DEF 14A: Definitive proxy statements

Published on February 6, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant | ☑ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

RED CAT HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: | |

| 2. | Aggregate number of securities to which transaction applies: | |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4. | Proposed maximum aggregate value of transaction: | |

| 5. | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: |

February 3, 2023

To Our Shareholders:

It is my pleasure to invite you to attend a Special Meeting of Stockholders (the “Special Meeting”) of Red Cat Holdings, Inc. (“Red Cat” or the “Company”). The Special Meeting will be held on March 8, 2023 as an audio-only conference call. You can attend the Special Meeting by calling 877-407-3088 (Toll Free), We have adopted a virtual format for our Special Meeting to protect the health and well-being of our employees, directors, stockholders and other stakeholders in light of the ongoing COVID-19 pandemic. Additionally, we believe that a virtual meeting allows us to make participation accessible for stockholders from any geographic location with telephonic connectivity The Special Meeting will begin at approximately 12 p.m., Eastern Time.

At the Special Meeting, you will be asked to approve the sale of Rotor Riot, LLC (“Rotor Riot”) and Fat Shark Holdings, Ltd (“Fat Shark”), each a wholly owned subsidiary of the Company, to Unusual Machines Inc. (“Unusual”), pursuant to a Share Purchase Agreement dated as of November 21, 2022 (the “Share Purchase Agreement”). The Company has agreed to sell, and Unusual has agreed to purchase, Rotor Riot and Fat Shark for $18 million in cash, notes and stock as follows: (i) $5.0 million in cash, (ii) a $2.5 million 8% Senior Secured Convertible Promissory Note that will mature on the 3 year anniversary date of the closing of the transaction, plus (iii) $10.5 million in Series A Convertible Preferred Stock. Jeffrey Thompson, our founder and Chief Executive Officer is also a founder of Unusual and a stockholder in both companies. Mr. Thompson will abstain from voting on the proposed transactions. The Company’s Board of Directors has unanimously approved the Share Purchase Agreement and recommends shareholders vote in favor of the transaction.

A majority of the votes cast in favor of the transaction will be required to approve Proposal One, the Share Purchase Agreement, excluding any votes held by Jeffrey Thompson, our Chief Executive Officer, who is a significant shareholder of both the Company and Unusual. As of January 27, 2023, the record date for the meeting, there were 55,131,784 shares eligible to vote, including 54,309,554 shares of common stock outstanding and 822,230 votes held by holders of Series B Preferred Stock eligible to vote on an as-converted basis. A majority of the votes cast in favor of the transaction will be required to approve the Share Purchase Agreement, excluding any votes held by Jeffrey Thompson, our Chief Executive Officer, who is also a significant stockholder of both the Company and Unusual. As of the January 27, 2023 record date, Mr. Thompson owned 12,304,877 shares of our common stock based on his Form 4 filings with the SEC and other related information available to us, representing approximately 22% of votes eligible to be cast at the meeting. After excluding Mr. Thompson's shares, Proposal One will require the affirmative vote of 50.1%, or 21,413,882 of the disinterested shares. Based on their Form 4 filings and other information available to us, our officers and directors are expected to vote approximately 2,283,000 shares "FOR " Proposal One.

On November 21, 2022, our Board of Directors (i) determined that it was advisable and in the best interests of Red Cat and its stockholders to enter into the Share Purchase Agreement and (ii) approved the Share Purchase Agreement and the transactions contemplated therein.

We are soliciting proxies for use at the Special Meeting to consider and vote upon proposals to (i) approve the sale of Rotor Riot and Fat Shark on the terms and subject to the conditions set forth in the Share Purchase Agreement (as it may be amended from time to time and including all exhibits and schedules thereto), and (ii) adjourn the Special meeting, if necessary, to solicit additional proxies if there are insufficient votes in favor of the proposed transactions. Our Board of Directors unanimously recommends that you vote “FOR” each of the foregoing proposals.

Your vote is important. Whether or not you plan to attend the audio-only Special Meeting, to ensure that your shares will be represented, please cast your vote as soon as possible via the internet, or, if you received a paper proxy card and voting instructions by mail, by completing and returning the enclosed proxy card in the postage-prepaid envelope. Your vote by proxy will ensure your representation at the Special Meeting regardless of whether or not you attend virtually.

| Sincerely, | |

| /s/ Joe Freedman | |

| Joe Freedman | |

| Lead Director and on behalf of the full Board of Directors |

YOUR VOTE IS IMPORTANT

Your vote is important. As described in your electronic proxy materials notice or on the enclosed paper proxy card and voting instructions, please vote by: (1) accessing the internet website or (2) signing and dating the proxy card as promptly as possible and returning it in the enclosed envelope (to which no postage need be affixed if mailed in the United States). Even if you plan to attend the virtual Special Meeting, we recommend that you vote your shares in advance, so that your vote will be counted if you later decide not to attend online.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING TO BE HELD ON MARCH 8, 2023: THE PROXY STATEMENT WILL BE AVAILABLE AT WWW.REDCAT.VOTE ON OR ABOUT FEBRUARY 7, 2023.

| 2 |

RED CAT HOLDINGS, INC.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

MARCH 8, 2023

To the Shareholders:

