DEF 14A: Definitive proxy statements

Published on July 13, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant | ☑ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

RED CAT HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: | |

| 2. | Aggregate number of securities to which transaction applies: | |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4. | Proposed maximum aggregate value of transaction: | |

| 5. | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: |

July 12, 2022

To Our Shareholders:

It is my pleasure to invite you to attend the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Red Cat Holdings, Inc. (“Red Cat”). The Annual Meeting will be held on September 23rd, 2022. This year, in light of the continued public health impact of the COVID-19 pandemic, the Annual Meeting will be held entirely online. The virtual meeting will also allow for greater participation by all of our stockholders, regardless of their geographic location. The Annual Meeting will be a virtual meeting to be held as an audio-only conference call by calling 877-407-3088 (Toll Free). The Annual Meeting will begin at approximately 12 p.m., Eastern Time.

The matters expected to be acted upon at the Annual Meeting are listed in the Notice of Annual Meeting of Stockholders and more fully described in the accompanying proxy statement. We have also made available or provided our Annual Report on Form 10-K for the fiscal year ended April 30, 2022 which contains important business and financial information regarding Red Cat.

Your vote is important. Whether or not you plan to attend the audio-only Annual Meeting, to ensure that your shares will be represented, please cast your vote as soon as possible via the internet, or, if you received a paper proxy card and voting instructions by mail, by completing and returning the enclosed proxy card in the postage-prepaid envelope. Your vote by proxy will ensure your representation at the Annual Meeting regardless of whether or not you attend virtually.

| Sincerely, | |

| /s/ Jeffrey M. Thompson | |

| Jeffrey M. Thompson | |

| Chief Executive Officer and Director |

YOUR VOTE IS IMPORTANT

Your vote is important. As described in your electronic proxy materials notice or on the enclosed paper proxy card and voting instructions, please vote by: (1) accessing the internet website or (2) signing and dating the proxy card as promptly as possible and returning it in the enclosed envelope (to which no postage need be affixed if mailed in the United States). Even if you plan to attend the virtual Annual Meeting, we recommend that you vote your shares in advance, so that your vote will be counted if you later decide not to attend online.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON SEPTEMBER 23, 2022: THE PROXY STATEMENT AND ANNUAL REPORT ARE AVAILABLE AT WWW.REDCAT.VOTE ON AUGUST 5, 2022.

| 2 |

RED CAT HOLDINGS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

SEPTEMBER 23, 2022

To the Shareholders:

| Time and Date: | September 23rd, 2022 at 12 p.m. Eastern Time | ||

| Place: | Audio-only conference call at 877-407-3088 (Toll Free) | ||

| Items of Business: | 1. | Elect the five (5) directors listed in the accompanying proxy statement. | |

| 2. | Ratify the appointment of BF Borgers, CPA, PC as the independent registered public accounting firm of Red Cat Holdings, Inc. for the fiscal year ending April 30, 2023. | ||

| 3. | Conduct an advisory vote to approve named executive officer compensation (the say-on-pay vote). | ||

| 4. | Conduct an advisory vote on the frequency of executive compensation shareholder votes (the say-on-frequency vote). | ||

| 5. | Transact any other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. | ||

| Record Date: | Only stockholders of record at the close of business on July 29th, 2022 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments thereof. | ||

| Proxy Voting: | Each share of common stock represents one vote. | ||

|

Questions:

|

If you are a registered holder, contact our transfer agent, Equity Stock Transfer, LLC, through its website at www.equitystock.com or by phone at (212) 575-5757. If you are a beneficial owner of record as of the Record Date (i.e., you held your shares in an account at a brokerage firm, bank or other similar agent), contact your broker, bank or other agent. |

||

This notice of the Annual Meeting, proxy statement, form of proxy and our 2022 Annual Report are being distributed or made available on or about August 5, 2022.

Whether or not you plan to attend the audio-only conference call Annual Meeting, we encourage you to vote or submit your proxy via the internet, or request and submit your proxy card as soon as possible, so that your shares may be represented at the meeting.

| By Order of the Board of Directors, | |

| /s/ Joseph Hernon | |

| Joseph Hernon, Corporate Secretary | |

| and Chief Financial Officer |

| 3 |

RED CAT HOLDINGS, INC.

15 AVE. MUNOZ RIVERA, STE 2200

SAN JUAN, PUERTO RICO 00901

PROXY STATEMENT FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

July 12, 2022

INFORMATION ABOUT SOLICITATION AND VOTING

The accompanying proxy is solicited on behalf of the board of directors of Red Cat Holdings, Inc. (“we,” “us,” the “Company,” “our company” or “Red Cat”) for use at our 2022 Annual Meeting of Stockholders (the “Annual Meeting”), to be held as an audio-only conference call by calling 877-407-3088 (Toll Free) on September 23, 2022 at 12 p.m. Eastern Time, and any adjournment or postponement thereof. Beginning on or about August 5th, 2022, a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”), which contains instructions on how to access this proxy statement for the Annual Meeting (this “Proxy Statement”) and our Annual Report on Form 10-K for the fiscal year ended April 30, 2022 (the “Annual Report”), is being mailed to our stockholders. Our fiscal year ended April 30, 2022 is also referred to herein as “Fiscal 2022.”

INTERNET AVAILABILITY OF PROXY MATERIALS

We are using the internet as the primary means for furnishing proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders a Notice of Internet Availability with instructions for accessing the proxy materials online, including this Proxy Statement and our Annual Report, and for voting via the internet or by mail. The Notice of Internet Availability also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. We encourage stockholders to take advantage of the online availability of proxy materials, as we believe it helps in conserving natural resources and reduces our printing and mailing costs.

GENERAL INFORMATION ABOUT THE MEETING

What is the purpose of the Annual Meeting?

The purpose is to have stockholders vote upon the proposals described in this Proxy Statement.

What proposals are scheduled to be voted on at the Annual Meeting?

