which shall survive for a period of eighteen (18) months following closing, and includes a basket amount of Fifty Thousand Dollars ($50,000) before any claim can be asserted and a cap equal to the value of the Escrow Shares or the Share Consideration, other than in cases involving fraud or willful misconduct.

As a condition to closing the Company has agreed that Teal shall enter into an employment agreement with George Matus, founder and CEO of Teal.

| S-4 |

| Summary of the Offering | |

| Common stock offered by us: | 13,333,334 shares of our common stock (15,333,334 shares if the underwriters exercise their over-allotment option in full). |

| Shares of common stock outstanding prior to the offering: | 34,371,719 shares |

|

Shares of common stock outstanding after the offering over- (1): |

47,705,053 shares (49,705,053 shares if the underwriters exercise their allotment option in full). |

| Over-allotment option: | The underwriters have an option for a period of 45 days to purchase up to 2,000,000 additional Shares to cover over-allotments, if any. |

| Use of proceeds: | We estimate that we will receive net proceeds of approximately $55,450,000 from our sale of Shares in this offering, after deducting underwriting discounts and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to provide funding for service, sales, and marketing efforts for our Red Cat Drone Services, strategic acquisitions and related expenses, and general working capital. See “Use of Proceeds.” |

| Potential sales to insiders: | It is possible that one or more of our directors or their affiliates or related parties could purchase common stock in this offering; however, these person or entities may determine not to purchase any shares in this offering, or the underwriters may elect not to sell any common stock in this offering to such persons or entities. |

| Nasdaq | Our common stock is listed on the Nasdaq Capital Market under the symbol “RCAT” |

| Risk factors: | Investing in our securities involves a high degree of risk and purchasers of our securities may lose their entire investment. See “Risk Factors” and the other information included and incorporated by reference into this prospectus supplement for a discussion of risk factors you should carefully consider before deciding to invest in our securities. |

(1)

The number of shares of our common stock that will be outstanding immediately after this offering is based

on 34,371,719 shares of common stock outstanding as of July 16, 2021 and excludes the following:

• 2,497,475 shares of common stock issuable upon exercise of outstanding options under our equity incentive plans

at a weighted-average exercise price of $1.79 per share;

• 873,332 shares of common stock issuable upon exercise of outstanding warrants with an exercise price of $1.50 per share;

• 1,322,004 shares of common stock issuable upon conversion of outstanding shares of our Series A Preferred Stock and 1.640,563

shares of our common stock issuable upon conversion of outstanding shares of our Series B Preferred Stock;

• 4,877,525 shares of common stock that are reserved for equity awards that may be granted under our equity incentive plans;

•1,020,834 shares of common stock awarded under employment agreements which have not yet been issued.

•533,333 shares of common stock issuable upon exercise of warrants to be issued to the representative

of the underwriters.

Except as otherwise indicated herein, all information in this prospectus assumes no exercise by the underwriter

of its over-allotment option to purchase additional shares.

| S-5 |

RISK FACTORS

Any investment in our securities involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus supplement before deciding whether to purchase our securities. Our business, financial condition and results of operations could be materially adversely affected by these risks if any of them actually occur. This prospectus supplement also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus supplement.

Risks Related to our Business

The COVID-19 pandemic has adversely impacted, and poses risks to, our business, results of operations and financial condition, the nature and extent of which are highly uncertain and unpredictable.

The global spread of COVID-19 is having, and will continue to have, an adverse impact on our operations, sales and delivery and supply chains. Many countries including the United States have implemented measures such as quarantine, shelter-in-place, curfew, travel restrictions and similar isolation measures, including government orders and other restrictions on the conduct of business operations. It remains uncertain what impact the pandemic will have on our ability to generate sales and customer interest even once conditions begin to improve. The COVID-19 pandemic has also impacted our supply chain as we have experienced disruptions or delays in shipments of certain materials or components of our products. Prices of our supplies have also increased as a result of the pandemic. Accordingly, COVID-19 has negatively affected our business. Given the rapid and evolving nature of the virus, it is uncertain how materially COVID-19 will affect our operations generally if these impacts persist, worsen or re-emerge over an extended period of time.