| Time and Date: | March 8, 2023 at 12 p.m. Eastern Time | ||

| Place: | Audio-only conference call at 877-407-3088 (Toll Free) | ||

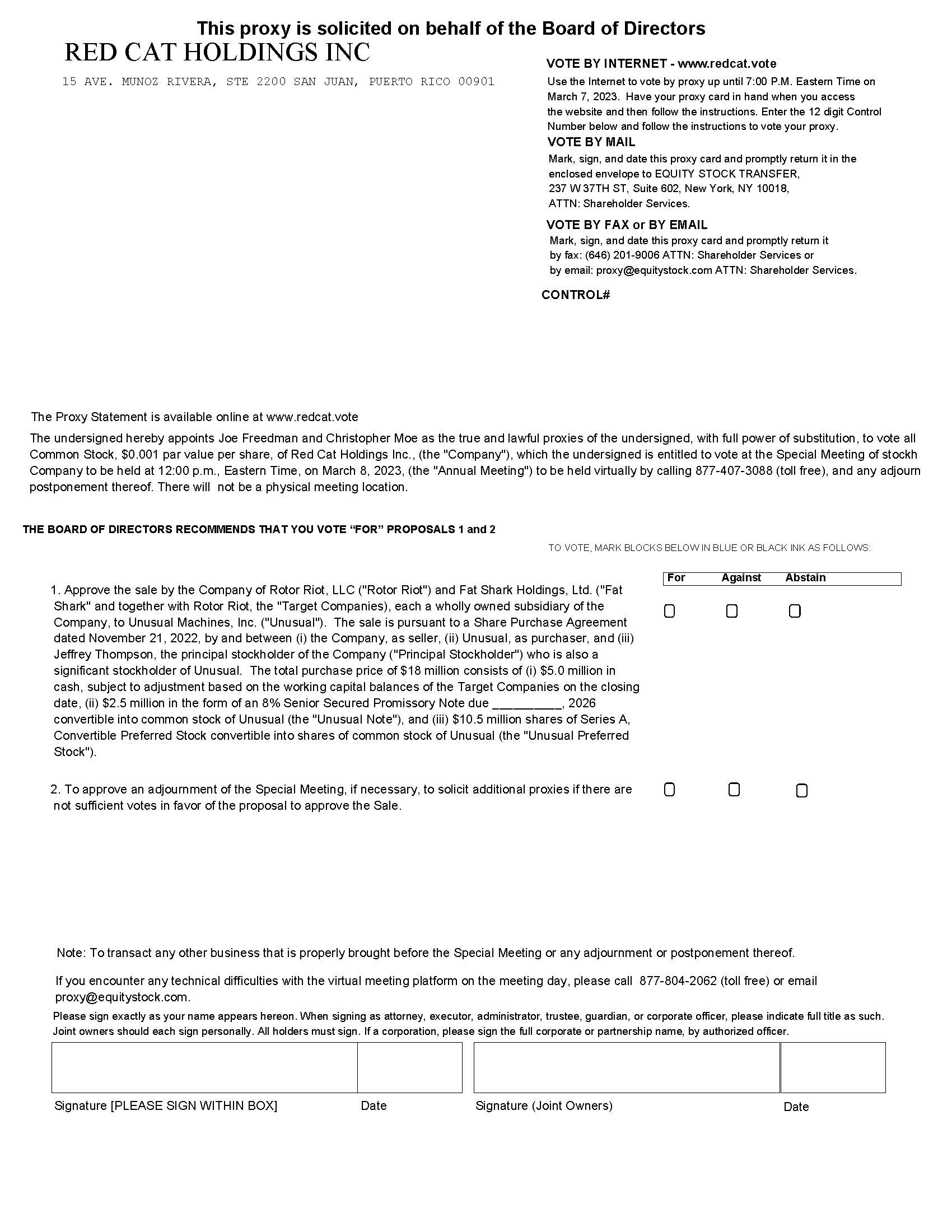

| Items of Business: | 1. | Approve the sale by the Company of Rotor Riot, LLC ("Rotor Riot") and Fat Shark Holdings, Ltd. ("Fat Shark") and together with Rotor Riot, the "Target Companies), each a wholly owned subsidiary of the Company, to Unusual Machines, Inc. ("Unusual"). The sale is pursuant to a Share Purchase Agreement dated November 21, 2022, by and between (i) the Company, as seller, (ii) Unusual, as purchaser, and (iii) Jeffrey Thompson, the principal stockholder of the Company ("Principal Stockholder") who is also a significant stockholder of Unusual. The total purchase price of $18 million consists of (i) $5.0 million in cash, subject to adjustment based on the working capital balances of the Target Companies on the closing date, (ii) $2.5 million in the form of an 8% Senior Secured Promissory Note that will mature on the 3 year anniversary date of the closing of the transaction convertible into common stock of Unusual (the "Unusual Note"), and (iii) $10.5 million shares of Series A, Convertible Preferred Stock convertible into shares of common stock of Unusual (the "Unusual Preferred Stock"). | |

| 2. | To approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the proposal to approve the Sale. | ||

| Record Date: | Only stockholders of record at the close of business on January 27, 2023 are entitled to notice of, and to vote at, the Special Meeting and any adjournments thereof. | ||

| Vote Required: | A majority of the votes cast in favor of the transaction will be required to approve Proposal One, the Share Purchase Agreement, excluding any votes held by Jeffrey Thompson, our Chief Executive Officer, who is a significant shareholder of both the Company and Unusual. As of January 27, 2023, the record date for the meeting, there were 55,131,784 shares eligible to vote, including 54,309,554 shares of common stock outstanding and 822,230 votes held by holders of Series B Preferred Stock eligible to vote on an as-converted basis. A majority of the votes cast in favor of the transaction will be required to approve the Share Purchase Agreement, excluding any votes held by Jeffrey Thompson, our Chief Executive Officer, who is also a significant stockholder of both the Company and Unusual. As of the January 27, 2023 record date, Mr. Thompson owned 12,304,877 shares of our common stock based on his Form 4 filings with the SEC and other related information available to us, representing approximately 22% of votes eligible to be cast at the meeting. After excluding Mr. Thompson's shares, Proposal One will require the affirmative vote of 50.1%, or 21,413,882 of the disinterested shares. Based on their Form 4 filings and other information available to us, our officers and directors are expected to vote approximately 2,283,000 shares "FOR " Proposal One. | ||

| Proxy Voting: | Each share of our common stock represents one vote. | ||

|

Questions:

|

If you are a registered holder, contact our transfer agent, Equity Stock Transfer, LLC, through its website at www.equitystock.com or by phone at (212) 575-5757. If you are a beneficial owner of record as of the Record Date (i.e., you held your shares in an account at a brokerage firm, bank or other similar agent), contact your broker, bank or other agent. |

||

This notice of the Special Meeting, proxy statement, form of proxy are being distributed or made available on or about February 9, 2023.

Whether or not you plan to attend the audio-only conference call Special Meeting, we encourage you to vote or submit your proxy via the internet, or request and submit your proxy card as soon as possible, so that your shares may be represented at the meeting.

| By Order of the Board of Directors, | |

| /s/ Joseph Hernon | |

| Joseph Hernon, Corporate Secretary | |

| and Chief Financial Officer |

| 3 |

RED CAT HOLDINGS, INC.

15 AVE. MUNOZ RIVERA, STE 2200

SAN JUAN, PUERTO RICO 00901

PROXY STATEMENT FOR THE SPECIAL MEETING OF STOCKHOLDERS

February 3, 2023

INFORMATION ABOUT SOLICITATION AND VOTING

The accompanying proxy is solicited on behalf of the board of directors of Red Cat Holdings, Inc. (“we,” “us,” the “Company,” “our company” or “Red Cat”) for use at a Special Meeting of Stockholders (the “Special Meeting”), to be held as an audio-only conference call by calling 877-407-3088 (Toll Free) on March 8, 2023 at 12 p.m. Eastern Time, and any adjournment or postponement thereof.

INTERNET AVAILABILITY OF PROXY MATERIALS AND VOTING

We will be mailing proxy materials to all stockholders of record as of January 27, 2023. Proxy materials will also be available online at www.redcat.vote We encourage stockholders to vote online to ensure their votes are counted.

GENERAL INFORMATION ABOUT THE MEETING

What is the purpose of the Special Meeting?

The purpose is to have stockholders vote upon the proposals described in this Proxy Statement.

What proposals are scheduled to be voted on at the Special Meeting?

Stockholders will be asked to vote upon the following two proposals:

1. Approve the sale by the Company of Rotor Riot, LLC ("Rotor Riot") and Fat Shark Holdings, Ltd. ("Fat Shark" and together with Rotor Riot, the "Target Companies), each a wholly owned subsidiary of the Company, to Unusual Machines, Inc. ("Unusual"). The sale is pursuant to a Share Purchase Agreement dated November 21, 2022, by and between (i) the Company, as seller, (ii) Unusual, as purchaser, and (iii) Jeffrey Thompson, the principal stockholder of the Company ("Principal Stockholder") who is also a significant stockholder of Unusual. The total purchase price of $18 million consists of (i) $5.0 million in cash, subject to adjustment based on the working capital balances of the Target Companies on the closing date, (ii) $2.5 million in the form of an 8% Senior Secured Promissory Note that will mature on the 3 year anniversary date of the closing of the transaction convertible into common stock of Unusual (the "Unusual Note"), and (iii) $10.5 million shares of Series A, Convertible Preferred Stock convertible into shares of common stock of Unusual (the "Unusual Preferred Stock").

2. To approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the proposal to approve the Share Purchase Agreement (The “Adjournment Proposal”).

What is the recommendation of our Board of Directors on each of the proposals scheduled to be voted upon at the Special Meeting?

Our Board of Directors recommends that you vote your shares:

| ● | FOR the approval of the Share Purchase Agreement as set forth in the proxy statement (Proposal One); and |

| ● | FOR the Adjournment Proposal (Proposal Two). |

Why are we having a virtual only meeting?

We have adopted a virtual format for our Special Meeting to protect the health and well-being of our employees, directors, stockholders and other stakeholders in light of the ongoing COVID-19 pandemic. Additionally, we believe that a virtual meeting allows us to make participation accessible for stockholders from any geographic location with telephonic connectivity.

Who may attend and how do I attend?

All holders of our common stock as of the Record Date, or their duly appointed proxies, may attend the Special Meeting (via webinar or phone call). Set forth below is a summary of the information you need to attend the Special Meeting:

| ● | Access the audio-only conference call by calling 877-407-3088 (Toll Free) or +1-877-407-3088 (International); |

| ● |

Instructions on how to attend and participate in the Special Meeting, including how to demonstrate proof of stock ownership, are also available as follows:

|

| ● | Stockholders may submit live questions on the conference line while attending the Special Meeting. |

What if I have technical difficulties or trouble accessing the virtual Special Meeting?