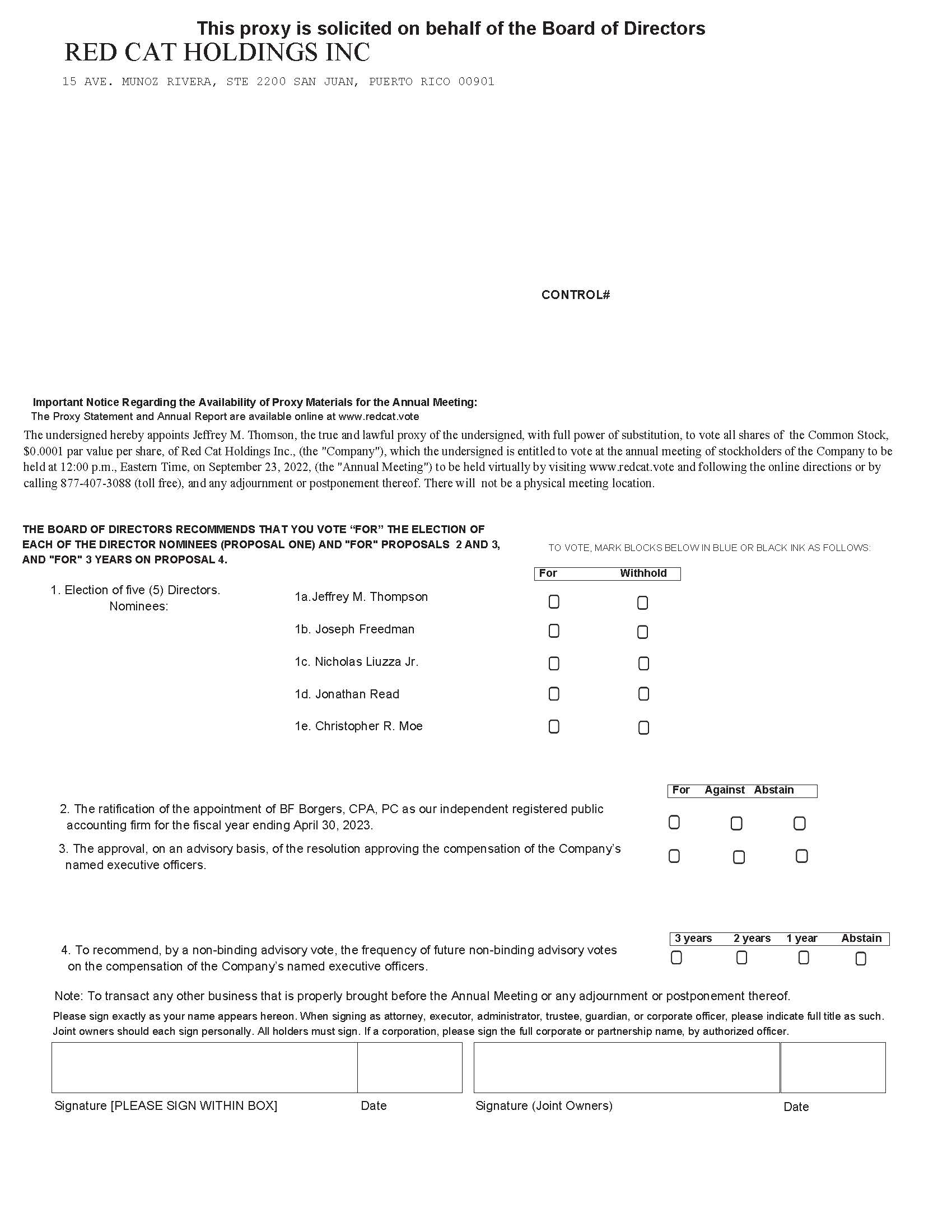

Stockholders will be asked to vote upon the following four proposals:

1. The election of each of the five (5) directors set forth in Proposal One to serve for a term of one year or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal.

2. The ratification of the appointment of BF Borgers, CPA, PC as our independent registered public accounting firm for the fiscal year ending April 30, 2023.

3. An advisory vote to approve named executive officer compensation (the say-on-pay vote).

4. An advisory vote on how frequently named executive officer compensation will be voted upon by the shareholders (the say-on-frequency vote).

What is the recommendation of our Board of Directors on each of the proposals scheduled to be voted upon at the Annual Meeting?

| 4 |

Our Board of Directors recommends that you vote your shares:

| ● | FOR each of the nominees to the Board of Directors (Proposal One); |

| ● | FOR the ratification of the appointment of BF Borgers, CPA, PC as our independent registered public accounting firm for the fiscal year ending April 30, 2023 (Proposal Two); |

| ● | FOR the approval, on an advisory basis, of the named executive officer compensation (Proposal Three); and |

| ● | FOR the approval of conducting future advisory votes on executive compensation every three (3) years. |

Why are we having a virtual only meeting?

In consideration of the continued public health impact of the COVID-19 pandemic and our commitment to support the health, safety and wellness of our communities, stockholders, and other stakeholders, we will hold the Annual Meeting in a virtual format which will be conducted via an audio-only conference. We intend to hold the virtual Annual Meeting in a manner that affords you the same rights and opportunities to participate as you would have at an in-person meeting.

Who may attend and how do I attend?

All holders of our common stock as of the Record Date, or their duly appointed proxies, may attend the Annual Meeting (via webinar or phone call). Set forth below is a summary of the information you need to attend the Annual Meeting:

| ● | Access the audio-only conference call by calling 877-407-3088 (Toll Free) or +1-877-407-3088 (International); |

| ● | Instructions on how to attend and participate in the Annual Meeting, including how to demonstrate proof of stock ownership, are also available as follows: |

| ○ | Stockholders of Record: Stockholders of record as of the Record Date can attend the Annual Meeting by calling the live audio conference call at +1-877-407-3088 and presenting your unique control number on the proxy card. |

| ○ | Beneficial Owners: If you were a beneficial owner of record as of the Record Date (i.e., you held your shares in an account at a brokerage firm, bank or other similar agent), you will need to obtain a legal proxy from your broker, bank or other agent. Once you have received a legal proxy from your broker, bank or other agent, it should be emailed to our transfer agent, Equity Stock Transfer, at proxy@equitystock.com and should be labeled “Legal Proxy” in the subject line. Please include proof from your broker, bank or other agent of your legal proxy (e.g., a forwarded email from your broker, bank or other agent with your legal proxy attached, or an image of your valid proxy attached to your email). Requests for registration must be received by Equity Stock Transfer no later than 5:00 p.m. Eastern Time, on September 21, 2022. You will then receive a confirmation of your registration, with a control number, by email from Equity Stock Transfer. Access the live audio conference call at +1-877-407-3088 and present your unique control number. |

| ● | Stockholders may submit live questions on the conference line while attending the Annual Meeting. |

What if I have technical difficulties or trouble accessing the virtual Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have in accessing the virtual Annual Meeting. If you encounter any difficulties, please call: 877-804-2062 (Toll Free) or email proxy@equitystock.com.

A replay of the Annual Meeting will be posted as soon as practical on www.redcat.vote.

| 5 |

Who can vote at the Annual Meeting?

Stockholders as of the Record Date are entitled to vote at the Annual Meeting. At the close of business on July 12, 2022, there were 53,807,973 shares of our common stock outstanding and entitled to vote. Each share of our common stock as of the close of business on the Record Date is entitled to one vote on each matter presented at the Annual Meeting. There is no cumulative voting.

How do I vote my shares?

Whether you plan to attend the virtual Annual Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. Except as set forth below, if you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board of Director’s recommendations. Voting by proxy will not affect your right to attend the Annual Meeting.

If your shares are registered directly in your name through our stock transfer agent, Equity Stock Transfer, or you have stock certificates, you may vote:

- By Internet. The website address for Internet voting is www.redcat.vote. Please click “Vote Your Proxy” and enter your control number.

- By mail. Mark, date, sign and mail promptly the Proxy Card, ATTN: Shareholder Services.

- At the Annual Meeting. If you are a shareholder of record, you can participate and vote your shares at the Annual Meeting by visiting www.redcat.vote and then clicking “Vote Your Proxy”. You may then enter the control number included on your Proxy Card and view the proposals and cast your vote.

If your shares are held in “street name,” your bank, broker or other nominee should provide to you a request for voting instructions along with the Company’s proxy solicitation materials. By completing the voting instruction card, you may direct your nominee how to vote your shares. If you partially complete the voting instruction but fail to complete one or more of the voting instructions, then your nominee may be unable to vote your shares with respect to the proposal as to which you provided no voting instructions. Alternatively, if you want to vote your shares during the Annual Meeting, you must contact your nominee directly in order to obtain a proxy issued to you by your nominee holder. Note that a broker letter that identifies you as a stockholder is not the same as a nominee-issued proxy. If you fail to present a nominee-issued proxy to proxy@equitystock.com by 5:00 p.m. Eastern Time on September 21, 2021, you will not be able to vote your nominee- held shares during the Annual Meeting.

Can I change my vote or revoke my proxy?

A stockholder of record who has given a proxy may revoke it at any time before it is exercised at the Annual Meeting by:

| ● | Delivering to our Corporate Secretary a written notice stating that the proxy is revoked; |

| ● | Signing and delivering a proxy bearing a later date; |

| ● | Voting again via internet no later than 7:00 p.m. Eastern Time on September 22, 2022; or |

| ● | Voting again during the Annual Meeting when the Chairman opens the polls |

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Will I be able to ask questions at the Annual Meeting?

Shareholders may submit live questions on the conference line while attending the virtual Annual Meeting. Only questions pertinent to meeting matters or our Company will be answered during the meeting, subject to time constraints. Questions that are substantially similar may be grouped and answered together to avoid repetition.

| 6 |

What is the quorum requirement for the Annual Meeting?

The holders of a majority of the voting power of the shares of our common stock entitled to vote at the Annual Meeting as of the Record Date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Annual Meeting if you are present and vote in person at the Annual Meeting, if you vote in advance of the Annual Meeting by mail or internet or by telephone or if you have properly submitted a proxy.

What is the vote required for each proposal?