Additionally, the COVID-19 pandemic caused significant volatility and uncertainty in U.S. and international markets, which may result in a prolonged economic downturn. A disruption of financial markets may reduce our ability to access capital and increase the cost of doing so. There are no assurances that the credit markets or the capital markets will be available to us in the future or that financing will be available.

We cannot reasonably estimate the length or severity of the COVID-19 pandemic or the related response, or the extent to which the disruption may continue to impact our business, financial position, results of operations and cash flows. Ultimately, the COVID- 19 pandemic could have a material adverse impact on our business, financial position, results of operations and cash flows.

We may not be able to continue operating as a going concern.

We have experienced losses from operations since inception and have never generated positive cash flow. The success of our business plan during the next 12 months and beyond will be contingent upon generating sufficient revenue to cover our operating costs and obtaining additional financing. The reports from our independent registered public accounting firm for the fiscal year ended April 30, 2020 and prior years include an explanatory paragraph stating the Company has recurring net losses from operations, negative operating cash flows, does not yet generate revenue from operations and will need additional working capital for ongoing operations These factors, among others, raise substantial doubt about the Company's ability to continue as a going concern. If we are unable to obtain sufficient funding, our business, prospects, financial condition and results of operations will be materially and adversely affected and we may be unable to continue as a going concern.

We have incurred net losses since inception.

We have accumulated net losses of approximately $12.7 million as of January 31, 2021. These losses have had an adverse effect on our financial condition, stockholders’ equity, net current assets, and working capital. We will need to generate higher revenues and control operating costs in order to attain profitability. There can be no assurances that we will be able to do so or to reach profitability.

| S-6 |

We will need additional capital to fund our expanding operations, and if we are not able to obtain sufficient capital, we may be forced to limit the scope of our operations.

We expect that our expansion of business activities will require additional working capital. Fat Shark’s level of sales far exceeds our historic sales and will require additional working capital to continue which we may not be able to secure. Rotor Riot’s e-commerce platform business operating at www.rotorriot.com has not attained profitability. The planned release of our first software product, DroneBox, will require working capital to finish product development, support its market release, and provide technical customer support upon its commercial release. We plan to offer DroneBox under a software-as-a-service (“SaaS”) platform which may require a higher number of customers in order to reach profitability. There can be no assurance that either or both of our operating businesses will reach profitability.

If adequate additional debt and/or equity financing is not available on reasonable terms or at all, then we may not be able to continue to develop our business activities, and we will have to modify our business plan. These factors could have a material adverse effect on our future operating results and our financial condition.

If we are unable to raise needed additional funds to continue as a going concern, we could be forced to cease our business activities and dissolve. In such an event, we may incur additional financial obligations, including the accelerated maturity of debt obligations, lease termination fees, employee severance payments, and other creditor and dissolution-related obligations.

Our ability to raise financing through sales of equity securities depends on general market conditions and the demand for our common stock. We may be unable to raise adequate capital through sales of equity securities, and if our stock has a low market price at the time of such sales, our existing stockholders could experience substantial dilution. If adequate financing is not available or unavailable on acceptable terms, we may find we are unable to fund expansion, continue offering products and services, take advantage of acquisition opportunities, develop or enhance services or products, or to respond to competitive pressures in the industry which may jeopardize our ability to continue operations.

We operate in an emerging and rapidly growing industry which makes it difficult to evaluate our business and future prospects.

The drone industry is relatively new and is growing rapidly. As a result, it is difficult to evaluate our business and future prospects. We cannot accurately predict whether, and even when, demand for our products will increase, if at all. The risks, uncertainties and challenges encountered by companies operating in emerging and rapidly growing industries include:

| • | Generating sufficient revenue to cover operating costs and sustain operations; |

| • | Acquiring and maintaining market share; |

| • | Attracting and retaining qualified personnel, especially engineers with the requisite technical skills; |

| • | Successfully developing and commercially marketing new products: |

| • | Accessing the capital markets to raise additional capital, on reasonable terms, if and when required to sustain operations or to grow the business. |

The drone industry is subject to various laws and government regulations which could complicate and delay our ability to introduce products, maintain compliance, and avoid violations, which could lead to increased costs or the interruption of normal business operations that could negatively impact our financial condition and results of operations.