We will have technicians ready to assist you with any technical difficulties you may have in accessing the virtual Special Meeting. If you encounter any difficulties, please call: 877-804-2062 (Toll Free) or email proxy@equitystock.com.

A replay of the Special Meeting will be posted as soon as practical on www.redcat.vote.

Who can vote at the Special Meeting?

As of January 27, 2023, the Record Date, there were 55,131,784 shares eligible to vote, including 54,309,554 shares of common stock outstanding and 822,230 votes held by holders of Series B Preferred Stock eligible to vote on an as-converted basis. Each share is entitled to one vote on each matter and there is no cumulative voting.

How do I vote my shares?

Whether you plan to attend the virtual Special Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. Except as set forth below, if you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board of Director’s recommendations. Voting by proxy will not affect your right to attend the Special Meeting.

If your shares are registered directly in your name through our stock transfer agent, Equity Stock Transfer, or you have stock certificates, you may vote:

- By Internet. The website address for Internet voting is www.redcat.vote. Please click “Vote Your Proxy” and enter your control number.

- By mail. Mark, date, sign and mail promptly the Proxy Card, ATTN: Shareholder Services.

- At the Special Meeting. If you are a shareholder of record, you can participate and vote your shares at the Special Meeting by visiting www.redcat.vote and then clicking “Vote Your Proxy”. You may then enter the control number included on your Proxy Card and view the proposals and cast your vote.

If your shares are held in “street name,” your bank, broker or other nominee should provide to you a request for voting instructions along with the Company’s proxy solicitation materials. By completing the voting instruction card, you may direct your nominee how to vote your shares. If you partially complete the voting instruction but fail to complete one or more of the voting instructions, then your nominee may be unable to vote your shares with respect to the proposal as to which you provided no voting instructions. Alternatively, if you want to vote your shares during the Special Meeting, you must contact your nominee directly in order to obtain a proxy issued to you by your nominee holder. Note that a broker letter that identifies you as a stockholder is not the same as a nominee-issued proxy. If you fail to present a nominee-issued proxy to proxy@equitystock.com by 5:00 p.m. Eastern Time on March 6, 2023, you will not be able to vote your nominee- held shares during the Special Meeting.

Can I change my vote or revoke my proxy?

A stockholder of record who has given a proxy may revoke it at any time before it is exercised at the Special Meeting by:

| ● | Delivering to our Corporate Secretary a written notice stating that the proxy is revoked; |

| ● | Signing and delivering a proxy bearing a later date; |

| ● | Voting again via internet no later than 7:00 p.m. Eastern Time on March 7, 2023; or |

| ● | Voting again during the Special Meeting when the Chairman opens the polls. |

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Will I be able to ask questions at the Special Meeting?

Shareholders may submit live questions on the conference line while attending the virtual Special Meeting. Only questions pertinent to meeting matters or our Company will be answered during the meeting, subject to time constraints. Questions that are substantially similar may be grouped and answered together to avoid repetition.

What is the quorum requirement for the Special Meeting?

The holders of a majority of the voting power of the shares of our common stock entitled to vote at the Special Meeting as of the Record Date must be present at the Special Meeting in order to hold the Special Meeting and conduct business. This presence is called a quorum. Your shares are counted as present at the Special Meeting if you are present and vote in person at the Special Meeting, if you vote in advance of the Special Meeting by mail or internet or by telephone or if you have properly submitted a proxy. Shares held by Mr. Thompson will be counted as present at the Special Meeting for purposes of a quorum.

What is the vote required for each proposal?

For Proposal One, approval of the Share Purchase Agreement proposal will be obtained if the number of votes cast “FOR” the proposal at the Special Meeting by holders of disinterested shares of the Company Common Stock represents a majority of votes cast by holders of disinterested shares cast by stockholders.

For Proposal Two, approval of the Adjournment Proposal will be obtained if the number of votes cast “FOR” the proposal at the Special Meeting represents a majority of the votes cast by stockholders.

How are abstentions and broker non-votes treated?

Abstentions (i.e. shares present at the Special Meeting and marked “abstain”) and “broker non-votes” are each included in the determination of the number of shares present and entitled to vote at the meeting for purposes of determining the presence or absence of a quorum for the transaction of business at the Special Meeting; however, neither abstentions nor broker non-votes are counted as voted either for or against a proposal and, as such, will not affect the outcome of the vote on any proposal.

A “broker non-vote” occurs when your broker submits a proxy for your shares but does not indicate a vote for a particular proposal because the broker has not received voting instructions from you and is not authorized to vote on that proposal without instructions. A broker is authorized to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares, but is not authorized to vote shares held for a beneficial owner on “non-routine” matters without instructions from the beneficial owner of those shares.

Proposal One is considered a “non-routine” matter. If you do not provide your broker with specific instructions on how to vote your shares, the broker that holds your shares will not be authorized to vote on Proposal One. Accordingly, we encourage you to provide voting instructions to your broker, whether or not you plan to attend the Special Meeting.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on each proxy card and vote each proxy card via the internet or by mail. If you requested or received paper proxy materials and you intend to vote by mail, please complete, sign and return each proxy card you received to ensure that all of your shares are voted.

Who is paying for this proxy solicitation?

We will pay the expenses of soliciting proxies, including preparation, assembly, printing and mailing of this Proxy Statement, the proxy card and any other information furnished to stockholders. Following the original mailing of the proxy materials, we and our agents, including directors, officers and other employees, without additional compensation, may solicit proxies by mail, email, telephone, facsimile, by other similar means or in person. Following the original mailing of the proxy materials, we will request brokers, custodians, nominees and other record holders to forward copies of the proxy materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, upon the request of the record holders, we will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials or vote via the internet, you are responsible for any internet access charges you may incur.

Where can I find the voting results?

Voting results will be tabulated and certified by the inspector of elections appointed for the Special Meeting. The preliminary voting results will be announced at the Special Meeting. The final results will be tallied by the inspector of elections and filed with the U.S. Securities and Exchange Commission (the “SEC”) in a current report on Form 8-K within four business days of the Special Meeting.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement and other documents referred to herein contain, or may contain, forward-looking statements that involve risks and uncertainties relating to the Share Purchase Agreement. Any statements that are not historical fact are forward-looking statements. When used in this proxy statement, the words “believe,” “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect,” and the like, and/or future-tense or conditional constructions (“will,” “may,” “could,” “should,” etc.), or similar expressions, identify certain of these forward-looking statements and relate to a variety of matters, including but not limited to (i) the timing and anticipated completion of the Share Purchase Agreement; (ii) the benefits expected to result from the proposed Share Purchase Agreement; (iii) the tax consequences of the Share Purchase Agreement; and (iv) other statements that are not purely statements of historical fact. These forward-looking statements are made on the basis of current beliefs, expectations and assumptions of our management, are not guarantees of performance and are subject to significant risks and uncertainties.

For information about other potential factors that could affect the Company’s business and financial results, investors should also review the risk factors in the Company’s Annual Report on Form 10-K filed with the SEC on July 27, 2022 as amended August 15, 2022 and the Company’s Quarterly Report on Form 10-Q filed with the SEC on December 15, 2022 as well as its Current Reports on Form 8-K filed with the SEC.

All forward-looking statements speak only as of the date on which they are made. The Company does not undertake any obligation to update such forward-looking statements to reflect events that occur or circumstances that exist after the date of this Proxy Statement except as required by federal securities law.

Risks Related to the Matters Under Consideration.

The announcement and pendency of the matters considered under Proposal One, whether or not completed, may adversely affect the trading price of our common stock.

The announcement and pendency of the transactions set forth for approval may adversely affect the trading price of our common stock, our business or our relationships with clients, customers, suppliers and employees. Third parties may be unwilling to enter into material agreements with the Company and/or the Target Companies. New or existing customers, suppliers and business partners may prefer to enter into agreements with our competitors who have not expressed an intention to sell their business because customers, suppliers and business partners may perceive that such new relationships are likely to be more stable. Additionally, employees working in the Company and/or the Target Companies, as applicable, may lose focus or seek other employment. In addition, while the completion of the transactions are pending, we may be unable to attract and retain key personnel and our management’s focus and attention and employee resources may be diverted from operational matters.