For Proposal One, each director will be elected by a plurality of the votes cast, which means that the five (5) individuals nominated for election to our Board of Directors at the Annual Meeting receiving the highest number of “FOR” votes will be elected. You may vote “FOR ALL NOMINEES,” to “WITHHOLD AUTHORITY FOR ALL NOMINEES” or “FOR ALL EXCEPT” one or more of the nominees you specify. If any nominee is unable or unwilling to serve for any reason, proxies may be voted for such substitute nominee as the proxy holder might determine. Proxies may not be voted for more than five directors. Each nominee has consented to being named in this Proxy Statement and to serve if elected.

For Proposal Two, ratification of the appointment of BF Borgers, CPA, PC as our independent registered public accounting firm for the fiscal year ending April 30, 2023 will be obtained if the number of votes cast “FOR” the proposal at the Annual Meeting represents a majority of the votes cast by stockholders.

For Proposal Three, the approval, on an advisory basis, of the named executive officer compensation will be obtained if the number of votes cast “FOR” the proposal at the Annual Meeting represents a majority of the votes cast by stockholders.

For Proposal Four, the approval, on an advisory basis, of taking future advisory votes on executive officer compensation every three (3) years, obtained if the number of votes cast “FOR” the proposal at the Annual Meeting represents a majority of the votes cast by stockholders.

How are abstentions and broker non-votes treated?

Abstentions (i.e. shares present at the Annual Meeting and marked “abstain”) and “broker non-votes” are each included in the determination of the number of shares present and entitled to vote at the meeting for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting; however, neither abstentions nor broker non-votes are counted as voted either for or against a proposal and, as such, will not affect the outcome of the vote on any proposal.

A “broker non-vote” occurs when your broker submits a proxy for your shares but does not indicate a vote for a particular proposal because the broker has not received voting instructions from you and is not authorized to vote on that proposal without instructions. A broker is authorized to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares, but is not authorized to vote shares held for a beneficial owner on “non-routine” matters without instructions from the beneficial owner of those shares.

Proposals One, Three, and Four are each considered a “non-routine” matter. If you do not provide your broker with specific instructions on how to vote your shares, the broker that holds your shares will not be authorized to vote on Proposal One, Three, or Four. Accordingly, we encourage you to provide voting instructions to your broker, whether or not you plan to attend the Annual Meeting.

Proposal Two is considered a “routine” matter. Brokers have discretionary authority to vote shares that are beneficially owned on Proposal Two.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on each proxy card and vote each proxy card via the internet or by mail. If you requested or received paper proxy materials and you intend to vote by mail, please complete, sign and return each proxy card you received to ensure that all of your shares are voted.

| 7 |

Who is paying for this proxy solicitation?

We will pay the expenses of soliciting proxies, including preparation, assembly, printing and mailing of this Proxy Statement, the proxy card and any other information furnished to stockholders. Following the original mailing of the proxy materials, we and our agents, including directors, officers and other employees, without additional compensation, may solicit proxies by mail, email, telephone, facsimile, by other similar means or in person. Following the original mailing of the proxy materials, we will request brokers, custodians, nominees and other record holders to forward copies of the proxy materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, upon the request of the record holders, we will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials or vote via the internet, you are responsible for any internet access charges you may incur.

Where can I find the voting results?

Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting. The preliminary voting results will be announced at the Annual Meeting. The final results will be tallied by the inspector of elections and filed with the U.S. Securities and Exchange Commission (the “SEC”) in a current report on Form 8-K within four business days of the Annual Meeting.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Composition of our Board of Directors

Our board of directors currently consists of five members. Our directors hold office until their successors have been elected and qualified or until the earlier of their death, resignation or removal. There are no family relationships among any of our directors or executive officers.

Director Independence

Our Board has determined that all of our present directors are independent, in accordance with standards under the Nasdaq Listing Rules, other than Mr. Thompson. Our Board determined that, under the Nasdaq Listing Rules, Mr. Thompson is not an independent director because he is the Chief Executive Officer and President of the Company.

Our Board has determined that Messrs. Read, Freedman, Moe and Liuzza are independent under the Nasdaq Listing Rules’ independence standards for Audit Committee members. Our Board has also determined that they are independent under the Nasdaq Listing Rules independence standards for Compensation Committee members and for Governance and Nominating committee members.

Committees of the Board of Directors

Audit Committee

The Audit Committee is composed of three independent directors: Christopher Moe, Chairman of the Committee, Nicholas Liuzza, and Jonathan Read. Each member of the Audit Committee is an independent director as defined by the rules of the SEC and Nasdaq. The Audit Committee has the sole authority and responsibility to select, evaluate and engage independent auditors for the Company. The Audit Committee reviews with the auditors and with the Company’s financial management all matters relating to the annual audit of the Company.

The Audit Committee monitors the integrity of our financial statements, monitors the independent registered public accounting firm’s qualifications and independence, monitors the performance of our internal audit function and the auditors, and monitors our compliance with legal and regulatory requirements. The Audit Committee also meets with our auditors to review the results of their audit and review of our annual and interim financial statements.

The Audit Committee meets at least on a quarterly basis to discuss with management the annual audited financial statements and quarterly financial statements and meets from time to time to discuss general corporate matters.

| 8 |

Audit Committee Financial Expert

Our Board determined that Christopher Moe is qualified as an Audit Committee Financial Expert, as that term is defined by the rules of the SEC, in compliance with the Sarbanes-Oxley Act of 2002.

Compensation Committee

The Compensation Committee consists of Nicholas Liuzza, Chairman of the Committee, Joseph Freedman, and Jonathan Read, each of whom are independent directors. The Compensation Committee reviews, recommends and approves salaries and other compensation of the Company’s executive officers, and administers the Company’s equity incentive plans (including reviewing, recommending and approving stock option and other equity incentive grants to executive officers). The Compensation Committee meets in executive session to determine the compensation of the Chief Executive Officer of the Company. In determining the amount, form, and terms of such compensation, the Committee considers the annual performance evaluation of the Chief Executive Officer conducted by the Board in light of company goals and objectives relevant to Chief Executive Officer compensation, competitive market data pertaining to Chief Executive Officer compensation at comparable companies, and such other factors as it deems relevant, and is guided by, and seeks to promote, the best interests of the Company and its shareholders.

In addition, subject to existing agreements, the Compensation Committee determines the salaries, bonuses, and other matters relating to compensation of other executive officers of the Company using similar parameters. It sets performance targets for determining periodic bonuses payable to executive officers. It also reviews and makes recommendations to the Board regarding executive and employee compensation and benefit plans and programs generally, including employee bonus and retirement plans and programs (except to the extent specifically delegated to a Board appointed committee with authority to administer a particular plan). In addition, the Compensation Committee approves the compensation of non-employee directors and reports it to the full Board.

The Compensation Committee also reviews and makes recommendations with respect to stockholder proposals related to compensation matters. The committee administers the Company’s equity incentive plans, including the review and grant of stock options and other equity incentive grants to executive officers and other employees and consultants.

The Compensation Committee may, in its sole discretion and at the Company’s cost, retain or obtain the advice of a compensation consultant, legal counsel or other adviser. The Compensation Committee is directly responsible for the appointment, compensation and oversight of the work of any compensation consultant, legal counsel and other adviser retained by the committee.

Governance and Nominating Committee

The Governance and Nominating Committee consists of Joseph Freedman, Chairman of the Committee, Jonathan Read and Christopher Moe, each of whom meets the independence requirements of all other applicable laws, rules and regulations governing director independence, as determined by the Board.

The Governance and Nominating Committee (i) identifies individuals qualified to become members of the Board, consistent with criteria approved by the Board; (ii) recommends to the Board the director nominees for the next annual meeting of stockholders or special meeting of stockholders at which directors are to be elected; (iii) recommends to the Board candidates to fill any vacancies on the Board; (iv) develops, recommends to the Board, and reviews the corporate governance guidelines applicable to the Company; and (v) oversees the evaluation of the Board and management.