We operate in the drone industry which is a highly regulated environment in the US and international markets. Federal, state and local governmental entities and foreign governments may regulate aspects of the industry, including the production or distribution of our products, software or services. These regulations may include accounting standards, taxation requirements (including changes in applicable income tax rates, new tax laws and revised tax law interpretations), product safety and other safety standards, trade restrictions, regulations regarding financial matters, environmental regulations, products directed toward children or hobbyists, and other administrative and regulatory restrictions. While we endeavor to take all the steps necessary to comply with these laws and regulations, there can be no assurance that we can maintain compliance on a continuing basis. Failure to comply could result in monetary liabilities and other sanctions which could increase our costs or decrease our revenue resulting in a negative impact on our business, financial condition and results of operations.

| S-7 |

Our business and products are subject to government regulation and may incur additional compliance costs or, if we fail to comply with applicable regulations, may incur fines or be forced to suspend or cease operations.

In our current business and as we expand into new markets and product categories, we must comply with a wide variety of laws, regulations, standards and other requirements governing, among other things, electrical safety, wireless emissions, health and safety, e- commerce, consumer protection, export and import requirements, hazardous materials usage, product-related energy consumption, packaging, recycling and environmental matters. Compliance with these laws, regulations, standards, and other requirements may be onerous and expensive, and they may be inconsistent from jurisdiction to jurisdiction (including from country to country), further increasing the cost of compliance and doing business. Our products may require regulatory approvals or satisfaction of other regulatory concerns in the various jurisdictions in which they are manufactured, sold or both. These requirements create procurement and design challenges that require us to incur additional costs identifying suppliers and manufacturers who can obtain and produce compliant materials, parts and products. Failure to comply with such requirements can subject us to liability, additional costs, and reputational harm and, in extreme cases, force us to recall products or prevent us from selling our products in certain jurisdictions. If there is a new regulation, or change to an existing regulation, that significantly increases our costs of manufacturing or causes us to significantly alter the way that we manufacture our products, this would have a material adverse effect on our business, financial condition and results of operations. Additionally, while we have implemented policies and procedures designed to ensure compliance with applicable laws and regulations, there can be no assurance that our employees, contractors, and agents will not violate such laws and regulations or our policies and procedures.

Our products must comply with certain requirements of the U.S. Federal Communications Commission (“FCC”) regulating electromagnetic radiation in order to be sold in the United States and with comparable requirements of the regulatory authorities of the European Union (“EU”), Japan, China and other jurisdictions in order to be sold in those jurisdictions. Our FPV products include wireless radios and receivers which require additional emission testing. We are also subject to various environmental laws and governmental regulations related to toxic, volatile, and other hazardous chemicals used in the third-party components incorporated into our products, including the Restriction of Certain Hazardous Substances Directive (the “RoHS”) and the EU Waste Electrical and Electronic Equipment Directive (the “WEEE Directive”), as well as the implementing legislation of the EU member states. This directive restricts the distribution of products within the EU that exceed very low maximum concentration amounts of certain substances, including lead. Similar laws and regulations have been passed or are pending in China, Japan, and numerous countries around the world and may be enacted in other regions, including in the United States, and we are, or may in the future be, subject to these laws and regulations.

From time to time, our products are subject to new domestic and international requirements. Compliance with regulations enacted in the future could substantially increase our cost of doing business or otherwise have a material adverse effect on our results of operations and our business. Any inability by us to comply with regulations in the future could result in the imposition of fines or in the suspension or cessation of our operations or sales in the applicable jurisdictions. Any such inability by us to comply with regulations may also result in our not being permitted, or limit our ability, to ship our products which would adversely affect our revenue and ability to achieve or maintain profitability.