Completion of matters considered under Proposal One are dependent on the funding of Unusual which is uncertain but required to close the Share Purchase Agreement.

Completion of the transactions set forth for approval are not certain and depend upon the closing of the initial public offering (IPO) of common stock by Unusual and the listing of its shares for trading on The NASDAQ Capital Market. Unusual has filed a Registration Statement on Form S-1 with the Securities and Exchange Commission (“SEC”) for registration of its initial public offering under the Securities Act of 1933, as amended (the “1933 Act”), which has not been declared effective by the SEC as of the date of this Proxy Statement. Even if approved by our stockholders, the closing of the Share Purchase Agreement and sale of the Target Companies may not occur if Unusual is unable to register its common stock for sale with the SEC or its initial public offering cannot be completed or is delayed. Currently, Unusual does not have the cash or resources to complete the transactions, even if approved by our stockholders, without completion of the IPO and does not have the financial resources to satisfy its obligations under the Senior Note. Following closing, we will become a significant stockholder and noteholder of Unusual. As such, the ability of Unusual to raise additional capital and be successful will become a risk to us.

The matters considered under Proposal One will require significant management resources.

The implementation of the Share Purchase Agreement will require significant time, attention, and resources of our senior management, potentially diverting their attention from the conduct of the Company’s business.

If we fail to complete the transactions contemplated in Proposal One, our business and financial performance may be adversely affected.

The completion of the transaction contemplated in Proposal One is subject to the satisfaction or waiver of various conditions, including the approval by a majority of our disinterested stockholders and the absence of a material adverse effect with respect to the Target Companies’ business, which may not be satisfied in a timely manner or at all.

If not completed, we may have difficulty recouping the costs incurred in connection with negotiating the transaction, preparing the Share Purchase Agreement and this proxy statement. Our directors, executive officers and other employees will have expended extensive time and effort and will have experienced significant distractions from their work during the pendency of the transactions, and we will have incurred significant third-party transaction costs, in each case, without any commensurate benefit, which may have a material and adverse effect on our stock price and results of operations.

In addition, if not completed, the Board of Directors, in discharging its fiduciary obligations to our stockholders, may evaluate other strategic options including, but not limited to, continuing to operate the Target Companies for the foreseeable future or an alternative sale transaction relating to the Target Companies. An alternative sale transaction, if available, may yield lower consideration than the proposed transaction, be on less favorable terms and conditions than those contained in the Share Purchase Agreement and involve significant delay. Any future sale or other transactions may be subject to further stockholder approval.

Finally, if not completed, the announcement of the termination of the Share Purchase Agreement may adversely affect our relationships with customers, suppliers and employees, which could have a material adverse effect on our ability to effectively operate the Target Companies, including as a result of our determination to focus our energies on our enterprise and government segments. In the event that we determine that a superior offer is available and we proceed with that alternative, we may be required to pay a termination fee of $500,000 to Unusual under certain circumstances, each of which could have further adverse effects on our business, results of operations and the trading price of our common stock.

You will not receive any of the proceeds from Proposal One.

The proceeds from the transactions contemplated in Proposal One will be received by the Company, not our stockholders. As discussed elsewhere in this proxy statement, the Company does not plan to distribute any of the proceeds to stockholders, and instead plans to use such proceeds to pursue its general business operations, including the costs associated with the transactions.

The Company will be subject to certain contractual restrictions while the transactions contemplated in Proposal One are pending.

The Share Purchase Agreement restricts the Company from making certain acquisitions and divestitures, entering into certain contracts, and taking other specified actions until the earlier of the completion of the transactions or the termination of the Share Purchase Agreement. These restrictions will apply during the period in which Unusual is seeking to complete its financing involving its initial public offering and listing on NASDAQ, which is anticipated to take several months following approval of Proposal One by our stockholders and may prevent the Company from pursuing attractive business opportunities that may arise prior to the completion of the transactions completion and could have the effect of delaying or preventing other strategic transactions or providing the Company capital in order to pursue its enterprise and government businesses.

The Company could suffer adverse effects that could be exacerbated by any delays in completion of the transactions contemplated in Proposal One.

Adverse effects arising from the pendency of the Share Purchase Agreement Transaction could be exacerbated by any delays in completion of the Share Purchase Agreement Transaction or termination of the Share Purchase Agreement.

Our directors and executive officers may have interests in the transactions involving Proposal One other than, or in addition to, the interests of our stockholders generally.

Our Chief Executive Officer, Chairman and founder, Jeffrey Thompson, is also the founder of Unusual and Chief Executive Officer and Chairman from its inception in July 2019 until April 2022. Mr. Thompson also owns 1,557,000 shares of Unusual common stock he acquired as a founder, which represents approximately 23% prior to giving effect to the Unusual IPO and the issuance of any securities under the Share Purchase Agreement. Accordingly, Mr. Thompson’s interest in the matters under consideration under Proposal One are different from, or are in addition to, the interests of our stockholders generally. The Board of Directors was aware of the interests of Mr. Thompson and formed a special committee of independent directors in order to negotiate the Share Purchase Agreement, and requires that Mr. Thompson’s ownership interest in the Company be excluded from the calculation of votes “in favor” of the transactions contemplated in Proposal One. In addition, Mr. Thompson did not participate in the deliberations and considerations of the Board of Directors in considering the Share Purchase Agreement and the transactions under consideration in Proposal One.

In light of the forgoing factors, including the different interests of Mr. Thompson, as well as the requirements of Nevada law as described below, we have determined that a majority of the votes cast in favor of the transaction will be required to approve the Share Purchase Agreement, excluding any votes held by Jeffrey Thompson, our Chief Executive Officer who is also a significant stockholder of the Company, and Unusual. As of January 27, 2023, the record date for the meeting, there were 55,131,784 shares eligible to vote, including 54,309,554 shares of common stock outstanding and 822,230 votes held by holders of Series B Preferred Stock eligible to vote on an as-converted basis. A majority of the votes cast in favor of the transaction will be required to approve the Share Purchase Agreement, excluding any votes held by Jeffrey Thompson, our Chief Executive Officer, who is also a significant stockholder of both the Company and Unusual. As of the January 27, 2023 record date, Mr. Thompson owned 12,304,877 shares of our common stock based on his Form 4 filings with the SEC and other related information available to us, representing approximately 22% of votes eligible to be cast at the meeting. After excluding Mr. Thompson's shares, Proposal One will require the affirmative vote of 50.1%, or 21,413,882 of the disinterested shares. Based on their Form 4 filings and other information available to us, our officers and directors are expected to vote approximately 2,283,000 shares "FOR " Proposal One.

The Share Purchase Agreement limits our ability to pursue alternatives.

The Share Purchase Agreement, contains provisions that may make it more difficult for us to sell the Target Companies to any party other than Unusual. These provisions include the prohibition on our ability to solicit competing proposals and the requirement that we pay Unusual a termination-fee of $500,000 in certain circumstances in the event that we accept a superior proposal.

These provisions could make it less advantageous for a third party that might have an interest in acquiring the Target Companies to consider or propose an alternative transaction, even if that party were prepared to pay consideration with a higher value than the consideration to be paid by Unusual.

Holders of the Company’s common stock will not have appraisal or dissenters’ rights in connection with the Share Purchase Agreement.

Neither Nevada law nor our Articles of Incorporation or Bylaws, as amended, provide Company stockholders with appraisal or dissenters’ rights in connection with the transactions under consideration in Proposal One.

The Share Purchase Agreement may be terminated in accordance with its terms and the transaction may not be completed. We may owe a break-fee in connection with a termination of the Share Purchase Agreement under certain circumstances.