In recommending director nominees for the next annual meeting of stockholders, the Governance and Nominating Committee ensures the Company complies with its contractual obligations, if any, governing the nomination of directors. It considers and recruits candidates to fill positions on the Board, including as a result of the removal, resignation or retirement of any director, an increase in the size of the Board or otherwise. The Committee conducts, subject to applicable law, any and all inquiries into the background and qualifications of any candidate for the Board and such candidate’s compliance with the independence and other qualification requirements established by the Committee. The Committee also recommends candidates to fill positions on committees of the Board.

| 9 |

In selecting and recommending candidates for election to the Board or appointment to any committee of the Board, the Committee does not believe that it is appropriate to select nominees through mechanical application of specified criteria. Rather, the Committee shall consider such factors at it deems appropriate, including, without limitation, the following: (i) personal and professional integrity, ethics and values; (ii) experience in corporate management, such as serving as an officer or former officer of a publicly-held company; (iii) experience in the Company’s industry; (iv) experience as a board member of another publicly-held company; (v) diversity of expertise and experience in substantive matters pertaining to the Company’s business relative to other directors of the Company; (vi) practical and mature business judgment; and (vii) composition of the Board (including its size and structure).

The Committee develops and recommends to the Board a policy regarding the consideration of director candidates recommended by the Company’s stockholders and procedures for submission by stockholders of director nominee recommendations.

In appropriate circumstances, the Committee, in its discretion, will consider and may recommend the removal of a director, in accordance with the applicable provisions of the Company’s certificate of incorporation and bylaws. If the Company is subject to a binding obligation that requires director removal structure inconsistent with the foregoing, then the removal of a director shall be governed by such instrument.

The Committee oversees the evaluation of the Board and management. It also develops and recommends to the Board a set of corporate governance guidelines applicable to the Company, which the Committee shall periodically review and revise as appropriate. In discharging its oversight role, the Committee is empowered to investigate any matter brought to its attention.

Board Diversity

While we do not have a formal policy on diversity, the Board considers diversity to include the skill set, background, reputation, type and length of business experience of the Board members as well as a particular nominee’s contributions to that mix. The Board believes that diversity brings a variety of ideas, judgments and considerations that benefit the Company and its stockholders. Although there are many other factors, the Board seeks individuals with experience operating and growing businesses.

Board Leadership Structure

Jeffrey Thompson serves as the Chairman of the Board and actively interfaces with management, the Board and counsel.

Board Risk Oversight

The Company’s risk management function is overseen by the Board. The Company’s management keeps the Board apprised of material risks and provides the directors with access to all information necessary for them to understand and evaluate how these risks interrelate, how they affect us, and how management addresses those risks. Jeffrey Thompson, Chairman of the Board, works closely together with the other members of the Board when material risks are identified on how to best address such risks. If the identified risk poses an actual or potential conflict with management, the Company’s independent directors may conduct the assessment. Presently, the primary risks affecting us are our lack of material revenue and continuing net losses.

Family Relationships

There are no family relationships among any of our officers or directors.

Involvement in Legal Proceedings

We are not aware of any of our directors or officers being involved in any legal proceedings in the past ten years relating to any matters in bankruptcy, insolvency, criminal proceedings (other than traffic and other minor offenses) or being subject to any of the items set forth under Item 401(f) of Regulation S-K other than Mr. Read as described under “Biographies.”

| 10 |

Code of Ethics

The Board has adopted a Code of Business Conduct and Ethics (the “Code of Ethics”) that applies to all of the Company’s employees, including the Chief Executive Officer, Chief Operating Officer, and Chief Financial Officer. Although not required, the Code of Ethics also applies to the Company’s directors. The Code of Ethics provides written standards that we believe are reasonably designed to deter wrongdoing and promote honest and ethical conduct, including (i) the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, (ii) full, fair, accurate, timely and understandable disclosure and compliance with laws, rules and regulations, (iii) the prompt reporting of illegal or unethical behavior, (iv) and accountability for adherence to the Code of Ethics.

Changes in Nominating Process

There are no material changes to the procedures by which security holders may recommend nominees to our Board.

PROPOSAL ONE: ELECTION OF DIRECTORS

At the recommendation of our Nominating and Corporate Governance Committee, our Board of Directors proposes that each of the five nominees named below be elected as a director to serve until our next annual meeting of stockholders or until such director’s successor is duly elected and qualified or until such director’s earlier death, resignation, disqualification or removal.

There are no family relationships among our directors and executive officers.

NOMINEES TO OUR BOARD OF DIRECTORS

The nominees, their ages as of July 1st, 2022, and biographical information are set forth below:

Jeffrey M. Thompson, Director, President and Chief Executive Officer, Age 58

Jeffrey Thompson has been President and Chief Executive Officer of the Company since May 15, 2019. In December 1999, Mr. Thompson founded Towerstream Corporation (NASDAQ:TWER), a fixed-wireless fiber alternative company delivering high-speed internet access to businesses, and served as its president, chief executive officer and a director from November 2005 to February 2016. In 1994, Mr. Thompson founded EdgeNet Inc., a privately held Internet service provider (which was sold to Citadel Broadcasting Corporation in 1997) and became eFortress through 1999. Mr. Thompson holds a B.S. degree from the University of Massachusetts.

Mr. Thompson’s management and public company experience and his role as President and Chief Executive Officer of the Company, led to his appointment as a director.

Joseph Freedman, Director, Age 56

Joe Freedman is an entrepreneur with experience launching, growing, and successfully exiting businesses in legal recruitment, settlement services, technology, and the hospitality industries. The businesses founded by Mr. Freedman have been recognized as hyper-growth, market leaders, and several have been acquired by NYSE listed, private equity and privately held companies. Four of the companies Mr. Freedman founded have been listed on the Inc. 500/5000, 14 times, with one being listed in the top 100. With more than two decades in the executive and legal search industry, Mr. Freedman has exceptional talent acquisition instincts for identifying and recruiting top-tier talent.

In 2006, Mr. Freedman co-founded and currently serves on the board of Peachtree Tents & Events Holdings, LLC. In 2009 Mr. Freedman co-founded and served on the board of RFx Legal, LLC until its acquisition in 2013. Mr. Freedman co-founded and served as the chief executive officer of Richmond Title, LLC until its acquisition in 2006, and founded and served as chief executive officer of AMICUS Legal Staffing, Inc. until its acquisition in 1996. Mr. Freedman currently serves as an advisor to Headsets.com, Onsite Healthcare, LLC and Joyride Tour, LLC. He also serves on several civic boards including the Entrepreneurs’ Organization (Nashville Chapter) where he’s held numerous board positions including the past president. He currently serves as Governance Chairman and is an active member of the Strategic Council. In 2022, Mr. Freedman founded the nonprofit, Drones For Good Worldwide which provides drones to assist with humanitarian efforts during disasters across the globe. Mr. Freedman earned a B.S. degree in Finance from Louisiana State University and Juris Doctorate from Northwestern California University School of Law.

| 11 |

Mr. Freedman’s recruiting, business and financial experience provide the basis upon which the Company has appointed him to the Board.

Nicholas Liuzza Jr., Director, Age 56

Nicholas Liuzza Jr. has been a director of the Company since June 1, 2019. Mr. Liuzza co-founded Beeline Loans, a Digital Mortgage Lender in 2019. Previously, Mr Liuzza founded Linear Title & Closing, Ltd, a highly automated, and one of the largest, private national title agencies in the U.S in 2005. In 2012, he founded Nexgen Mortgage Services. Both companies merged with Real Matters and went public on the Toronto Stock Exchange (TSX) in 2018 at a $1 billion valuation. Nick served as Executive Vice President of Real Matters, Inc. and exited in 2020 to work for Beeline Loans. Mr. Liuzza founded New Age Nurses, a healthcare staffing company which he grew into a national provider of healthcare personnel services which became the platform for a reverse merger which listed on the OTC upon its acquisition in 2003 by Crdentia. Prior thereto, Mr. Liuzza was Executive Vice President of AMICUS Legal Staffing, a national staffing services provider with a specialization in real estate transactions. Mr. Liuzza started his career with Xerox Corporation in 1988. Mr. Liuzza’s more than 20 years of experience as an entrepreneur in the software industry and his sales and software development experience led to his appointment as a director.