Although we encourage our contract manufacturers and major component suppliers to comply with the supply chain transparency requirements, such as the RoHS Directive, we cannot provide assurance that our manufacturers and suppliers consistently comply with these requirements. In addition, if there are changes to these or other laws (or their interpretation) or if new related laws are passed in other jurisdictions, we may be required to re-engineer our products to use components compatible with these regulations. This re-engineering and component substitution could result in additional costs to us or disrupt our operations or logistics.

The WEEE Directive requires electronic goods producers to be responsible for the collection, recycling and treatment of such products. Changes in interpretation of the directive may cause us to incur costs or have additional regulatory requirements to meet in the future in order to comply with this directive, or with any similar laws adopted in other jurisdictions. Our failure to comply with past, present, and future similar laws could result in reduced sales of our products, substantial product inventory write-offs, reputational damage, penalties and other sanctions, which could harm our business and financial condition. We also expect that our products will be affected by new environmental laws and regulations on an ongoing basis. To date, our expenditures for environmental compliance have not had a material impact on our results of operations or cash flows and, although we cannot predict the future impact of such laws or regulations, they will likely result in additional costs and may increase penalties associated with violations or require us to change the content of our products or how they are manufactured, which could have a material adverse effect on our business and financial condition.

| S-8 |

We face competition from larger companies that have substantially greater resources which challenges our ability to establish market share, grow the business, and reach profitability.

The drone industry is attracting a wide range of significantly larger companies which have substantially greater financial, management, research and marketing resources than we have. These competitors include transportation companies like United Parcel Service, Federal Express and Amazon, as well as defense companies such as Lockheed Martin Corporation and Northrop Grumman Corporation. Our competitors may be able to provide customers with different or greater capabilities than we can provide, including technical qualifications, pricing, and key technical support. Many of our competitors may utilize their greater resources to develop competing products and technologies, leverage their financial strength to utilize economies of scale and offer lower pricing, and hire more qualified personnel by offering more generous compensation packages. In order to secure contracts, we may have to offer comparable products and services at lower pricing which could adversely affect our operating margins. Our inability to compete effectively against these larger companies could have a material adverse effect on our business, financial condition and operating results.

Fat Shark operates in a highly competitive market and the size, resources and brand name of some of its competitors may allow them to compete more effectively than Fat Shark can, which could result in a loss of market share and a decrease in revenue and profitability.

The market for head-worn display devices, including FPV HMDs, is highly competitive. Further, we expect competition to intensify in the future as existing competitors introduce new and more competitive offerings alongside their existing products, and as new market entrants introduce new products into our markets. We compete against established, well-known diversified consumer electronics manufacturers such as Samsung Electronics Co., Sony Corporation, LG Electronics (LGE), HTC, Lenovo, and large software and other products companies such as Alphabet Inc. (Google), Microsoft Corporation, Facebook and Snap. In the FPV drone market we compete with additional established, well-known manufacturers such as Epson, Yuneec, Boscam, Eachine, Walkera, SkyZone, MicroLED and DJI. Many of our current competitors have substantial market share, diversified product lines, well-established supply and distribution systems, strong worldwide brand recognition and greater financial, marketing, research and development and other resources than we do. In addition, many of our existing and potential competitors enjoy substantial competitive advantages, such as:

| • | longer operating histories; |

| • | the capacity to leverage their sales efforts and marketing expenditures across a broader portfolio of products; |

| • | broader distribution and established relationships with channel partners; |

| • | access to larger established customer bases and known branding; |

| • | greater resources to fund research and development and to make acquisitions; |

| • | larger intellectual property portfolios; and |

| • | the ability to bundle competitive offerings with other products and services. |

Moreover, smartphones, tablets, and new wearable devices with ever growing larger video display screens and computing power have significantly improved the mobile personal computing experience. In the future, the manufacturers of these devices, such as Apple Inc., Samsung, LGE, Lenovo, Google/Fitbit, Snap, Garmin, Facebook, Microsoft and others may design or develop products similar to ours. In addition to competition or potential competition from large, established companies, new companies may emerge and offer competitive products. Increased competition may result in pricing pressures and reduced profit margins and may impede our ability to increase the sales of our products, any of which could substantially harm our business and results of operations.