The completion of the Share Purchase Agreement Transaction is subject to the satisfaction or waiver of a number of conditions. These conditions to closing may not be fulfilled and, accordingly, the transaction, even if approved by stockholders, may not be completed. In addition, if not completed by March 30, 2023, either the Company or Unusual may terminate the Share Purchase Agreement, provided that the right to terminate the Share Purchase Agreement shall not be available to a party whose breach of any representation, warranty, covenant, or agreement in the Share Purchase Agreement has been the principal cause of, or resulted in the failure of the closing to be contemplated.. In addition, each of Red Cat and Unusual may elect to terminate the Share Purchase Agreement in certain circumstance. Red Cat may be required to pay a termination fee to Unusual if Red Cat terminates the Share Purchase Agreement in certain circumstances. If the Share Purchase Agreement is terminated by either party, the Company may incur substantial fees in connection with the termination of the Share Purchase Agreement and will not recognize the anticipated benefits of the transaction, including receipt of the purchase price.

Termination of the Share Purchase Agreement could negatively impact the Company.

If the Share Purchase Agreement is terminated in accordance with its terms and the transactions contemplated in Proposal One are not completed, the ongoing business of the Company may be adversely affected by a variety of factors. The Company’s business may be impacted by having foregone other strategic opportunities during the pendency of the transaction, the failure to obtain the anticipated benefits of completing the transaction, changes to existing business relationships caused by uncertainties pending the transaction, payment of certain costs, and the attention, time, and resources of our senior management and other employees devoted to the transaction, diverting their attention from the conduct of our business and the ability to refocus energies on the enterprise and government segments of the business. The Company may also be negatively impacted if the Share Purchase Agreement is terminated and the Board is unable to execute an alternative strategic transaction offering equivalent or more attractive benefits than the benefits to be provided in the pending transaction.

Failure to complete the transactions contemplated in Proposal One could cause the Company’s stock price to decline.

The failure to complete and close the Share Purchase Agreement the may create doubt as to the value of the Company and about the Company’s ability to effectively implement its current business strategies and/or a strategic transaction, which may result in a decline in the Company’s stock price.

The Company will have discretion in the use of the net proceeds.

If completed, the purchase price consisting of a minimum of $5 million in cash paid at closing, unless adjusted will be paid directly to the Company. The Company currently plans to use such funds for costs and expenses of the transaction as well as increasing its focus upon the enterprise and government sectors. The Company retains the right to revise the purchase price, including following approval by the stockholders of Proposal One, including the cash payable at closing, in the event that the Company’s Board of Directors determines that such adjustment is in the best interests of its stockholders, for example, in the event that the Unusual IPO produces less proceeds from the sale of Unusual securities than may be anticipated at present.

The amount of consideration the Company will receive is subject to uncertainties.

Pursuant to the Share Purchase Agreement, the amount of consideration that the Company will receive from Unusual is subject to uncertainties by virtue of the purchase price adjustments set forth in the Share Purchase Agreement, which is subject to adjustments based on levels of working capital at closing. Working capital balances fluctuate over time and it is expected that the amount of working capital reflected in the pro-forma financial statements presented in this proxy statement will be reduced significantly prior to closing, with the cash proceeds from sales of inventory, among other things, reducing intercompany loan balances to zero or close to the average working capital that would be reflected for normal monthly operations. In addition, the value to the Company from the Senior Secured Note and the Series A Preferred Stock to be received at closing is uncertain and may not be realized and depends to a large extent on the ability of Unusual to succeed as a separate company.

The Company will incur significant transaction costs in connection with the transaction contemplated in Proposal One.

The Company has incurred, and expects to incur, significant non-recurring costs associated with the transactions contemplated in Proposal One, even if the stockholders of the Company fail to approve Proposal One. These costs and expenses include financial advisory, legal, accounting, consulting, and other advisory fees and expenses, restructuring costs, employee benefits-related expenses, public company filing fees and other regulatory expenses, printing expenses, and other related charges. Through the date of this proxy statement, the Company has incurred aggregate transaction costs of approximately $75,000, which have been defrayed by a $100,000 non-refundable earnest money deposit paid by Unusual. Based on information available as of the date of this proxy statement, the Company anticipates incurring additional transaction costs of approximately $150,000 in connection with the transactions contemplated in Proposal One, most of which are contingent upon the closing. Some of these costs are payable by the Company regardless of whether the closing of the Share Purchase Agreement occurs.

Risks Related to the Company and its Continuing Operations if the Transactions Contemplated in Proposal One are Completed

If the Share Purchase Agreement is completed, we will no longer be engaged in the hobbyist and consumer segments and our future results of operations will be dependent solely on our efforts to capitalize on enterprise and government business (including domestic and international military, border security and safety) and differ materially from our previous results of operations.

Since January 2020, we acquired four separate businesses operating in various aspects of the drone industry. Following the acquisition of Teal Drones, Inc. in August 2021, the Company focused on integrating and organizing its acquired businesses. These efforts included refining the establishment of Enterprise and Consumer segments to sharpen the Company’s focus on the unique opportunities in each sector of the drone industry. The Enterprise segment, which includes Teal Drones and Skypersonic, Inc. is focused on opportunities in the commercial sector, including military. Enterprise is building the infrastructure to manage drone fleets, fly and provide services remotely, and navigate confined industrial interior spaces and dangerous military environments. The Consumer segment, which includes Rotor Riot and Fat Shark, is focused on enthusiasts and hobbyists which are expected to increase as drones become more visible in our daily lives. Effective May 1, 2022, we began to manage our business operations through these business segments. The reportable segments were identified based on how our chief operating decision maker (“CODM”), which is a committee comprised of our Chief Executive Officer (“CEO”), Chief Operating Officer (“COO”) and our Chief Financial Officer (“CFO”), manages our business, makes resource allocation and operating decisions, and evaluates operating performance. The financial results for each segment for the three and six months ended, as reported in our most recently filed 10-Q, were as follows:

| For the three months ended October 31, 2022 | ||||||||||||||||

| Enterprise | Consumer | Corporate | Total | |||||||||||||

| Revenues | $ | 747,612 | $ | 782,850 | $ | — | $ | 1,530,462 | ||||||||

| Cost of goods sold | 623,761 | 673,046 | — | 1,296,807 | ||||||||||||

| Gross margin | 123,851 | 109,804 | — | 233,655 | ||||||||||||

| Operating expenses | 3,615,614 | 531,349 | 2,859,026 | 7,005,989 | ||||||||||||

| Operating loss | (3,491,763 | ) | (421,545 | ) | (2,859,026 | ) | (6,772,334 | ) | ||||||||

| Other expenses, net | 96,015 | (8,050 | ) | (615,822 | ) | (527,857 | ) | |||||||||

| Net loss | $ | (3,587,778 | ) | $ | (413,495 | ) | $ | (2,243,204 | ) | $ | (6,244,477 | ) | ||||

| For the six months ended October 31, 2022 | ||||||||||||||||

| Enterprise | Consumer | Corporate | Total | |||||||||||||

| Revenues | $ | 1,874,163 | $ | 2,725,570 | $ | — | $ | 4,599,733 | ||||||||

| Cost of goods sold | 1,668,192 | 2,340,259 | — | 4,008,451 | ||||||||||||

| Gross margin | 205,971 | 385,311 | — | 591,282 | ||||||||||||

| Operating expenses | 5,276,977 | 1,026,377 | 4,758,758 | 11,062,112 | ||||||||||||

| Operating loss | (5,071,006 | ) | (641,066 | ) | (4,758,758 | ) | (10,470,830 | ) | ||||||||

| Other expenses, net | 159,244 | (8,174 | ) | (565,824 | ) | (414,754 | ) | |||||||||

| Net loss | $ | (5,230,250 | ) | $ | (632,892 | ) | $ | (4,192,934 | ) | $ | (10,056,076 | ) | ||||

The following table sets forth specific asset categories which are reviewed by our CODM in the evaluation of operating segments:

| As of October 31, 2022 | ||||||||||||||||

| Enterprise | Consumer | Corporate | Total | |||||||||||||

| Accounts receivable, net | $ | 874,439 | $ | 43,363 | $ | — | $ | 917,802 | ||||||||

| Inventory, net | 4,332,532 | 2,227,560 | — | 6,560,092 | ||||||||||||

| Inventory deposits | $ | 1,164,884 | $ | 2,540,969 | $ | — | $ | 3,705,853 | ||||||||

The descriptions and amounts under the heading “Consumer”, if the Share Purchase Agreement transactions close, will no longer be available to the Company following closing. As a result, the Company’s assets and performance of its Enterprise segment will be its only business and assets following the closing.