Jonathan Read, Director, Age 65

Jonathan Read has been a director of the Company since August 18, 2017 and was the Chief Executive Officer, Secretary and Treasurer of the Company from October 20, 2017 until May 2019. From July 14, 2017 through July 20, 2018, Mr. Read served as a director of BTCS Inc, a digital asset-related company. From November 1, 2015 to January 31, 2017, Mr. Read was Chief Executive Officer and a director of the Company. Since 2013, Mr. Read has been Managing Partner of Quadratam1 LLC, a Scottsdale, Arizona based firm specializing in providing financial and organizational consulting services for growth-stage companies in the United States and China. From 2005 through 2012, Mr. Read was the Chief Executive Officer and a director of ECOtality, Inc. (“ECOtality”), a San Francisco based company that Mr. Read founded, and was the founding company of the “Blink” charging network. In 2013, ECOtality, Inc. filed for Chapter 11 bankruptcy protection. In 2014, Mr. Read filed for bankruptcy personally. Mr. Read’s prior experience with the Company and other public companies led to his appointment as a director.

Christopher R. Moe, Director, Age 66

Christopher R. Moe serves as the Chief Financial Officer and Director of Yates Electrospace Corporation, a heavy payload autonomous cargo delivery drone developer and producer. Earlier he was the Chairman, Chief Executive Officer and co-Founder of ProBrass Inc., a rifle brass cartridge case manufacturing company. Previously he was the Chief Financial Officer of Vectrix Holdings Limited, a subsidiary of GP Industries Ltd (G20:SGX), an international developer and manufacturer of electric motorcycles and Chief Financial Officer and Director of Mission Motor Company, a company focused on advanced EV and hybrid powertrains for automobile and power sports applications. Earlier he served as the Chief Financial Officer & Director of Vectrix Corporation (LSE:VRX), Managing Director of GH Ventures, Managing Director of Kirkland Investment Corporation, Chief Executive Officer of St. Louis Ship Industries, Vice President of Wasserstein, Perella & Co.’s merchant banking fund and Vice President/Area Head with Citicorp’s Leveraged Capital Group. He served as a Captain of United States Marines and deployed with artillery and infantry units twice to the Western Pacific and Indian Ocean. He is a current Trustee and the former Treasurer of The Pennfield School and the former Treasurer of the Zabriskie Memorial Church of Saint John the Evangelist. He holds a BA degree in English from Brown University and an MBA from the Harvard Business School.

Mr. Moe’s experience in operational finance, and with venture capital, private equity, M&A, and corporate finance transactions, both as agent and principal, with a focus on transportation, provide the basis upon which the Company appointed him to the Board.

| 12 |

Director Compensation Table

The following table presents the total compensation for each person who served as a non-employee director during Fiscal 2022. Mr. Thompson is not included in the table below, as he is employed as our Chief Executive Officer and receives no compensation for his service as director. The compensation received by Mr. Thompson as an employee is included in the “Executive Compensation—Summary Compensation Table.”

| Name | Fees Earned or Paid in Cash | Stock Awards(1) | Options Awards(2) | Non-Equity Incentive Plan Compensation | Nonqualified Deferred Compensation Earnings | Total | ||||||||||||||||||

| Joseph Freedman | $ | 17,000 | $ | 20,001 | $ | 36,895 | — | — | $ | 73,896 | ||||||||||||||

| Nicholas Liuzza | $ | 76,666 | $ | 42,502 | — | — | — | $ | 119,168 | |||||||||||||||

| Jonathan Read | $ | 13,333 | $ | 20,001 | — | — | — | $ | 33,334 | |||||||||||||||

| Christopher Moe | $ | 8,333 | $ | 20,001 | — | — | — | $ | 28,334 | |||||||||||||||

| (1) | We value stock awards based on their fair value on the date that awards vest. Fair value is calculated by multiplying the number of awards vesting times the Company’s closing stock price on the date of vesting. |

| (2) | We value option awards in accordance with Accounting Standards Codification Topic 718, Compensation - Stock Compensation. Fair value is determined based on the Black-Scholes Model using inputs reflecting our estimates of expected volatility, term, discount rates and dividend expectations. Compensation expense is recognized based on the vesting terms of the award. |

Non-Employee Director Compensation Arrangements

In April 2022, the Board of Directors established a formal compensation plan for Non-Employee Directors. Under the plan, Non-Employee Directors shall receive annual compensation of $100,000 consisting of:

| ● | $40,000 in cash compensation, payable in monthly installments beginning May 1, 2022 |

| ● | $60,000 in equity compensation, payable in the form of shares of restricted common stock to be issued on May 1 annually, with 25% of the shares vesting immediately and the remaining 75% vesting in 24 monthly installments beginning on June 1 |

In addition, the Chairman of each Committee of the Board shall receive additional annual cash compensation, payable in monthly installments, as follows:

| ● | $10,000 - Audit Committee |

| ● | $6,000 - Compensation Committee |

| ● | $5,000 - Nominating and Governance Committee |

In consideration of services rendered prior to establishment of a formal compensation plan, the Non-Employee Directors were awarded plan compensation retroactive to January 1, 2022. This resulted in total compensation to each Non-Employee Director for the fiscal year ended April 30, 2022 as follows:

| ● | $37,001 to Joseph Freedman, consisting of $13,333 for board service, $2,000 as Chairman of the Compensation Committee, $1,667 as Chairman of the Nominating and Governance Committee, and $20,001 representing the fair value of the 9,390 shares which vested in the fiscal year ended April 30, 2022. |

| ● | $36,667 to Nicholas Liuzza, consisting of $13,333 for board service, $3,333 as Chairman of the Audit Committee and $20,001 representing the fair value of the 9,390 shares which vested in the fiscal year ended April 30, 2022. |

| ● | $33,334 to Jonathan Read, consisting of $13,333 for board service and $20,001 representing the fair value of the 9,390 shares which vested in the fiscal year ended April 30, 2022. |

| ● | $28,334 to Christopher Moe consisting of $8,333 for board service and $20,001 representing the fair value of the 9,390 shares which vested in the fiscal year ended April 30, 2022. |

| 13 |

On January 11, 2021, the Company issued a ten-year option to purchase 100,000 shares of Common Stock at an exercise price of $2.01 per share under the Equity Incentive Plan to Joseph Freedman upon his acceptance of appointment as a director of the Company. Fifty percent of these options vested immediately, with twenty-five percent of the options vesting on each of the first and second anniversary of the grant date. The options were valued at $147,581 and compensation expense totaled $36,895 in fiscal 2022.

Finally, in recognition of services provided dating back to 2019, Nick Liuzza was awarded additional cash compensation of $60,000 and additional stock compensation of $22,501 representing the fair value of the 10,564 shares which vested in the fiscal year ended April 30, 2022.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR ALL NOMINEES” FOR THE ELECTION OF THE FIVE DIRECTORS SET FORTH IN THIS PROPOSAL ONE.

PROPOSAL TWO: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has selected BF Borgers, CPA, PC as our independent registered public accounting firm to perform the audit of our consolidated financial statements for the fiscal year ending April 30, 2023, and recommends that our stockholders vote for the ratification of such selection. The ratification of the selection of BF Borgers, CPA, PC as our independent registered public accounting firm for the fiscal year ending April 30, 2023 requires the affirmative vote of a majority of the votes cast by stockholders. In the event that BF Borgers, CPA, PC is not ratified by our stockholders, the Audit Committee will review its future selection of BF Borgers, CPA, PC as our independent registered public accounting firm.

BF Borgers, CPA, PC audited our financial statements for the fiscal year ended April 30, 2022.