We may not be able to keep pace with technological advances; we depend on advances in technology by other companies.

The drone industry in general, and the software and hardware industries in particular, continue to undergo significant changes, primarily due to technological developments. Because of the rapid growth of technology, shifting consumer tastes and the popularity and availability of other forms of activities, it is impossible to predict the overall effect these factors could have on potential revenue from, and profitability of, software and hardware or training directed to the drone industry. It is impossible to predict the overall effect these factors could have on our ability to compete effectively in a changing market, and if we are not able to keep pace with these technological advances, then our revenues, profitability and results from operations may be materially adversely affected.

We rely on and will continue to rely on components of our products (including micro-display panels organic light-emitting diode (“OLED”) and liquid crystal (“LC”) displays for our goggle displays, transmitters and cameras) that are developed and produced by other companies. The commercial success of certain of our planned future products will depend in part on advances in these and other technologies by other companies. We may, from time to time, contract with and support companies developing key technologies in order to accelerate the development of such products for our specific uses. Such activities might not result in useful technologies or components for us.

| S-9 |

We may not be able to successfully launch, compete and sell our DroneBox software.

Our first software product, DroneBox, is presently in beta testing in order to identify operating issues and to secure user feedback on its features, including both those presently part of the software and those that might be added to enhance the product. To date, the FAA has not issued any formal rules and regulations regarding software applications used by drones. However, it could decide to issue formal rules and regulations which could delay the release of DroneBox or cause us to withdraw it from the market. It is possible that we may not be able to comply with any rules and regulations issued by the FAA.

DroneBox will compete against software solutions which are already available in the marketplace. These include competing products offered by Airdata, a small company, and Skyward which is owned by Verizon. We plan to include features in DroneBox that we believe will provide a competitive advantage. These include (i) flight analyzation and replay, (ii) an embedded, encrypted ticket system, and (iii) live support assistance. However, users may not perceive our enhancements as providing added value and may determine not to migrate to DroneBox. In addition, Verizon could provide sales and marketing support to Skyward that could distract users and cause them not to focus on the enhanced features provided by DroneBox. These risks could adversely impact the number of users that subscribe to DroneBox and have a material adverse impact on our operating results.

If Fat Shark fails to keep pace with changing consumer preferences or technologies our business and results of operations may be materially adversely affected.

Rapidly changing customer requirements, evolving technologies and industry standards characterize the consumer electronics, wearables, and display industries. To achieve these goals, we seek to enhance existing products and develop and market new products that keep pace with continuing changes in industry standards, requirements, and customer preferences.

Our success depends on our ability to originate new products and to identify trends as well as to anticipate and react to changing customer demands in a timely manner. If are unable to introduce new products or novel technologies in a timely manner or new products or technologies are not accepted by customers, our competitors may introduce more attractive products, which could hurt our competitive position. New products might not receive customer acceptance if customer preferences shift to other products, and future success depends in part on the ability to anticipate and respond to these changes. Failure to anticipate and respond in a timely manner to changing customer preferences could lead to, among other things, lost business, lower revenue and excess inventory levels.

If critical components used to assemble our products become scarce or unavailable, then we may incur delays in fulfilling sales orders which could adversely impact our business.

We obtain components for our drones from a limited number of suppliers. Most of these components are sourced from China which has been engaged in a trade war with the United States over the past few years. We do not have a long term agreement with these suppliers that obligates them to sell components to us. Our reliance on these suppliers entails significant risks and uncertainties, including whether these suppliers will provide an adequate quantity of components, at a reasonable price, and on a timely basis. While there are options to purchase certain components from suppliers based in the United States, we would be forced to pay higher prices which would adversely impact our gross margin and operating results. Our operating results could be materially, adversely impacted if our suppliers do not provide the critical components used to assemble our products on a timely basis, at a reasonable price, and in sufficient quantities.