We will continue to incur the expenses of complying with public company reporting requirements following the closing of the sale of the Target Companies notwithstanding the decrease in the size of our operations.

After the closing of the transactions contemplated in Proposal One, we will continue to be required to comply with the reporting requirements of the Securities Exchange Act of 1934 and as a NASDAQ listed company. The expense of complying with these requirements is expected to at least initially represent a greater percentage of our revenues and overall operating expenses than they did prior to the closing because of our reduced operations following the disposition of the Target Companies.

The market price of our common stock may be adversely affected by the transactions contemplated in Proposal One and we may fail to satisfy the continued listing standards of The NASDAQ Capital Market, which could result in the delisting of our common stock.

The continued listing standards of The NASDAQ Capital Market include, among other things, requirements that we maintain certain levels of stockholders’ equity, net income from continuing operations or market capitalization and a minimum trading price. Recently, our stock price has failed to close above $1.00 per share for extended periods. As a result, even if we were to regain compliance, we may not be able to continue to meet the $1.00 minimum bid price requirement of The NADAQ Capital Market and/or satisfy other of the continued listing requirements.

PROPOSAL ONE: THE SALE OF ROTOR RIOT AND FAT SHARK

At discussed elsewhere in this proxy statement, including under, the holders of the Company’s common stock, other than the shares owned by our Chairman and Chief Executive Officer (the “Disinterested Shareholders”) will consider and vote on Proposal One. The Disinterested Shareholders should read this proxy statement carefully in its entirety, including but not limited to the section entitled “The Share Purchase Agreement Transaction” including the annexes (which are incorporated by reference herein), for more detailed information concerning the Share Purchase Agreement. A copy of the Share Purchase Agreement is attached to this proxy statement as Annex A.

Under the Nevada Revised Statutes we determined that Jeffrey Thompson is deemed to an “interested shareholder” of the Company. The Nevada Revised Statutes generally prohibit a Nevada corporation, such as the Company, from engaging in a combination with any shareholder considered an interested shareholder of the corporation. However, Section 78.439 of the Nevada Revised Statutes permits such a transaction provided that is approved by a majority the outstanding shares of the corporation not owned by the interested shareholder. Because he owns approximately 23% of the outstanding capital stock of Unusual, the transactions contemplated in Proposal One are considered by us to be a combination with an interested shareholder under the Nevada Revised Statutes. Accordingly, we believe that is it is prudent to approve the sale by the Disinterested Shareholders and we are therefore asking the Disinterested Shareholders to approve the sale of the Target Companies by adopting the following resolution:

“WHEREAS, the Board of Directors of the Company has determined that it is expedient and in the best interests of the Company and its stockholders for the Company to dispose and sell its consumer businesses consisting of Rotor Riot, LLC and Fat Shark Holdings, Ltd. (the “Target Companies” on the terms and subject to the conditions set forth in that certain Share Purchase Agreement, by and between the Company, Jeffrey Thompson, and Unusual Machines, Inc. dated as of November 21, 2022 (as it may be amended from time to time and including all exhibits and schedules referenced therein and/or attached thereto, the “Share Purchase Agreement”).

RESOLVED, that the sale of the Target Companies on the terms and subject to the conditions set forth in the Share Purchase Agreement is hereby approved, authorized and adopted in all respects.”

A vote in favor of the Proposal One will be deemed the approval of the Share Purchase Agreement, the terms and conditions thereof, and the transactions contemplated therein and thereby, including any and all amendments thereto approved by the Board of Directors of the Company following approval.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL ONE.

PROPOSAL TWO: ADJOURNMENT PROPOSAL

If the number of shares of common stock present in person or represented by proxy at the Special Meeting and voting in favor of Proposal One is insufficient to approve the Purchase and Sale Agreement at the time of the Special Meeting, we intend to move to adjourn the Special Meeting, if necessary or appropriate (as determined by our Board of Directors) to a later time or date, from time to time, in order to enable the Board of Directors to solicit additional proxies in respect of Proposal One.

In the Adjournment Proposal, we are asking you to authorize the holder of any proxy solicited by the Board of Directors to vote in favor of granting discretionary authority to the proxy holders, and each of them individually, to adjourn the Special Meeting to another time and place for the purpose of soliciting additional proxies. If our stockholders approve the Adjournment Proposal, we could adjourn the Special Meeting and any adjourned session of the Special Meeting and use the additional time to solicit additional proxies, including the solicitation of proxies from stockholders that have previously voted.

Required Vote; Recommendation of the Board of Directors

Approval of Proposal Two requires the affirmative vote of the holders of a majority of the Company’s common stock present in person or by proxy and entitled to vote on the matter at the Special Meeting (meaning that of the shares of common stock represented at the Special Meeting and entitled to vote, a majority of them must be voted “FOR” the Adjournment Proposal for it to be approved). For Proposal Two, Mr. Thompson’s will be entitled to cast a vote “For” Proposal Two which shall be counted. For purposes of the vote on Proposal Two, an abstention will have the same effect as voting “AGAINST” the Adjournment Proposal, but the failure to sign and return your proxy card or vote by telephone, fax, over the Internet or in person at the Special Meeting will have no effect on the outcome of the proposal. Broker non-votes will also have no effect on the outcome of the proposal.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF PROPOSAL TWO.

THE SHARE PURCHASE AGREEMENT TRANSACTION

The discussion in this proxy statement is qualified in its entirety by reference to the Share Purchase Agreement, a copy of which is attached to this proxy statement as Annex A and hereby incorporated by reference into this proxy statement. We encourage you to read the Share Purchase Agreement carefully and, in its entirety, as it is the legal document that governs the Sale.

Overview of the Share Purchase Agreement

On November 21, 2022 (the “Effective Date”), the Company, as seller, and Jeffrey Thompson, as principal stockholder, entered into a Share Purchase Agreement with Unusual pursuant to which Unusual will acquire, upon the terms and conditions set forth in the Share Purchase Agreement, 100% of the issued and outstanding equity interests of the Target Companies, for a total purchase price of $18 million consisting of (i) $5.0 million in cash, subject to adjustment for the Target Companies’ working capital balance on the closing date, and a $2.5 million 8% Senior Secured Convertible Promissory Note that will mature on the 3 year anniversary date of the closing of the transaction (the “Unusual Note”) of Unusual convertible into common stock of Unusual, and (ii) $10.5 million in shares of Series A Convertible Preferred Stock (the “Unusual Preferred Stock”) of Unusual. Each of the Unusual Note and the Unusual Preferred Stock are convertible into Unusual common stock, par value $0.001 per share, at the lower of (A) $4.00 (subject to adjustment for stock splits, stock dividends or similar events) or (B) the Offering price of Unusual in its initial public offering transaction. The Unusual Note and the Unusual Preferred Stock contain 4.99/9.99% beneficial ownership blockers and other usual and customary provisions, including price protection for lower priced issuances, for so long as the Unusual Note or the Unusual Preferred Stock remain outstanding. In addition, all shares of Unusual common stock issuable upon conversion of Unusual’s 8% Senior Secured Convertible Notes and Series A Convertible Preferred Stock are subject to a registration rights agreement which obligates Unusual to register the shares of common stock issuable for resale by Red Cat under certain circumstances.

The Share Purchase Agreement is attached hereto as Annex A.

The 8% Senior Secured Convertible Note is attached hereto as Annex B.

The Security Agreement is attached hereto as Annex C

The Series A Convertible Preferred Stock Certificate of Designation is attached hereto as Annex D.

The Registration Rights Agreement is attached hereto as Annex E

The discussions in this proxy statement of the Share Purchase Agreement, 8% Senior Secured Note that will mature on the 3 year anniversary date of the closing of the transaction, Security Agreement, Series A Convertible Preferred Stock Certificate of Designation, and Registration Rights Agreement are qualified in their entirety by reference to the copies thereof attached to this proxy statement as Annex A-E hereto and are incorporated by reference into this proxy statement. We encourage you to read the Annexes carefully and in their entirety as they are the legal documents that govern the transactions submitted for approval under Proposal One.

Parties to the Share Purchase Agreement

Red Cat Holdings, Inc.

Based in San Juan Puerto Rico, Red Cat acquired four separate businesses operating in various aspects of the drone industry. Following the acquisition of Teal Drones, Inc. in August 2021, the Company focused on integrating and organizing its acquired businesses. These efforts included refining the establishment of Enterprise and Consumer segments to sharpen the Company’s focus on the unique opportunities in each sector of the drone industry. The Enterprise segment, which includes Teal Drones, Inc. and Skypersonic, Inc. is focused on opportunities in the commercial sector, including the military. Enterprise is building the infrastructure to manage drone fleets, fly and provide services remotely, and navigate confined industrial interior spaces and dangerous military environments. The Consumer segment, which includes Rotor Riot and Fat Shark, is focused on enthusiasts and hobbyists which are expected to increase as drones become more visible in our daily lives. Effective May 1, 2022, we began to manage our business operations through these business segments.

Effective May 15, 2019, the Company closed a Share Exchange Agreement (the “SEA”) with Red Cat Propware, Inc. (“Propware”), a privately-held Nevada corporation and each of its shareholders. Under the SEA, we acquired all of the issued and outstanding capital stock of Propware, in exchange for issuance to the Propware shareholders of: (i) 236,000,000 (pre-split) shares of common stock, and (ii) 2,169,068 (pre-split) shares of newly-designated Series A Preferred Stock. Our Series A Preferred Stock has been fully converted.

Jeffrey Thompson, founded the Company in 2018 as a privately held company, which became public as described above. He currently serves as our CEO and Chairman of the Board.

Unusual Machines, Inc.

Unusual is a Puerto Rico corporation organized in 2019. It is a development stage technology company engaged in the commercial drone industry and its current primary business objective is to acquire the Target Companies. Unusual intends for the Target Companies to continue to focus on leveraging and growing the market share in the consumer and hobbyist sectors of drone products for use in entertainment, recreational and competitive racing purposes. Unusual also plans to explore a potential expansion into new sub-markets such as public safety and drone delivery functions, organically and/or through strategic acquisitions.

Background to the Share Purchase Agreement

The following chronology summarizes the key meetings and events that led to the signing of the Share Purchase Agreement. This chronology does not purport to catalogue every conversation among the officers of Red Cat, the Board of Directors or the representatives of Red Cat, and other parties, including those employed by or associated with Unusual.

Strategic Review Process

From time to time, the Board of Directors and our senior management team review and evaluate strategic opportunities and alternatives as part of a long-term strategy to increase stockholder value. Such opportunities include remaining as a stand-alone entity, potential acquisitions of companies, businesses or assets that align with our strategic objectives and potential dispositions of one of more businesses. Following the acquisition of Teal Drones, Inc. in August 2021, the Company began to establish separate enterprise and consumer divisions in anticipation of growth in government customers including defense, public safety, and infrastructure. The Company expects enterprise customers to become its most significant revenue drivers for the fiscal year beginning May 1, 2023, anchored by Teal. Following the Teal acquisition, several major driving forces were examined by the Board of Directors and senior management including the following:

Teal Drones

| · | The U.S. Army banned its forces from using Chinese-made quadcopter due to security risks |

| · | The U.S. Department of Defense began developing its own alternatives under a defense program known as Blue sUAS |

| · | Teal opened a new 25,000 square foot manufacturing facility in Salt Lake City, Utah |

| · | Teal was one of five contractors awarded firm, fixed price, multiple award blanket purchase agreements by United States Customs and Border Protection with an estimated $90 million value over a 5 year period inclusive of orders that can be placed by the Department of Homeland Security |

| · | The US Infrastructure Investment and Jobs Act of 2022 was passed which management believes will enhance built in America sourcing |

| · | In March 2022, Teal was selected by the Innovation Unit of the Department of Defense and the U.S. Army to compete in the Short Range Reconnaissance Tranche 2 Program and notified it would advance to the prototype phase and awarded a $1.5 million contract |

| · | In April 2022, Teal secured an order for 15 Golden Eagle drone units, parts, and training from a NATO member country to be deployed in Ukraine |

| · | In May 2022, Teal completed development and production of a four-drone, multi-vehicle system for defense, government and public safety markets which provides the technology for a single pilot to simultaneously control up to four Golden Eagle drones |

Skypersonic

| · | In September 2021, Skypersonic was awarded a five-year contract with NASA to provide drone and rover software, hardware and support for NASDA’s Simulated Mars mission |

| · | In May 2022, Skypersonic completed a 2 year inspection program with General Motors in 19 of its North American facilities |

| · | In June 2022, Skypersonic completed inspection of a utility plant in Turin, Italy piloted from Orlando, Fl on an internet connection |

Sale of Target Companies

In August of 2022, our Chief Operating Officer, Allan Evans, had several informal discussions with Brandon Torres Declet, Chief Executive Officer of Unusual, regarding a potential transaction involving the sale of the Target Companies to Unusual. On August 23, 2022, Evans and Mr. Torres Declet met in person for further discussions. Following that meeting, Unusual provided an unsolicited draft Letter of Intent outlining proposed terms for the acquisition of the Target Companies (the “LOI”).

On September 2, 2022, our Chief Operating Officer, Allan Evans, our Chief Financial Officer and our Lead Director Joseph Freedman, held a conference call to discuss the LOI.

On September 12, 2022, Mr. Freedman spoke with Mr. Torres Declet by telephone to discuss the LOI and to discuss his background and vision and the circumstances surrounding his appointment as CEO of Unusual Machines. During the call, issues related to competing with the Company, financing and the cash position of Unusual Machines were also raised.

.

On September 15, 2022, the Board of Directors met by video conference, with outside legal and financial advisers participating. The Board of Directors heard an informal presentation from Think Equity!, its investment banking firm, addressing the condition of the public markets, the Company’s present market capitalization , the interest in the markets of an enterprise division separated from a consumer division, and the prospects for a successful spin-out in the current depressed market. No written report was provided. The Board discussed various aspects of the proposed LOI including valuation, a no-shop period, and current valuation and stock price of the Company. The Board of Directors also analyzed the conflict of interest concerning the Company’s Chief Executive Officer and his position as a founder, significant stockholder and board member of Unusual. Accordingly, the Board determined that a special committee consisting of Mr. Freedman and Mr. Moe, both independent directors, would be established to consider and evaluate the proposed sale of the Target Companies (the “Special Committee”). Mr. Freedman served as chair of the Special Committee. In addition, the Board determined that Mr. Thompson would be excluded from negotiations and abstain from voting on all matters related to the transaction.

During the period between September 15, 2022 and September 25, 2022, the Company’s outside legal counsel exchanged several drafts of the LOI with Unusual.

On September 23, 2022, the Company held its annual meeting of shareholders in Newport, Rhode Island. Following the meeting, the Special Committee met with Mr. Evans to discuss management’s views on the advantages of moving forward with an exclusive focus on the infrastructure segment, including military, border control, police and homeland security type opportunities. Afterwards, Mr. Torres Declet met with the Special Committee in person and reviewed materials he distributed outlining the proposal and future prospects for Unusual, including his background and experience as a drone company executive, Unusual’s present funding, its future IPO, its commitment to consumer focus, the terms of the purchase contract and securities to be issued and other aspects of the transaction should the transaction be approved. Outside counsel to the Company was also present and discussed legal requirements for approval, legal fiduciary duty obligations of directors of a Nevada publicly traded company to entertain alternative proposals, desire to obtain a third-party independent valuation and stockholder votes required for approval. The Special Committee indicated to Mr. Torres Declet that the Company would require that it entertain alternative bids and solicit proposals from third parties as part of the process in order for the Company to proceed with any proposal from Unusual, matters to which Mr. Torres Declet agreed in principal at the meeting.

On September 27, 2022, the Special Committee met via conference call with the Company’s outside legal counsel to consider the September 25, 2022, version of the LOI. The Special Committee focused on the risk and significance to the potential transaction of a successful initial public offering by Unusual and the nature of and parties to the representations and warranties being requested by Unusual with respect to the Target Companies. Following the meeting, the Company’s outside legal counsel spoke with Unusual’s legal counsel to discuss certain issues relating to the LOI.

On September 28, 2022, the Company’s outside legal counsel met with the Special Committee via conference call and briefed the Committee on the call with Unusual’s legal counsel the day before. Following that call, the Special Committee met again via conference call with Mr. Torres Declet and counsel to Unusual via conference call to discuss certain aspects of the documentation requests by Unusual. In particular, the Company generally rejected Unusual’s proposal that the Company provide business representations and warranties with respect to the operations of the Target Companies and indemnification rights that could be asserted against the Company for a period following closing. After that call, the Company’s outside legal counsel spoke with Mr. Thompson who indicated his approval to personally provide Unusual certain operational representations and warranties and his willingness to pledge Unusual shares to as security to Unusual to support any indemnification obligations in connection with the business representations and warranties. The Company’s legal counsel updated the Special Committee via conference call. There was a follow-up conference call with the Special Committee and Mr. Torres Declet to further discuss the proposed transaction. Over the next several days, the parties exchanged marked-up drafts of the LOI, the Special Committee had several calls to discuss the mark-ups, and remaining issues were resolved.

On September 29, 2022, the Special Committee met via conference call to address further LOI revisions.

On October 1, 2022, Unusual provided an executed version of the revised LOI to the Special Committee.

On October 2, 2022, counsel to the Company sent a message and non-disclosure agreement to a third-party potential alternative bidder for the Target Companies that had previously expressed interest in Fat Shark involved in the virtual headset business. In the call that followed, the potential bidder indicated it would not be interested in making an offer and no longer had interest in the specific business performed by Fat Shark.

On October 3, 2022, the full Board of Directors met by video conference to receive the recommendations of the Special Committee and consider the LOI and the proposed transaction. Mr. Thompson did not attend the meeting and did not participate in the deliberations or recommendations. The Company’s legal counsel outlined for the Board the history of the negotiations of the LOI and responded to questions of the Board members with respect thereto and outlined steps for a valuation, receiving alternative proposals and submission of a transaction to a vote of shareholders as contemplated by the LOI. After discussion, the members of the Board unanimously approved the LOI and authorized execution by the Company.

On October 3, 2022, the Company engaged Vantage Point Advisors, Inc. to prepare a valuation to be used in connection with the transaction.

Between October 4, 2022, and November 16, 2022, the Company’s management team worked with representatives of Unusual to facilitate due diligence review of the Target Companies and held discussions with other potential alternative bidders for the Target Companies. The management team also provided information and materials to Vantage Point Advisors to be used in their valuation of the Target Companies. In addition, during this period, the Company’s outside legal counsel worked with the Special Committee and representatives of Unusual to draft, negotiate and finalize the Share Purchase Agreement.

On November 16, 2022, the Special Committee met with outside legal counsel via a conference call to discuss the status of the Share Purchase Agreement. That was followed by a video conference call of senior management of each of the Company and Unusual to discuss the proposed transaction.

On November 21, 2022, the Board of Directors held a special meeting by video conference to consider the proposed transaction and the Share Purchase Agreement. The Company’s newly appointed director Mary Beth Long as well as the full board were provided with a lengthy presentation by the Special Committee and outside legal counsel of the history and negotiation of the Share Purchase Agreement. The Company’s Chief Financial Officer also participated in the meeting and provided comments. The Company’s outside legal counsel reviewed the history and nature of the Unusual relationship, the relationship of Mr. Thompson to Unusual, and the negotiation of the Share Purchase Agreement. The outside legal counsel and Special Committee responded to numerous questions from the Board members including the impact of the transaction on the projected revenues and cash flow of the Company. After discussion, the members of the Board present at the meeting unanimously (i) determined that the transactions contemplated in the Share Purchase Agreement are in the best interests of the Company and its stockholders, and (ii) approved the Share Purchase Agreement and the transactions contemplated therein, with Mr. Thompson abstaining from the vote.

Fair Market Value Analysis by Vantage Point Advisors, Inc.

On October 3, 2022, the Board engaged Vantage Point Advisors, Inc. (“VPA”) to prepare a fair market value analysis of each of the Target Companies. On December 14, 2022, VPA delivered draft reports to the Board with respect to each Target Company providing its analysis of the fair market value analysis of each Target Company as of November 30, 2022.

Summary of Material Financial Analysis

Vantage Point Advisors, Inc. (“VPA”), which was subsequently acquired by Stout Risius Ross, LLC, was engaged by the Company to provide a valuation of the Target Companies in connection with the proposed transaction. As part of its engagement, VPA, at the request of the Company, on December 14, 2022, provided to the Company materials regarding VPA's valuation of the Target Companies.

VPA's materials were provided for the information of the Company in its review of the Target Companies in connection with the proposed Transaction and were not to be used for any other purpose. VPA's materials did not address the underlying business decision of the Company, its board of directors or any other party to enter into the Share Purchase Agreement, or the relative merits of the proposed Transaction as compared to any alternative transaction or strategy that may have been available to the Company or the Target Companies. The materials were not intended to provide the sole basis for the Company's evaluation of the proposed Transaction, did not purport to contain all information that may have been required by, or of interest to, the Company in connection with such evaluation, and did not constitute an opinion or recommendation to the Company, its board of directors, any security holder of the Company or any other person or entity as to how to vote or act with respect to any matter relating to the Target Companies, the proposed Transaction or otherwise. VPA's materials did not constitute an opinion as to the fairness of the consideration, the financial terms or any other aspect of the proposed transaction.

With the consent of the Company, VPA assumed and relied upon, without independent verification, the accuracy and completeness of the financial and other information furnished by or discussed with the Company, the Target Companies and their respective representatives or otherwise available from public sources. VPA's role in reviewing such information was limited solely to performing such review as VPA deemed necessary and appropriate to support its analyses, and such review was not conducted on behalf of the Company, the Target Companies or any other person. With respect to the projections regarding the Target Companies prepared by Company management and provided to VPA, VPA was advised and assumed that they were reasonably prepared on bases reflecting the best currently available information, estimates and judgments of the management of the Company as to the future financial performance of the Target Companies. VPA expressed no view or opinion with respect to such projections or the assumptions or circumstances on which they were based. At the direction of the Company, VPA assumed that such projections provided a reasonable basis upon which to evaluate the Target Companies and, at the Company's direction, VPA relied upon such projections for purposes of its analyses.

VPA further relied upon and assumed, without independent verification, that there had been no change in the business, assets, liabilities, financial condition, results of operations, cash flows or prospects of the Target Companies since the respective dates of the most recent financial statements and other information, financial or otherwise, provided to it, and that there was no information or any facts that would make any of the information discussed with or reviewed by VPA incomplete or misleading. In connection with its analyses, VPA did not conduct a physical inspection of the properties, assets or facilities of the Target Companies and was not requested to, and did not, make an independent evaluation or appraisal of the assets or liabilities (fixed, contingent, derivative, off balance sheet or otherwise) of the Target Companies , nor was VPA furnished with any such evaluations or appraisals. VPA's materials did not constitute a solvency opinion or credit rating, and VPA had no obligation to evaluate the solvency of the Company, the Target Companies or any other person or entity under any law. VPA's analyses addressed only the estimated fair market value of the Target Companies and did not address any term or aspect of the Purchase and Sale Agreement or the proposed Transaction.