Independent Registered Public Accounting Firm Fees and Services

We regularly review the services and fees from our independent registered public accounting firm. These services and fees are also reviewed with our Audit Committee annually. In accordance with standard policy, BF Borgers, CPA, PC periodically rotates the individuals who are responsible for our audit. Our audit for the fiscal year ended April 30, 2022 has not yet been completed and the final audit fees have not yet been determined. We estimate that fees for the audit for the fiscal year ended April 30, 2022 will be comparable to those for the prior audit. During the years ended April 30, 2021 and April 30, 2020, fees for services provided by BF Borgers, CPA, PC were as follows:

| Fiscal Year Ended | ||||||||

| April 30, 2021 | April 30, 2020 | |||||||

| Audit fees (1) | $ | 86,400 | $ | 94,800 | ||||

| Audit-related fees (2) | — | — | ||||||

| Tax fees (3) | — | — | ||||||

| Other fees (4) | 30,100 | — | ||||||

| Total fees | $ | 116,500 | $ | 94,800 | ||||

| (1) | Consists of fees rendered in connection with the audit of our consolidated financial statements included in our annual report on Form 10-K, review of the interim consolidated financial statements included in our quarterly reports and services normally provided in connection with regulatory filings. |

| (2) | Consists of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.” |

| (3) | Consists of fees billed for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding federal, state and international tax compliance, as well as technical tax advice related to federal and state income tax matters, assistance with sales tax and assistance with tax audits. |

| (4) | Consists of fees for professional services other than those reported in the categories above, including access to resource materials and portals. |

| 14 |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by our independent registered public accounting firm, the scope of services provided by our independent registered public accounting firm and the fees for the services to be performed. These services may include audit services, audit-related services, tax services and other services. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by our independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. All of the services relating to the fees described in the table above were approved by our Audit Committee.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL TWO.

PROPOSAL THREE: ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

This stockholder advisory vote, commonly known as "say-on-pay," is required pursuant to Section 14A of the Exchange Act and gives our stockholders the opportunity to approve or not approve, on a non-binding advisory basis, the compensation paid to our Chief Executive Officer and the other officers named in the Summary Compensation Table (“named executive officers”) as disclosed in this Proxy Statement.

The Board recommends a vote "FOR" the following resolution:

“RESOLVED, that the stockholders of Red Cat Holdings, Inc. approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Proxy Statement.”

The Executive Compensation disclosure section of this Proxy describes our executive compensation programs and the compensation decisions made by our Compensation Committee and Board of Directors for the three fiscal years ending April 30, 2022 with respect to the named executive officers.

Our Board of Directors is asking you to support this proposal. Because your vote is advisory, it will not be binding. However, the Board and the Compensation Committee will review the voting results in their entirety and take them into consideration when making future decisions regarding named executive officer compensation. We currently intend to submit the executive compensation of our named executive officers to an advisory vote at our annual meeting of stockholders every three (3) years.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL THREE.

PROPOSAL FOUR: ADVISORY VOTE ON FREQUENCY OF EXECUTIVE COMPENSATION VOTE

The Company is presenting the following proposal, which gives you as a shareholder the opportunity to inform the Company as to how often you wish the Company to include a proposal, similar to Proposal Three, in our proxy statement. This resolution is required pursuant to Section 14A of the Securities Exchange Act. While our Board of Directors intends to carefully consider the shareholder vote resulting from the proposal, the final vote will not be binding on us and is advisory in nature.

The Board recommends a vote "FOR" the following resolution:

“RESOLVED, that the shareholders wish the company to include an advisory vote on the compensation of the Company’s named executive officers pursuant to Section 14A of the Securities Exchange Act every three (3) years.”

The Board of Directors recommends that you vote to hold an advisory vote on executive compensation every three years. The Board is proposing an advisory vote every three years because the Board believes that investor feedback would be more useful if the success of a compensation program is judged over a period of time, especially for a small and growing company like Red Cat.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL FOUR.

| 15 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table lists, as of July 12, 2022, the number of shares of common stock beneficially owned by (i) each person, entity or group (as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934) known to the Company to be the beneficial owner of more than 5% of the outstanding common stock; (ii) each of our directors; (iii) each of our Named Executive Officers; and (iv) all executive officers and directors as a group. Information relating to beneficial ownership of common stock by our principal stockholders and management is based upon information furnished by each person using "beneficial ownership" concepts under the rules of the SEC. Under these rules, a person is deemed to be a beneficial owner of a security if that person directly or indirectly has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to dispose or direct the disposition of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the SEC rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary interest. Except as noted below, each person has sole voting and investment power with respect to the shares beneficially owned and each stockholder's address is c/o Red Hat Holdings, Inc., 15 Ave. Munoz Rivera, STE 2200, San Juan, PR 00901.

The percentages below are calculated based on 53,807,973 shares of common stock issued and outstanding as of July 12, 2022.

| Name and Address of Beneficial Owner | Amount of Shares Beneficially Owned | Percentage of Beneficial Ownership | ||||||

| Named Executive Officers and Directors: | ||||||||

| Jeffrey Thompson | 12,697,438 | (1) | 23.37% | |||||

| Joseph Hernon | 994,832 | (2) | 1.82% | |||||

| Nicholas Liuzza | 1,360,196 | (3) | 2.51% | |||||

| Allan Evans | 1,089,461 | (4) | 2.02% | |||||

| Joseph Freedman | 351,090 | (5) | 0.65% | |||||

| Jonathan Read | 55,752 | (6) | 0.10% | |||||

| Christopher Moe | 14,085 | (7) | 0.03% | |||||

| All executive officers and directors as a group (7 persons) | 16,562,854 | 30.50% | ||||||

|

Other 5% Holders

|

||||||||

| Gregory French | 4,031,442 | (8) | 7.49% | |||||

(1) Includes 12,182,438 shares of common stock, 500,000 shares issuable upon the exercise of options, and 15,000 shares issuable upon the exercise of call options.

(2) Represents 155,470 shares of common stock, 816,667 shares issuable upon the exercise of options, and 22,695 shares of restricted stock vesting in the next 60 days.

(3) Consists of 920,207 shares of common stock, 335,000 shares issuable upon the exercise of warrants, 100,000 shares issuable upon the exercise of options, and 4,989 shares of restricted stock vesting in the next 60 days.

(4) Represents 1,068,523 shares of common stock and 20,938 shares of restricted stock vesting in the next 60 days.

(5) Includes 123,743 shares of common stock, 225,00 shares issuable upon the exercise of options, and 2,347 shares of restricted stock vesting in the next 60 days.

(6) Includes 53,405 shares of common stock, and 2,347 shares of restricted stock vesting in the next 60 days.

(7) Includes 11,738 shares of common stock, and 2,347 shares of restricted stock vesting in the next 60 days.

(8) Under the Lock-Up Agreement with Mr. French, up to the greater of 20% or $1,000,000 of his shares may be sold prior to November 2, 2021 (the 12-month anniversary of the closing of the Fat Shark acquisition) in previously negotiated transactions. Thereafter, shares may be sold at 10% of the average daily volume of the common stock during the prior 10 days.

| 16 |

Change-in-Control Agreements

The Employment Agreements of the Company’s Executive Officers include standard change-in-control provisions under which an officer is entitled to terminate the agreement, and receive the stated severance payments, if a third party acquires more than a 50% ownership interest in the Company or there are other significant changes in the operating structure of the Company.

Potential Payments and Benefits Upon Termination or a Change in Control

Our named executive officers are entitled to certain benefits in the event their employment is terminated without cause by the Company or for good reason by the Executive, as described in the Employment Agreements. The following table describes the potential payments and benefits to each of our named executive officers, as if these obligations were payable on April 30, 2022. The actual amounts payable to each executive listed below upon termination can only be determined definitively at the time of each executive’s actual departure. In addition to the amounts shown in the table below, each executive would receive payments for amounts of base salary and vacation time accrued through the date of termination and payment for any reimbursable business expenses incurred. In the event of a named executive officer’s death, the named executive officer’s beneficiary, legal representative or estate would receive the named executive officer’s potential payments.

| Potential Payments and Benefits | Jeffrey Thompson | Joseph Hernon | Allan Evans | ||||||||

| Base Salary (1) | $ | 600,000 | $ | 230,000 | $ | 230,000 | |||||

| Healthcare Benefits (2) | $ | 15,899 | $ | 12,216 | $ | 10,837 | |||||

| Equity Awards Vesting on Termination (3) | — | $ | 1,167,250 | $ | 647,188 | ||||||

| Total | $ | 615,899 | $ | 1,405,801 | $ | 886,746 | |||||

(1) Represents the named executive officer’s base salary payable over twenty-four (24) months for Thompson and twelve (12) months for Hernon and Evans.