Lack of long-term purchase orders and commitments from customers may lead to a rapid decline in sales.

All customers issue purchase orders solely at their own discretion, often shortly before the requested date of shipment. Customers are generally able to cancel orders (without penalty) or delay the delivery of products on relatively short notice. In addition, current customers may decide not to purchase products for any reason. If those customers do not continue to purchase products, sales volume could decline rapidly with little or no warning.

We cannot rely on long-term purchase orders or commitments to protect from the negative financial effects of a decline in demand for products and typically plans production and inventory levels based on internal forecasts of customer demand, which are highly unpredictable and can fluctuate substantially. Customers give rolling forecasts and issue purchase orders but they have options to reschedule or pay cancellation fees. The uncertainty of product orders makes it difficult to forecast sales and allocate resources in a manner consistent with actual sales. Moreover, expense levels and the amounts invested in capital equipment and new product development costs are based in part on expectations of future sales and, if expectations regarding future sales are inaccurate, we may be unable to reduce costs in a timely manner to adjust for sales shortfalls. Similar factors apply to the lead times for our software and SaaS products. As a result of lack of long- term purchase orders and purchase commitments, and long software development lead times, we may experience a rapid decline in sales.

| S-10 |

As a result of these and other factors, investors should not rely on revenues and operating results for any one quarter or year as an indication of future revenues or operating results. If quarterly revenues or results of operations fall below expectations of investors or public market analysts, the price of the common stock could fall substantially.

If we do not effectively maintain and further develop sales channels for products, including developing and supporting retail sales channel, value added resellers (VARs) and distributors, our business could be harmed.

We depend upon effective sales channels in reaching the customers who are the ultimate purchasers of HMD products and primarily sell products either from in-house sales teams directly to retail outlets such as hobby shops or through websites and VARs.

Distributors, third-party online resellers and VARs generally offer products from several different manufacturers. Accordingly, we are at risk that these distributors, resellers and VARs may give higher priority to selling other companies’ products. If we were to lose the services of a distributor, online reseller, or VAR, they might need to find another in that area, and there can be no assurance of the ability to do so in a timely manner or on favorable terms. Further, resellers and distributors can at times build inventories in anticipation of future sales, and if such sales do not occur as rapidly as they anticipate, resellers and distributors will decrease the size of their future product orders. We are also subject to the risks of distributors, resellers and VARs encountering financial difficulties, which could impede their effectiveness and also expose us to financial risk, for example if they are unable to pay for the products they purchase or ongoing disruptions in business, for example from natural disasters or the effects of COVID-19. Any reduction in sales by current distributors or VARs, loss of key distributors and VARs or decrease in revenue from distributors and VARs could adversely affect our revenue, operating results, and financial condition.

Future growth and profitability may be adversely affected if marketing initiatives are not effective in generating sufficient levels of brand awareness.

Our future growth and profitability will depend in large part upon the effectiveness and efficiency of our marketing efforts, including our ability to:

| • | create awareness of brands and products; |

| • | convert consumer awareness into actual product purchases; |

| • | effectively manage marketing costs (including creative and media) in order to maintain acceptable operating margins and return on marketing investment; and |

| • | successfully offer to sell products or license technology to third-party companies for sale. |

Planned marketing expenditures are unknown and may not result in increased total sales or generate sufficient levels of product and brand name awareness. We may not be able to manage marketing expenditures on a cost-effective basis.

Our products require ongoing research and development and may experience technical problems or delays, which could lead the business to fail.

Our research and development efforts remain subject to all of the risks associated with the development of new products based on emerging and innovative technologies, including, for example, unexpected technical problems or the possible insufficiency of funds for completing development of these products. If technical problems or delays arise, further improvements in products and the introduction of future products could be adversely impacted, and we could incur significant additional expenses and the business may fail.

If HMD’s and pilot gear do not gain greater acceptance in the marketplace, the business strategy may fail.