(2) Represents the cost of continued healthcare coverage for 18 months for Thompson and 12 months for Hernon and Evans. This value is based upon the type of health insurance coverage and premiums in effect on April 30, 2022.

(3) Represents the value attributable to the accelerated vesting of unvested shares of restricted stock and stock options. The value of accelerated options is determined by multiplying the number of options accelerated by the difference between the closing price of our common stock and the exercise price of the options. The value of accelerated stock is determined by multiplying the number of shares accelerated by the closing price of our common stock on April 30, 2022 which was $2.03.

EXECUTIVE OFFICERS

Our executive officers and their ages, as of July 12, 2022, and biographical information are set forth below.

| Name | Age | Position | ||

| Jeffrey M. Thompson | 58 | President, Chief Executive Officer and Director | ||

| Allan Evans | 38 | Chief Operating Officer | ||

| Joseph Hernon | 62 | Chief Financial Officer, Treasurer and Secretary |

| 17 |

Jeffrey M. Thompson, President and Chief Executive Officer

Jeffrey Thompson has been President and Chief Executive Officer of the Company since May 15, 2019. In December 1999, Mr. Thompson founded Towerstream Corporation (NASDAQ:TWER), a fixed-wireless fiber alternative company delivering high-speed internet access to businesses, and served as its president, chief executive officer and a director from November 2005 to February 2016. In 1994, Mr. Thompson founded EdgeNet Inc., a privately held Internet service provider (which was sold to Citadel Broadcasting Corporation in 1997) and became eFortress through 1999. Mr. Thompson holds a B.S. degree from the University of Massachusetts.

Mr. Thompson’s management and public company experience and his role as President and Chief Executive Officer of the Company, led to his appointment as a director.

Joseph Hernon, Chief Financial Officer and Secretary

Joseph Hernon has been Chief Financial Officer and Secretary of the Company since January 23, 2020. Mr. Hernon has extensive experience in financial services over the course of his 35-year career. Mr. Hernon was a financial consultant to various private companies from May 2016 until January 2020. Prior to that, Mr. Hernon was the Chief Financial Officer for three public companies including most recently, Towerstream Corporation from May 2008 through May 2016. Previously, Mr. Hernon was employed for almost 10 years by PricewaterhouseCoopers in its audit practice and was a Senior Business Assurance Manager during his last five years with the firm. Mr. Hernon is a certified public accountant, but not presently licensed to practice, and earned a Master’s degree in Accountancy from Bentley University in 1986.

Dr. Allan Evans, Chief Operating Officer

Dr. Allan Evans is a serial entrepreneur with a history of founding and leading technology innovation. He has extensive experience in overseeing different emerging technologies. Prior to becoming Chief Operating Officer of the Company, Dr. Evans was the Chief Executive Officer of our subsidiary, Fat Shark. From August 2017 to October 2020, Dr. Evans served as a board member for Ballast Technologies, a company that specialized in technology for location-based entertainment. In November 2012, he co-founded Avegant, a technology company focused on developing next-generation display technology to enable previously impossible augmented reality experiences. He led design, development, and initial production of the Glyph head mounted display and oversaw technology research and patent strategy while serving as Chief Technology Officer of Avegant until 2016. Dr. Evans received a PhD and M.S. degree in electrical engineering from the University of Michigan and has a B.S. degree from Michigan State University. Dr. Evans has 45 pending or issued patents that cover a range of technologies from implantable medical devices to mixed reality headsets. Academically, his work has an h-index of 15, an i-index of 27, and has been cited in more than 900 publications. He has extensive experience with new technologies, engineering, business development, and corporate strategy, and his expertise in these areas strengthens the company’s collective knowledge and capabilities.

The following table sets forth information concerning all cash and non-cash compensation awarded to, earned by or paid to each Officer with compensation exceeding $100,000 during the fiscal years ended April 30, 2022 and 2021 (each a "Named Executive Officer").

| 18 |

EXECUTIVE COMPENSATION

Summary Compensation Table

| Name and Principal Position | Year | Salary | Bonus | Option Awards(3) | All Other Compensation(4) | Total | ||||||||||||||||||

| Jeffrey Thompson | 2022 | $ | 255,333 | $ | 153,600 | $ | — | $ | — | $ | 408,933 | |||||||||||||

|

Chief Executive Officer and President |

2021 | $ | 160,000 | $ | 300 | $ | 2,038,368 | $ | — | $ | 2,198,668 | |||||||||||||

| Joseph Hernon | 2022 | $ | 191,500 | $ | 128,000 | $ | — | $ | 185,400 | $ | 504,900 | |||||||||||||

|

Chief Financial Officer and Secretary |

2021 | $ | 120,000 | $ | — | $ | — | $ | — | $ | 120,000 | |||||||||||||

| Allan Evans | 2022 | $ | 181,918 | $ | 136,000 | $ | — | $ | 875,341 | $ | 1,193,259 | |||||||||||||

| Chief Operating Officer | 2021 | $ | 63,534 | $ | — | $ | — | $ | 959,999 | $ | 1,023,533 | |||||||||||||

| (1) | Joseph Hernon joined the Company in January 2020 |

| (2) | Allan Evans joined the Company in November 2020 |

| (3) | Option awards are valued in accordance with Accounting Standards Codification Topic 718, Compensation - Stock Compensation. Fair value is determined based on the Black-Scholes Model using inputs reflecting estimates of expected volatility, term, discount rates and dividend expectations. Compensation expense is recognized based on the vesting terms of the award. In March 2021, Mr. Thompson received an option award for 500,000 shares exercisable at $3.95 per share which were fully vested upon issuance. |

| (4) | Represents the fair value of restricted stock upon its vesting as follows: (i) Hernon - 75,000 shares in fiscal 2022; and (ii) Evans - 312,500 shares in fiscal 2021 and 369,318 shares in fiscal 2022. |

2019 Equity Incentive Plan

In May 2019, shareholders approved the Company’s 2019 Equity Incentive Plan (the “Plan”). The Plan provides for the award of stock options (incentive and non-qualified), stock awards and stock appreciation rights to officers, directors, employees and consultants who provide services to the Company.

The terms of awards under the Plan are made by the Board or by a compensation committee appointed by the Board. The Company has reserved 8,750,000 shares for issuance under the Plan. The Board may terminate the Plan at any time. Unless sooner terminated, the Plan will terminate ten years after the effective date of the Plan. All vested or unvested awards are immediately forfeited at the option of the Board in the event that the recipient performs certain acts against the interests of the Company as described in the Plan. The number of shares of common stock covered by each outstanding stock right, and the number of shares of common stock which have been authorized for issuance under the Plan as well as the price per share of common stock (or cash, as applicable) covered by each such outstanding option or SAR, shall be proportionately adjusted for any increases or decrease in the number of issued shares of common stock resulting from a stock split, reverse stock split, stock dividend, combination or reclassification, or any other increase or decrease in the number of issued shares of common stock effected without receipt of consideration by the Company.

| 19 |

The following table sets forth information concerning our equity compensation plans as of April 30, 2022.