The acquisition of Fat Shark was based upon the acceptance of HMD wearables for FPV control of drones and the continuation of the attractiveness of that method for piloting drones. Fat Shark has experienced declining revenues over the past several years and such trend may continue or accelerate. Advances in other technologies may overcome their current market limitations and permit them to remain or become more attractive technologies for FPV applications, which could limit the potential market for our products and cause our business strategy to fail. If end-users fail to accept HMDs in the numbers we anticipate or as soon as we anticipate, the sales of our FPV products and our results of operations would be adversely affected and our business strategy may fail.

| S-11 |

There are a number of competing providers of micro-display-based personal display technology, including HMDs, and we may fail to capture a substantial portion of the FPV personal wearable display market.

In addition to competing with other HMD manufacturers and distributors for FPV displays, we also compete with micro-display-based personal display technologies that have been developed by other companies. Numerous start-up companies have announced their intentions to offer HMD products and developer kits in the near future. Further, industry blogs have speculated that companies such as Apple may offer HMDs in the near future.

Most of our competitors have greater financial, marketing, distribution, and technical resources than we do. Moreover, our competitors may succeed in developing new micro-display-based personal display technologies and products that are more affordable or have more desirable features than our technology. If our products are unable to capture a reasonable portion of the HMD market, our business strategy may fail.

The nature of our business involves significant risks and uncertainties that may not be covered by insurance or indemnity.

We develop and sell products where insurance or indemnification may not be available, including:

| • | Designing and developing products using advanced and unproven technologies and drones; and |

| • | Designing and developing products to collect, distribute and analyze various types of information. |

Failure of certain of our products could result in loss of life or property damage. Certain products may raise questions with respect to issues of civil liberties, intellectual property, trespass, conversion and similar concepts, which may raise new legal issues. Indemnification to cover potential claims or liabilities resulting from a failure of technologies developed or deployed may be available in certain circumstances, but not in others. We do not and are not able to maintain insurance to protect against our risks and uncertainties. Substantial claims resulting from an accident, failure of our product, or liability arising from our products in excess of any indemnity or insurance coverage (or for which indemnity or insurance is not available or was not obtained) could harm our financial condition, cash flows, and operating results. Any accident, even if fully covered or insured, could negatively affect our reputation among our customers and the public, and make it more difficult for us to compete effectively.

Product quality issues and a higher-than-expected number of warranty claims or returns could harm our business and operating results.

The products that we sell could contain defects in design or manufacture. Defects could also occur in the products or components that are supplied to us. There can be no assurance we will be able to detect and remedy all defects in the hardware and software we sell, which could result in product recalls, product redesign efforts, loss of revenue, reputational damage and significant warranty and other remediation expenses. Similar to other mobile and consumer electronics, our products have a risk of overheating in the course of usage or upon malfunction. Any such defect could result in harm to property or in personal injury. If we determine that a product does not meet product quality standards or may contain a defect, the launch of such product could be delayed until we remedy the quality issue or defect. The costs associated with any protracted delay necessary to remedy a quality issue or defect in a new product could be substantial.

We generally provide a one-year warranty on all of our products, except in certain European countries where it can be two years for some consumer-focused products. The occurrence of any material defects in our products could expose us to liability for damages and warranty claims in excess of our current reserves, and we could incur significant costs to correct any defects, warranty claims or other problems. In addition, if any of our product designs are defective or are alleged to be defective, we may be required to participate in a recall campaign. In part due to the terms of our warranty policy, any failure rate of our products that exceeds our expectations may result in unanticipated losses. Any negative publicity related to the perceived quality of our products could affect our brand image and decrease retailer, distributor and consumer confidence and demand, which could adversely affect our operating results and financial condition. Further, accidental damage coverage and extended warranties are regulated in the United States at the state level and are treated differently within each state. Additionally, outside of the United States, regulations for extended warranties and accidental damage vary from country to country. Changes in interpretation of the regulations concerning extended warranties and accidental damage coverage on a federal, state, local or international level may cause us to incur costs or have additional regulatory requirements to meet in the future in order to continue to offer our support services. Our failure to comply with past, present and future similar laws could result in reduced sales of our products, reputational damage, penalties and other sanctions, which could harm our business and financial condition.

| S-12 |

Our products will likely experience declining unit prices and we may not be able to offset that decline with production cost decreases or higher unit sales.

In the markets in which we compete, prices of established consumer electronics, displays, personal computers, and mobile products tend to decline significantly over time or as new enhanced versions are introduced, frequently every 12 to 24 months. In order to maintain adequate product profit margins over the long term, we believe that we will need to continuously develop product enhancements and new technologies that will either slow price declines of our products or reduce the cost of producing and delivering our products. While we anticipate many opportunities to reduce production costs over time, we may not be able to reduce our component costs. We expect to attempt to offset the anticipated decrease in our average selling price by introducing new products, increasing our sales volumes or adjusting our product mix. If we fail to do so, our results of operations will be materially and adversely affected.

Our products could infringe on the intellectual property rights of others.

Companies in the consumer electronics, wireless communications, semiconductor, IT, and display industries steadfastly pursue and protect intellectual property rights, often times resulting in considerable and costly litigation to determine the validity of patents and claims by third parties of infringement of patents or other intellectual property rights. Our products could be found to infringe on the intellectual property rights of others. Other companies may hold or obtain patents or inventions or other proprietary rights in technology necessary for our business. Periodically, other companies inquire about our products and technology in their attempts to assess whether we violate their intellectual property rights. If we are forced to defend against infringement claims, we may face costly litigation, diversion of technical and management personnel, and product shipment delays, even if the allegations of infringement are unwarranted. If there is a successful claim of infringement against us and we are unable to develop non-infringing technology or license the infringed or similar technology on a timely basis, or if we are required to cease using one or more of our business or product names due to a successful trademark infringement claim against us, it could adversely affect our business.

Our intellectual property rights and proprietary rights may not adequately protect our products.

Our commercial success will depend substantially on the ability to obtain patents and other intellectual property rights and maintain adequate legal protection for products in the United States and other countries. We will be able to protect our intellectual property from unauthorized use by third parties only to the extent that these assets are covered by valid and enforceable patents, trademarks, copyrights or other intellectual property rights, or are effectively maintained as trade secrets. As of the date of this filing, we own 12 granted United States and foreign patents and 5 pending United States and foreign patent applications. The U.S. patents and patent applications include claims to, among other things, a drone, a printed circuit board, and HMD technology. We apply for patents covering our products, services, technologies, and designs, as we deem appropriate. We may fail to apply for patents on important products, services, technologies or designs in a timely fashion, or at all. We do not know whether any of our patent applications will result in the issuance of any patents. Even if patents are issued, they may not be sufficient to protect our products, services, technologies, or designs. Our existing and future patents may not be sufficiently broad to prevent others from developing competing products, services technologies, or designs. Intellectual property protection and patent rights outside of the United States are even less predictable. As a result, the validity and enforceability of patents cannot be predicted with certainty. Moreover, we cannot be certain whether:

| • | we were the first to conceive, reduce to practice, invent, or file the inventions covered by each of our issued patents and pending patent applications; |

| • | others will independently develop similar or alternative products, technologies, services or designs or duplicate any of our products, technologies, services or designs; |

| • | any patents issued to us will provide us with any competitive advantages, or will be challenged by third parties; |

| • | we will develop additional proprietary products, services, technologies or designs that are patentable; or |

| • | the patents of others will have an adverse effect on our business. |

The patents we own or license and those that may be issued to us in the future may be challenged, invalidated, rendered unenforceable or circumvented, and the rights granted under any issued patents may not provide us with proprietary protection or competitive advantages. Moreover, third parties could practice our inventions in territories where we do not have patent protection or in territories where they could obtain a compulsory license to our technology where patented. Such third parties may then try to import products made using our inventions into the United States or other territories. We cannot ensure that any of our pending patent applications will result in issued patents, or even if issued, predict the breadth, validity and enforceability of the claims upheld in our and other companies’ patents.

| S-13 |