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted- average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans |

||||||

| Plans approved by security holders | 3,694,142 | 2.17 | 2,910,199 | ||||||

| Plans not approved by security holders | — | — | — | ||||||

| Total | 3,694,142 | 2.17 | 2,910,199 |

Employment Agreements

Employment Agreement with Jeffrey Thompson, Chief Executive Officer

On March 31, 2021, the Company entered into an employment agreement (the “Employment Agreement”) with Jeffrey M. Thompson, the Company’s Chief Executive Officer. The Employment Agreement provides for an initial term of one year and will renew for successive one-year terms unless either party provides written notice of their intent not to renew the agreement at least three months prior to expiration. The Employment Agreement provides for a base salary of $248,000 per year. On April 29th 2022, Mr. Thompson’s base salary was increased to $300,000. In any fiscal year in which the Company's (a) market capitalization is at least $500,000,000 and (b) its traded price per share is at least $6.00 on a national securities exchange for 60 consecutive days (the “Incentive Criteria”), Mr. Thompson may elect to receive all or any portion of the base salary for a subsequent period in shares of Company common stock valued at the thirty-day VWAP for each pay period for which the election is applicable.

In connection with the Employment Agreement, the Company granted Mr. Thompson fully-vested 10-year stock options to purchase 500,000 shares of the Company's common stock (the “Options”) pursuant to the Company’s 2019 Equity Incentive Plan (the "Stock Plan"). The Options are exercisable at $3.95 per share which represents the fair market value of the Company’s common stock on the date of grant.

Mr. Thompson may earn an annual bonus, in an amount up to 200% of his base salary, based upon attaining goals and objectives defined by the Compensation Committee. If the Incentive Criteria is attained, then Mr. Thompson may elect to receive all or any portion of his bonus in common stock of the Company, valued at the thirty-day VWAP on the date set for payment of the bonus.

The Employment Agreement contains certain “clawback” provisions which are triggered upon a restatement of financial results of the Company which were the basis for payment of compensation to Mr. Thompson. Under the clawback provisions, Mr. Thompson will be required to repay any annual bonus and stock-based compensation to the extent the amounts paid exceeded the amounts that would have been paid, based on the restatement of the Company’s financial information.

| 20 |

Upon termination of the Employment Agreement for any reason, Mr. Thompson will be entitled to all base salary earned through the termination date, as well as pro-rated annual bonuses, if any, and payment of all accrued but unused vacation time and any reimbursable expenses. As defined in the agreement, upon termination by (i) the Company for any reason other than “Cause”, or (ii) by Mr. Thompson for “Good Reason”, then Mr. Thompson will also be entitled to: (i) twenty-four (24) months of his then Base Salary; (ii) continued participation in the Company's health and welfare benefit plans to be paid in full by the Company for at least twelve (12) months; and (iii) immediate vesting of all stock options/equity awards.

Employment Agreement with Joseph Hernon, Chief Financial Officer

On July 1, 2021, the Company entered into an Employment Agreement with Joseph Hernon to serve as chief financial officer of the Company. The Employment Agreement will automatically renew for successive one-year terms unless either party notifies the other party at least three months prior to the expiration of the then current term of its desire to terminate the Employment Agreement. The Employment Agreement provides for a base salary equal to at least 75% percent of the salary of the Company’s Chief Executive Officer. On April 29, 2022, Mr. Hernon's base salary was increased to $230,000. Mr. Hernon is also eligible for an annual cash bonus of up to 150% percent of his base salary.

In connection with the Employment Agreement, the Company granted Mr. Hernon 375,000 shares of the Company’s common stock, of which 45,000 vested on November 1, 2021, with the remaining 330,000 shares vesting in 11 equal quarterly installments commencing on February 1, 2022, subject to his continued employment by the Company. The shares will vest immediately upon a change of control, as defined in the Company’s Stock Plan. Hernon will also be eligible for additional awards under the Stock Plan.

The Employment Agreement contains certain “clawback” provisions which are triggered upon a restatement of financial results of the Company which were the basis for payment of compensation to Mr. Hernon. Under the clawback provisions, Mr. Hernon will be required to repay any annual bonus and stock-based compensation to the extent the amounts paid exceeded the amounts that would have been paid, based on the restatement of the Company’s financial information.

Upon termination of the Employment Agreement for any reason, Mr. Hernon will be entitled to all base salary earned through the termination date, as well as pro-rated annual bonuses, if any, and payment of all accrued but unused vacation time and any reimbursable expenses. As defined in the agreement, upon termination by (i) the Company for any reason other than “Cause”, or (ii) by Mr. Hernon for “Good Reason”, then Mr. Hernon will also be entitled to: (i) twelve (12) months of his then Base Salary; (ii) continued participation in the Company's health and welfare benefit plans to be paid in full by the Company for at least twelve (12) months; and (iii) immediate vesting of all stock options/equity awards.

Employment Agreement with Allan Evans, Chief Operating Officer

On January 11, 2021, the Company entered into an Employment Agreement with Allan Evans (“Evans”), to serve as chief executive officer of Fat Shark, a wholly owned subsidiary of the Company. In June 2021, Mr. Evans was appointed Chief Operating Officer of the Company. The Employment Agreement will automatically renew for successive one-year terms unless either party notifies the other party at least three months prior to the expiration of the then current term of its desire to terminate the Employment Agreement. The Employment Agreement provides for a base salary equal to at least 70% percent of the salary of the Company’s Chief Executive Officer. On April 29, 2022, Mr. Evans' base salary was increased to $230,000. Mr. Evans is also eligible to receive an annual cash bonus of up to 100% percent of his base salary.

In connection with the Employment Agreement, the Company granted 1,000,000 shares of common stock to Mr. Evans, of which 250,000 vested on January 11, 2021, with the remaining 750,000 shares vesting in 36 equal monthly installments commencing on February 28, 2021, subject to his continued employment with the Company. The shares will vest immediately upon a change of control, as defined in the Company’s Stock Plan. On April 25th, 2022, the vesting of 125,000 shares accelerated when the Company received payment of $250,000 related to the sale of services at a net profit margin higher than that realized from similar sales over the prior 12 months. Other acceleration provisions in the Employment Agreement include (i) 250,000 shares shall vest immediately if the Company's stock price closes at or above $5.00 per share for 30 consecutive days; and (ii) 125,000 shares shall vest immediately upon receipt of payment from any unrelated third-party purchaser of goods or services in an amount of $1,000,000 (exclusive of any payments which previously resulted in an acceleration of vesting) at a net profit margin no less than the average net profit margin for similar goods or services during the preceding 12 months. Evans will also be eligible for additional awards under the Plan.

| 21 |

The Employment Agreement contains certain “clawback” provisions which are triggered upon a restatement of financial results of the Company which were the basis for payment of compensation to Mr. Evans. Under the clawback provisions, Mr. Evans will be required to repay any annual bonus and stock-based compensation to the extent the amounts paid exceeded the amounts that would have been paid, based on the restatement of the Company’s financial information.

Upon termination of the Employment Agreement for any reason, Mr. Evans will be entitled to all base salary earned through the termination date, as well as pro-rated annual bonuses, if any, and payment of all accrued but unused vacation time and any reimbursable expenses. As defined in the agreement, upon termination by (i) the Company for any reason other than “Cause”, or (ii) by Mr. Evans for “Good Reason”, then Mr. Evans will also be entitled to: (i) twelve (12) months of his then Base Salary; (ii) continued participation in the Company's health and welfare benefit plans to be paid in full by the Company for at least twelve (12) months; and (iii) immediate vesting of all stock options/equity awards.

Outstanding Equity Awards

The table below reflects option awards made to each Named Executive Officer that were outstanding on April 30, 2022.

| Name | Grant Date | Number of Securities Underlying Unexercised Options Exercisable | Number of Securities Underlying Unexercised Options Unexercisable | Option Exercise Price |

Expiration Date |

|||||||||||

| Jeffrey M. Thompson | 3/31/2021 | 500,000 | — | $ | 3.95 | 3/31/2031 | ||||||||||

| Joseph Hernon | 1/23/2020 | 725,000 | 275,000 | $ | 0.82 | 1/23/2030 | ||||||||||

| Allan Evans | — | — | — | — | — | |||||||||||

The table below reflects stock awards that were outstanding and that had not vested as of April 30, 2022.

| Name | Number | Market value | ||

| Jeffrey M. Thompson | — | — | ||

| Joseph Hernon | 300,000 | $609,000 | ||

| Allan Evans | 318,182 | $645,909 |

There were no unearned equity incentive plan awards outstanding at April 30, 2022.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE