10-K: Annual report pursuant to Section 13 and 15(d)

Published on April 9, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2017

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from ______ to ______

Commission File Number 814-00175

TimefireVR Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 86-0490034 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

7150 E. Camelback Rd. Suite 444 |

|

| Scottsdale, AZ | 85251 |

| (Address of principal executive offices) |

(Zip Code)

|

(602) 617-8888

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

|

Title of each class: Common Stock, $.001 par value

|

Name of each exchange on which registered: N/A |

Indicate by check mark if a registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller Reporting Company |

☑ |

| Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $936,180.

As of April 3, 2018, there were 155,601,804 shares of the issuer's $0.001 par value common stock issued and outstanding.

TABLE OF CONTENTS

| Page No. | ||||

| Part I | ||||

| Item 1. | Business. | 4 | ||

| Item 1A | Risk Factors. | 6 | ||

| Item 2. | Properties. | 7 | ||

| Item 3. | Legal Proceedings. | 7 | ||

| Item 4. | Mine Safety Disclosures. | 7 | ||

| Part II | ||||

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities. | 7 | ||

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations. | 8 | ||

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk. | 19 | ||

| Item 8 | Financial Statements and Supplementary Data. | 20 | ||

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. | 34 | ||

| Item 9A. | Controls and Procedures. | 34 | ||

| Item 9B. | Other Information. | 34 | ||

| Part III | ||||

| Item 10. | Directors, Executive Officers, and Corporate Governance. | 35 | ||

| Item 11. | Executive Compensation. | 35 | ||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 35 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 35 | ||

| Item 14. | Principal Accountant Fees and Services. | 35 | ||

| Part IV | ||||

| Item 15. | Exhibits, Financial Statements Schedules. | 36 | ||

| Item 16 | Form 10-K Summary | 36 | ||

| Signatures | 36 | |||

PART I

Item 1. Description of Business

General

TimefireVR Inc. (“we”, “us”, “our” the “Company” and “Timefire”) was originally incorporated in the State of Colorado on February 16, 1984 under the name of Oravest Interests, Inc. On April 10, 2002 we re-domiciled to the State of Nevada under the name Broadleaf Capital Partners, Inc. On July 23, 2014 we changed our name to EnergyTek Corp. since the Company was engaged in the oil and gas business. On November 21, 2016, we changed our name to TimefireVR Inc. We are currently in the process of changing our name to TeraForge Ventures Inc.

On March 31, 2014 we closed a transaction whereby we acquired certain assets and assumed certain liabilities of Texas Gulf Oil & Gas, Inc., a Nevada corporation, which were contributed to our then wholly-owned subsidiary Texas Gulf Exploration & Production, Inc. On March 31, 2014, we also closed a transaction whereby we acquired certain assets and assumed certain liabilities of Litigation Capital, Inc., a Nevada corporation, which were contributed to our then wholly-owned subsidiary Legal Capital Corp.

On January 6, 2015, we entered into a Joint Venture Agreement with Wagley Offshore-Onshore, Inc. to pursue a distressed energy asset acquisition program. The joint venture was formed as Wagley-EnergyTEK J.V. LLC, a Texas limited liability company, to which we issued 2,000,000 restricted shares of our common stock.

Sale of Our Existing Business

Effective September 13, 2016, the Company acquired Timefire, LLC (“TLLC”), a Phoenix-based virtual reality content developer which is an Arizona limited liability company. As consideration for the acquisition, the Company issued the equity holders of TLLC a total of 41,400,000 shares of the Company's common stock and 2,800,000 five-year warrants, which constituted a change of control of the Company (the “Merger”).

In December 2016, the Company transferred ownership of its legacy oil and gas subsidiaries and Legal Capital Corp. to Litigation Capital, Inc. in exchange for Litigation Capital, Inc. assuming approximately $180,000 of the Company’s liabilities.

On January 3, 2018, the Company effected the sale of TLLC to a group which included its former owners including two of our former executive officers and directors. The Company received: (i) $100,000 in cash and (ii) a secured promissory note in the principal amount of $120,000 bearing 6% annual interest that matures in September 2018. Additionally, the buyers of TLLC assumed certain of the Company’s liabilities totaling approximately $558,054. The Company’s business model in the virtual reality business was not successful and the Company was unable to continue to finance its business due to a loss of confidence in the virtual reality business by the Company’s investors and threats of resignation from the Company’s officers, directors and lead technologist and TLLC employees. While shareholder approval was required by Nevada law, the purchasers refused to fund TLLC unless we closed immediately. Certain investors that had financed the Company had agreed to provide further funding if we sold TLLC and received a release from key liabilities including past due promissory notes. Rather than cease operations and have no working capital, we adhered to the TLLC purchasers' demands and closed the sale. Pending finalization of the sale of TLLC over the year-end holidays, these investors lent us approximately $669,000 on December 21, 2017 and cancelled past due notes held by the investors on January 3, 2018 as explained in the following paragraph. Because we needed to eliminate state law liabilities, we opted to get irrevocable proxies which would permit us to seek shareholder ratification. We have filed a preliminary proxy statement which has not yet been finalized. We expect to file an amendment by mid-April 2018.

Effective January 3, 2018, the Company entered into an Exchange Agreement (the “Exchange”) with certain of the Company’s investors pursuant to which the Company issued 303,714 shares of the Company’s new Convertible Series E Preferred Stock in exchange for the cancellation of the Company’s Series A Convertible Preferred Stock, Series A-1 Convertible Preferred Stock, Series C Convertible Preferred Stock, Senior Convertible Notes issued March 3, 2017, Senior Convertible Notes issued August 21, 2017, and certain of the Company’s outstanding Warrants. This Exchange had the effect of simplifying our capital structure and eliminating past due secured debt while substantially increasing future potential dilution. Effective December 21, 2017, we closed a private placement with our principal investors in which we borrowed $668,750 and issued the investors $703,947 in 5% Original Issue Discount Senior Secured Convertible Notes which Notes were due January 18, 2018, convertible at $0.03 per share and pay 8% per annum interest. The short-term nature was designed to ensure the TLLC sale closed in early January. On March 6, 2018, we borrowed $1 million from these same investors and issued them $1,052,632 new 5% Original Issue Discount Senior Secured Convertible Notes (the "March Notes") which are due on April 15, 2019. The March Notes pay 8% per annum interest and are convertible at $0.03 per share. On the maturity date, we must pay 120% of the principal of the March Notes. The March Notes are secured by a first lien on the Company's assets. For information on the warrants we issued, see Item 8 “Financial Statements” Note 11. Also on March 6, 2018, the investors extended their other Convertible Notes to April 15, 2019.

Summary of Recent Developments

On January 3, 2018, we announced our entry into the cryptocurrency business. As of April 6, 2018, we owned approximately $41,000 worth of Ether. In addition to its current business, the Company intends to enter into the cryptocurrency mining business. In order to enter the cryptocurrency mining business, we entered into an Advisory Agreement with two parties on March 16, 2018. Under the Advisory Agreement, the parties will provide consulting services to us concerning cryptocurrency mining and other opportunities in the cryptocurrency business. The parties to the Advisory Agreement will also provide us with an engineer who will provide half-time services to us in the mining business under which he will provide logistical advice and mining oversight including designing, and building overhead operating proprietary software, and monitoring operations of the mining systems. Under the Advisory Agreement, we agreed to reimburse one party $5,000 per month for the services of the mining engineer. Assuming we have entered into the mining business within 90 days, we agreed to pay a sales royalty as additional consideration. Further, upon finalizing the agreement, we will issue 6,666,666 shares of common stock (with an agreed value of $200,000) which will vest quarterly subject to the Advisory Agreement remaining in effect on each applicable vesting date and an additional 6,666,666 three-year warrants exercisable at $0.05 with the same vesting provisions.

Our Bitcoin Mining Business

In late March we entered into a co-location arrangement with an unaffiliated third party in the mining business. We ordered high speed computer servers and, in early April 2018, after delivery of the servers, will initiate our mining of Bitcoin. The intent of this purchase and location is to allow us to solidify, test and validate our hardware and software operating systems prior to expanding our mining operations. We are currently evaluating locations in Pennsylvania, Oregon, and Wyoming for mining and are considering the costs, management, and security advantages of each potential future location. See the general discussion of mining beginning at page 5 of this Report.

| 4 |

Cryptocurrency Business

We have been negotiating a series of agreements with Cryptogram, LLC (“Cryptogram”) including a License Agreement (the “License”). Cryptogram is a development stage company developing cryptocurrency data analytics, portfolio management, a cryptocurrency trading platform, and an information sharing software program. The software program being developed is designed for traders of cryptocurrency and is being designed to provide real price and volume information similar to how Bloomberg’s software programs are used in the capital markets. Cryptogram has developed prototype software which can be used on a computer and mobile devices by cryptocurrency investors in tracking prices and receiving technical data and other information which we believe can be sold to investors. The initial target is to complete the development of the first stage for sale to individual investors on a monthly fee basis with further development for the professional market when Cryptogram raises additional funds.

Under a term sheet we entered into with Cryptogram, we will pay Cryptogram $500,000 for the License. Additionally, we will issue Cryptogram $250,000 of our new Series A Convertible Preferred Stock in exchange for a 10% interest in Cryptogram and a Warrant to acquire up to an additional 30% of Cryptogram for $10 million. The License to the Cryptogram software will allow us to market the software to individual retail investors. Although we believe that we will finalize our agreements with Cryptogram in April, there are no assurances that we will successfully enter into any agreements with Cryptogram or acquire the License.

The Company intends to acquire Bitcoin, Ether, and invest in other cryptocurrency technologies.

Bitcoins and the Bitcoin Network

A Bitcoin is one type of cryptocurrency that is issued by, and transmitted through, an open source, math-based protocol platform using cryptographic security that is known as the “Bitcoin Network.” The Bitcoin Network is an online, peer-to-peer user network that hosts the public transaction ledger, known as the “Blockchain,” and the source code that comprises the basis for the cryptography and math-based protocols governing the Bitcoin Network. Bitcoins can be used to pay for goods and services or can be converted to fiat currencies, such as the US Dollar. Bitcoins are the initial and leading cryptocurrency and therefore offer the greatest mining opportunity.

Bitcoin transactions and ownership are recorded and reflected on the digital transaction ledger known as the “Blockchain,” which is a digital file stored in a decentralized manner on the computers of each Bitcoin Network user. The Blockchain records the transaction history of all Bitcoins in existence and, through the transparent reporting of transactions, allows the Bitcoin Network to verify the association of each Bitcoin with the digital wallet that owns them. Users keep their Bitcoins in an electronic computer file known as a digital wallet.

The Bitcoin Network is decentralized and does not rely on either governmental authorities or financial institutions to create, transmit or determine the value of Bitcoins. Rather, Bitcoins are created and allocated by the Bitcoin Network protocol through a “mining” process subject to a strict, well-known issuance schedule.

Overview of the Bitcoin Network’s Operations

In order to own, transfer or use Bitcoins, a person generally must have internet access to connect to the Bitcoin Network. Bitcoin transactions between parties occur very rapidly (within several seconds) and may be made directly between end-users without the need for a third-party intermediary, although there are entities that provide third-party intermediary services. To prevent the possibility of double-spending a single Bitcoin, a user must notify the Bitcoin Network of the transaction by broadcasting the transaction data to its network peers. The Bitcoin Network provides confirmation against double-spending by memorializing every transaction in the Blockchain, which is publicly accessible and transparent. This memorialization and verification against double-spending is accomplished through the Bitcoin mining process, which adds “blocks” of data, including recent transaction information, to the Blockchain.

Transaction Verification (Mining)

The process by which Bitcoins are “mined” results in new blocks being added to the Blockchain and new Bitcoins being issued to the miners. Miners engage in a set of prescribed complex mathematical calculations in order to add a block to the Blockchain and thereby confirm Bitcoin transactions included in that block’s data. Miners that are successful in adding a block to the Blockchain are automatically awarded a fixed number of Bitcoins for their effort; we also refer to this process of receiving the aforementioned award as transaction verification services. This reward system is the method by which new Bitcoins enter into circulation to the public and is accomplished in the added block through the notation of the new Bitcoin creation and their allocation to the successful miner’s digital wallet. To begin mining, a user can download and run Bitcoin Network mining software, which, like regular Bitcoin Network software programs, turns the user’s computer into a “node” on the Bitcoin Network that validates blocks. Due to the enhanced investor interest in Bitcoin, there has been large increases in, and a scarcity of, computer servers needed for mining. Additionally, since these high-speed servers use vast amounts of electricity, there has been a spike in the prices of electricity in the areas where mining has been prevalent. These areas were selected for their then low prices. The “poster boy or girl” for mining is Bitcoin mining which uses huge amounts of electricity to operate the computer servers. Miners sought out areas where electric power was relatively inexpensive. This has caused electricity prices to spike in these areas. Locations such as East Wenatchee, Washington have witnessed a swell in occupants and business as miners relocate to areas with cheap electricity. The mining industry has witnessed a change from small miners operating from their homes to large mining “farms” operated by companies with substantial capital, computer resources and other capabilities and competitive advantages. As electricity prices have risen as a result of mining, local officials have become alarmed because area residents are forced to pay more for their electricity. Very recently, Plattsburg, NY banned certain aspects of mining.

We have purchased servers and entered into an arrangement with a mining company that will permit us to commence mining operations. We anticipate that we will commence our actual mining by April 10, 2018 from our mining location in Brooklyn, NY

| 5 |

Alternative cryptocurrencies

Bitcoins are not the only type of cryptocurrency founded on math-based algorithms and cryptographic security, although it was considered the most prominent as of March 2018. Over 1,500 other cryptocurrencies, have been developed since the Bitcoin Network’s inception, including Ether, Ripple, Litecoin, Dash, and Monero. The Bitcoin Network, however, possesses the “first-to-market” advantage and thus far has captured the majority of the industry’s market share and is secured by a mining network with significantly more processing power than that of any other cryptocurrency. The Company is examining and will continue to examine these other cryptocurrencies, subject to financing, existing market conditions and regulatory compliance.

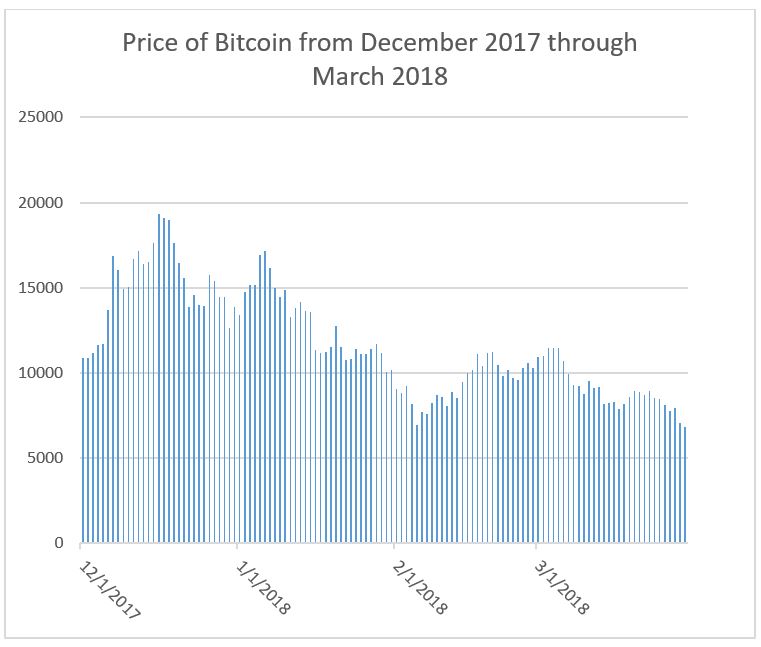

In 2017, Bitcoin and other cryptocurrencies experienced substantial price increases particularly in the late fall with extreme volatility beginning in the second half of December as illustrated by the following chart showing the price of Bitcoin from December 1, 2017 through March 30, 2018:

As the price of Bitcoin and other cryptocurrencies rose, the speculative fever brought substantial competition to the business both from established companies, early stage entrants and bad actors. The effect has been to make existing and new businesses much more expensive due to the growing demand and relatively limited supply.

Competition

As we enter this business, we face substantial competition and a myriad of other risks. We have one employee, our Chief Executive Officer, and relatively limited financial and other resources. See the “Risk Factors” that are at the end of Item 9. “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” including the regulatory section under the section of “Risk Factors” entitled “Risk of Future Cryptocurrency Legislation and Regulation.”

Cryptocurrency

Subject to raising additional capital, the Company’s cryptocurrency initiatives will compete with other industry participants that focus on investing in and mining of Bitcoin, Ether, and other cryptocurrencies. Market and financial conditions, and other conditions beyond the Company’s control, may make it more attractive to invest in other entities, or to invest in cryptocurrency directly. Companies have raised substantial capital this year seeking to enter the cryptocurrency business. Our lack of capital is a competitive disadvantage.

Mining

The business of mining of Bitcoin and other cryptocurrency is extremely competitive. Over the last several years as costs have spiked and the price of Bitcoin increased, large sources of capital have entered the mining business. This factor, as well as the prior experience and technical capabilities of our competitors, puts us at a competitive disadvantage.

Cryptocurrency Software Business

If we acquire the License our potential competitors may have greater resources, longer histories, and lower cost operations. Several other companies offer cryptocurrency software which provides users with the ability to buy, sell, and access important cryptocurrency information. They may secure better terms from server suppliers and devote more resources to technology infrastructure. Other companies may also enter into business combinations or alliances that strengthen their competitive positions.

Employees

We currently have one full time employee, our Chief Executive Officer. Our Chief Financial Officer is a part-time contractor.

Regulation

Because we will buy, hold, and sell cryptocurrency, we are subject to numerous federal and state laws around the world regarding cryptocurrency. The scope of these regulations are continuing to evolve, and they may be inconsistent among the locations in which we operate and our users reside. Compliance with these rules may be difficult and costly, and if we fail to comply, we could face liability under these statutes and legal or administrative actions by government entities and private litigants. See “Risk Factors” below, for further discussion of the risks we face.

Facilities

See Item 2. “Description of Property.”

| 6 |

Item 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 (the “Exchange Act”) and are not required to provide the information under this item. See the Risk Factors we voluntarily disclose at the end of Item 7 of this Report.

Item 2. Description of Property

The Company’s principal office is located at 7150 E. Camelback Rd. Suite 444 Scottsdale AZ 85251 for which the Company pays monthly rent in the amount of $729.

Item 3. Legal Proceedings

From time to time, we may be party to, or otherwise involved in, legal proceedings arising in the normal and ordinary course of business. As of the date of this Report, we are not aware of any proceeding, threatened or pending, against us which, if determined adversely, would have a material effect on our business, results of operations, cash flows or financial position.

Item 4. Mine Safety Disclosures

Not Applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

The common stock of the Company is quoted on the OTCQB under the symbol of TFVR. The following table sets forth the range of high and low bid prices during each quarter for the years ended December 31, 2017 and December 31, 2016. The over-the-counter market quotations may reflect inter-dealer prices, without retail market-up, markdown or commission and may not represent actual transactions. The market information was obtained from the OTCQB. Prices have been adjusted for the 1-for-10 reverse stock split effective November 21, 2016.

| Year Ended December 31, 2017 | ||||||||||

| High | Low | |||||||||

| Quarter ended March 31, 2017 | $ | 0.85 | $ | 0.20 | ||||||

| Quarter ended June 30, 2017 | $ | 0.55 | $ | 0.03 | ||||||

| Quarter ended September 30, 2017 | $ | 0.06 | $ | 0.02 | ||||||

| Quarter ended December 31, 2017 | $ | 0.19 | $ | 0.01 | ||||||

| Year Ended December 31, 2016 | ||||||||||

| High | Low | |||||||||

| Quarter ended March 31, 2016 | $ | 0.60 | $ | 0.20 | ||||||

| Quarter ended June 30, 2016 | $ | 0.50 | $ | 0.40 | ||||||

| Quarter ended September 30, 2016 | $ | 0.80 | $ | 0.40 | ||||||

| Quarter ended December 31, 2016 | $ | 2.50 | $ | 0.40 | ||||||

Dividends

We have not paid cash dividends on our common stock and do not plan to pay such dividends in the foreseeable future. Our board of directors (the “Board”) will determine our future dividend policy on the basis of many factors, including results of operations, capital requirements, general business conditions, and state law regulating the payment and distribution of dividends.

Shareholders

As of April 3, 2018, there were 155,601,804 shares of common stock outstanding, held by approximately 557 shareholders of record. In addition, as of April 3, 2018, there were approximately 195,382 shares of Series E Convertible Preferred Stock outstanding.

Transfer Agent

The Transfer Agent for the Company's Common Stock is Equity Stock Transfer, 237 W 37th Street, Suite 601, New York, New York 10018.

| 7 |

Recent Sales of Unregistered Securities

We have previously disclosed all sales of securities without registration under the Securities Act of 1933 (the “Act”), other than the following:

On January 20, 2017, the Company issued 50,000 shares of the Company’s common stock to a third party for services to be rendered.

On April 27, 2017, the Company issued 1,000,000 shares of the Company’s common stock to a third party for services to be rendered.

On April 27, 2017, the Company issued 25,000 shares of the Company’s common stock to a third party for services to be rendered.

In connection with the conversion of the Company’s Convertible Series E Preferred Stock into shares of the Company’s common stock the Company has issued a total of 108,332,000 shares of common stock on various dates between January 4, 2018 and April 2, 2018.

All the shares issued in connection with the transactions listed above were exempt from registration under Section 4(a)(2) of the Securities Act of 1933 (the “Act”) and Rule 506(b) thereunder as transactions not involving a public offering. Each of the third parties acquired their shares for investment and not with a view to distribution. We reasonably believed that each third party was an accredited investor as defined by Rule 501 under the Act.

Purchases of Equity Securities by the Registrant and Affiliated Purchasers

We did not repurchase any shares of our common stock during the fiscal year ended December 31, 2017.

Item 6. Selected Financial Data

None

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This discussion should be read in conjunction with the other sections contained herein, including the risk factors and the consolidated financial statements and the related exhibits contained herein. The various sections of this discussion contain a number of forward-looking statements, all of which are based on our current expectations and could be affected by the uncertainties and risk factors described throughout this Report as well as other matters over which we have no control. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including but not limited to those set forth in this Report. See “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

Company Overview

The Company is a Nevada corporation. In 2017, we completed the development of TLLC’s virtual reality software and failed in our attempt to monetize it. In the fourth quarter of 2017, based upon input from our principal investors who refused to further fund TLLC, we made the decision to terminate TLLC, and our then Chief Executive Officer, who was one of TLLC’s founders, resigned. We negotiated the sale of TLLC to its founders and prior key investors in December 2017 and closed the sale on January 3, 2018. On January 4, 2018, we announced our entry into the cryptocurrency business and we are currently pursuing business ventures in the cryptocurrency business and have initiated the mining of Bitcoins.

Results of Operations

Total revenue for the years ended December 31, 2017 and 2016 was $933 and $203,640, respectively. The revenue in 2016 was due to a one-time project completed for a related party. The revenue in 2017 was due to the limited release of our virtual reality business platform. The Results of Operations refers to our legacy TLLC virtual reality business.

Operating expenses in the year ended December 31, 2017 amounted to $2,688,824 as compared to $1,655,948 for the year ended December 31, 2016. The increase in operating expenses is due to an increase in operations of TLLC for the year ended 2017 compared to the year ended 2016.

Net income for the year ended December 31, 2017 was $1,128,827 compared to a loss of $3,376,775 for the year ended December 31, 2016. This difference is primarily due to the post-merger operational scale-up which was offset by a $4,193,081 non-cash gain in the fair value of the warrants issued to investors. Investors should understand that these warrants either create a non-cash gain or loss which is inverse to the price of the Company’s common stock. Because the price was lower on December 31, 2017 than on December 31, 2016, the resulting difference is non-cash income.

Our operating loss for 2017 increased to $2,688,171 from $1,655,948 for 2016.

Liquidity and Capital Resources

As of April 3, 2018, we had approximately $1.15 million in cash which is sufficient working capital to support operations for the next 12 months. There is no assurance that any additional financing will be available or if available, on terms that will be acceptable. However, we have $1,826,579 of Convertible Notes due in April 2019 which require payment of 120% of principal and interest.

Going Concern

The Company has incurred losses since inception and requires additional funding for future operating activities. The Company’s activities are not generating a level of revenue sufficient to fund its current operating activities. These factors create an uncertainty as to how the Company will fund its operations and maintain sufficient cash flow to operate as a going concern. The combination of these factors, among others, raise substantial doubt about the Company’s ability to continue as a going concern.

The Company’s ability to meet its cash requirements in the next year is dependent upon obtaining additional financing. If this is not achieved, the Company may be unable to obtain sufficient cash flow to fund its operations and obligations, and as a result there is substantial doubt the Company will be able to continue as a going concern. The accompanying condensed consolidated financial statements have been prepared on a going concern basis, and accordingly, do not include any adjustments relating to the recoverability and classification of recorded asset amounts; nor do they include adjustments to the amounts and classification of liabilities that might be necessary should the Company be unable to continue operations or be required to sell its assets.

| 8 |

Critical Accounting Policies and Estimates

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

We regularly evaluate the accounting policies and estimates that we use to prepare our financial statements. A complete summary of these policies is included in the notes to our financial statements. In general, management’s estimates are based on historical experience, on information from third party professionals, and on various other assumptions that are believed to be reasonable under the facts and circumstances. Actual results could differ from those estimates made by management.

The Company has implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Off Balance Sheet Arrangements

We do not engage in any activities involving variable interest entities or off-balance sheet arrangements.

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the following Risk Factors before deciding whether to invest in our Company. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also impair our business operations or our financial condition. If any of the events discussed in the Risk Factors below occur, our business, consolidated financial condition, results of operations or prospects could be materially and adversely affected. In such case, the value and marketability of the common stock could decline.

You should recognize that we have been unable to generate material revenues from our legacy business. As a result, we made the decision to enter the blockchain and cryptocurrency business, a business which is subject to special risks described below

Risks Relating to Our Financial Condition

If we cannot complete a financing in the near future, we will be required to cease operations.

We had net income of $1,128,827 during the year ended December 31, 2017. However, the Company has a history of incurring losses. The Company has an accumulated deficit of $2,740,558 as of December 31, 2017. As of April 3, 2018, we have approximately $1.15 million in cash available and based on our estimated current liabilities, our working capital is approximately $1.1million. We expect that we can manage our accounts payable and sustain operations until March 2019. To remain operational beyond that time, we must complete a financing. Because small companies like ours generally face more obstacles in obtaining financing, we cannot assure you that we will be successful in raising additional capital if needed. Further, if we complete a financing it may be very dilutive to shareholders.

Our ability to continue as a going concern is in doubt unless we obtain adequate new debt or equity financing and achieve sufficient sales levels.

As noted above, we have incurred significant net losses to date. We anticipate that we will continue to lose money for the foreseeable future. Additionally, we have negative cash flows from operations and no expectations of revenue in the near future. Our continued existence is dependent upon generating sufficient working capital and obtaining adequate new debt or equity financing. Because of our continuing losses, without improvements in our cash flow from operations or new financing, we may have to continue to restrict our expenditures. Working capital limitations may impinge on our day-to-day operations, which may contribute to continued operating losses.

Because of the recent declines in the price of our common stock, third parties have declined to do business with us.

As of the close of business on April 3, 2018, the price of our common stock was $0.008 as reported on the OTCQB. The holders of our Series E Preferred Stock may convert their Series E Preferred Stock into a large number of shares of our common stock which may cause the price of our common stock to stay below $0.01. Because of the recent large decline in the price of our common stock, we have faced the loss of pending business opportunities and reluctance by third parties to enter into business with us. As a result of our low stock price, we may continue to lose business opportunities in the future. If our stock price does not increase or if we are unable to enter into agreements with third parties, we likely will be unable to pay our debt which is due in April 2019.

Risk of Future Cryptocurrency Legislation and Regulation

Because of sharp run ups in the price of Bitcoin and other cryptocurrencies and the recent declines, as well as a number of fraudulent and other wrongful campaigns affecting cryptocurrency, the Securities and Exchange Commission (the “SEC”) and, other federal regulators and state regulators, and foreign authorities have recently increased their focus on cryptocurrency issuances and trading and it is likely that there will be future legislation and new rules, which may adversely affect the business of the Company.

In public speeches, the Chairman of the SEC has focused substantial attention and concerns related to the issuance and trading of cryptocurrency. The SEC has also filed lawsuits, suspended trading of cryptocurrency companies, taken administrative action to stop an initial coin offering (“ICO”) and is reportedly issuing subpoenas relating to promotion of ICOs. While the Company cannot predict what kind of legislation and regulation may be enacted in the future, it is possible that any such legislation and regulation may adversely affect the Company which could cause our stock price to fall sharply.

| 9 |

If regulatory changes or interpretations require the regulation of cryptocurrency under the Act and the Company under the Investment Company Act of 1940 (the “1940 Act”) by the SEC, we may be required to register and comply with such regulations, which may result in extraordinary, non-recurring expenses to us.

Current and future legislation, the SEC rulemaking and other regulatory developments, including interpretations released by a regulatory authority, may impact the manner in which cryptocurrency is treated for classification and clearing purposes. The SEC’s July 25, 2017 Report of Investigation Pursuant to Section 21(a) of the Securities Exchange Act of 1934: The DAO (the “Report”) expressed its view that cryptocurrencies may be securities depending on the facts and circumstances. We are not aware of any rules that have been proposed to regulate cryptocurrency as securities. We cannot be certain as to how future regulatory developments will impact the treatment of cryptocurrency under the law. Such additional registrations may result in extraordinary, non-recurring expenses, thereby materially and adversely impacting an investment in us. If we determine not to comply with such additional regulatory and registration requirements, we may seek to cease certain of our operations. Any such action may adversely affect an investment in us.

To the extent that cryptocurrencies including Ether and any other cryptocurrencies we may own are deemed by the SEC to fall within the definition of a security, we may be required to register and comply with additional regulation under the 1940 Act, including additional periodic reporting and disclosure standards and requirements and the registration of our Company as an investment company. Further, we have acquired a minority interest in a cryptocurrency business which interest is a security. Because the 40% test under the 1940 Act includes this minority interest and the Ether we own, we are limited in our future activities with respect to acquisitions of minority interests in businesses and our ownership of cryptocurrencies. In addition, as our percentage ownership of securities increases, the volatility of Ether or other cryptocurrencies we own may cause us to inadvertently cross this 40% threshold. While we would have one-year to cure a violation, this can only occur once in a three-year period.

Additionally, one or more states may conclude that Ether, Bitcoin and the other cryptocurrencies we may own are a security under state securities laws which would require registration under state laws including merit review laws which would adversely impact us since we would likely not comply. Some states including California define the term “investment contract” more strictly than the SEC. Such additional registrations may result in extraordinary, non-recurring expenses of our Company, thereby materially and adversely impacting an investment in our Company. If we determine not to comply with such additional regulatory and registration requirements, we may seek to cease all or certain parts of our operations. Any such action would likely adversely affect an investment in us and investors may suffer a complete loss of their investment.

If regulatory changes or actions occur, it may restrict the use of virtual currency in a manner that adversely affects an investment in us.

Until recently, little or no regulatory attention has been directed toward Bitcoin, other cryptocurrencies and the markets where they trade by U.S. federal and state governments, foreign governments and self-regulatory agencies. As Bitcoin and other cryptocurrency have grown in popularity and in market size and ICOs which tend to be securities, the SEC, Federal Reserve Board, U.S. Congress and certain other U.S. agencies (e.g., the CFTC, the Financial Crimes Enforcement Network (“FinCEN”) and the Federal Bureau of Investigation) have questioned whether ICOs and cryptocurrencies are securities. Based on enforcement actions brought by the SEC and speeches by its Chairman, it seems clear that ICOs are, in almost all cases, securities. The Company does not intend to acquire ICOs because they are securities and, with one exception not applicable to the Company, sold in violation of the federal securities laws.

On July 25, 2017, the SEC issued its Report which concluded that cryptocurrencies issued for the purpose of raising funds may be securities within the meaning of the federal securities laws. The Report focused on the activities of a virtual organization which offered tokens in exchange for Ether which is the second largest reported cryptocurrency. The Report emphasized that whether a cryptocurrency is a security is based on the facts and circumstances. Although the Company’s activities are not focused on using cryptocurrency to raise capital or assisting others that do so, the federal securities laws are very broad, and there can be no assurances that the SEC will not take enforcement action against the Company in the future including for the sale of unregistered securities in violation of the Act or acting as an unregistered investment company in violation of the 1940 Act. The SEC has taken various actions against persons or entities misusing Bitcoin in connection with fraudulent schemes (i.e., Ponzi scheme), inaccurate and inadequate publicly disseminated information, and the offering of unregistered securities. More recently, the SEC suspended trading a number of cryptocurrencies public companies. To the extent Bitcoin is determined to be a security or to the extent that a US or foreign government or quasi-governmental agency exerts regulatory authority over the trading and ownership, trading or ownership in Bitcoin, an investment in us may be adversely affected. Very recently there has been much discussion concerning the need for legislation and underlying regulation to address these concerns.

Local state regulators such as the New York State Department of Financial Services (the “NYSDFS”) have also initiated examinations of Bitcoin, the Bitcoin Network and the regulation thereof. In 2015 the NYSDFS issued its final BitLicense regulatory framework. The BitLicense regulates the conduct of businesses that are involved in “virtual currencies” in New York or with New York customers and prohibits any person or entity involved in such activity to conduct activities without a license. As more states regulate cryptocurrency investing and trading, we may be required to comply with these regulations or cease operation.

A similar message is being expressed overseas by regulators. While the Company cannot predict what kind of legislation and regulation may be enacted in the future, it is possible that any such legislation and regulation may adversely affect the Company which could cause our stock price to fall sharply.

Bitcoin currently faces an uncertain regulatory landscape in not only the United States but also in many foreign jurisdictions such as the European Union, China and Russia. While certain governments such as Germany, where the Ministry of Finance has declared Bitcoin to be “Rechnungseinheiten” (a form of private money that is recognized as a unit of account, but not recognized in the same manner as fiat currency), have issued guidance as to how to treat Bitcoin, most regulatory bodies have not yet issued official statements regarding intention to regulate or determinations on regulation of Bitcoin, the Bitcoin Network and Bitcoin users. Some countries such as Kyrgyzstan, Nepal, and Cambodia have banned the trading or possession of cryptocurrencies or have issued reports that possessing cryptocurrencies may not be legal. Other Countries, such as South Korea, have not banned cryptocurrencies but have made statement’s that ICOs would be prohibited as a fundraising tool.

The effect of any future regulatory change on us, Bitcoins, or other cryptocurrency is impossible to predict, but such change could be substantial and adverse to us and could adversely affect an investment in us.

| 10 |

If cryptocurrencies such as Bitcoin and Ether are found to be securities, our business model may not be successful.

Bitcoin is the oldest and most well-known form of cryptocurrency. Bitcoin, Ether, and other forms of cryptocurrencies have been the source of much regulatory consternation, resulting in differing definitional outcomes without a single unifying statement. When the interests of investor protection are paramount, for example in the offer or sale of ICO tokens, the SEC has no difficulty concluding that the token offerings are securities under the “Howey” test as stated by the United States Supreme Court. As such, ICO offerings would require registration under the Act or an available exemption therefrom for offers or sales in the United States to be lawful. Section 5 of the Act provides that, unless a registration statement is in effect as to a security or it is exempt, it is unlawful for any person, directly or indirectly, to engage in the offer or sale of securities. To date, we are not aware of any court that has considered whether or not any forms of cryptocurrency are involved in the offer and sale of a security. In contrast, the SEC’s Chairman has stated that all ICOs of which he is aware involve the sale of a security. In any event, our counsel has advised us that it does not believe that Bitcoin is a security. Although we do not believe our activities require registration for us to conduct such activities, the SEC or a state securities regulator may challenge our position, and we may face regulation under the Act or the 1940 Act. Such regulation or the inability to meet the requirements to continue operations, would have a material adverse effect on our business and operations.

If Bitcoin were held to be a security, we may be exposed to liabilities to the SEC. We may face similar issues with various state securities regulators who may interpret our actions as requiring registration under state securities laws.

If we acquire cryptocurrencies which are securities, even unintentionally, we may violate the 1940 Act and incur potential third-party liabilities

The Company intends to comply with the 1940 Act in all respects. To that end, if the Company acquires cryptocurrencies which are determined to constitute investment securities of a kind that subject the Company to registration and reporting under the 1940 Act, the Company will limit its holdings of securities to less than 40% of its assets (excluding cash). Section 3(a)(1)(C) of the 1940 Act defines “investment company” to mean any issuer that is engaged in the business of investing in securities, having a value exceeding 40% of the value of such issuer’s total assets (exclusive of cash). If we violate this 40% limit, we will have one-year to cure by getting our investment securities below the 40% test. However, we may only do this every three years. What complicates this is (i) we may inadvertently surpass the 40% limit due to a spike in the price of a security we own or (ii) a court or the SEC administratively may rule that cryptocurrencies we own are securities. If we ever are required to register as an investment company, we may be required to cease operations.

If regulatory changes or interpretations of our activities require our registration as a money services business under the regulations promulgated by FinCEN under the authority of the U.S. Bank Secrecy Act or under state regulations, we may be required to register and comply with such regulations, the required registrations, licensure and regulatory compliance steps may result in extraordinary, non-recurring expenses to us or cause us to cease operating in the area which requires registration.

The Company is engaged in a business activity that involves transmitting cryptocurrency. Although the Company does not feel this business activity categorizes it as a Money Services Business (“MSB”) or Money Transmitter (“MT”) under regulations promulgated by the Financial Crimes Enforcement Network (“FinCEN”) under the Bank Secrecy Act or any other applicable state MSB or MT law changing regulations or regulatory interpretations of the Company’s business activities may require it to register and comply with MSB and/or MT regulations. In the event the Company is required to register as a MSB or MT, the Company may be required to obtain MSB or MT licensure and take regulatory compliance steps including implementing anti-money laundering programs, reporting to FinCEN or a state regulatory authority regarding the Company’s MSB or MT business, and maintaining certain records. Additionally, in the event that companies that we do business with are not properly registered, our business will be adversely affected and we may be liable for being an unlicensed MSB or MT.

Currently, multiple states have finalized or proposed regulatory frameworks for businesses conducting cryptocurrency business activities and have made public statements indicating cryptocurrency businesses may be required to seek licenses as MSBs or MTs in the near future. The effect of any future regulatory change on us, Bitcoins, or other cryptocurrencies is impossible to predict, but such change could be substantial and adverse to us and could adversely affect an investment in us.

To the extent that the activities of the Company cause it to be deemed a MSB or MT or equivalent designation the Company may be required to seek a license or otherwise register with the U.S. Department of Treasury or a state regulator and comply with state regulations that may include the implementation of anti-money laundering programs, maintenance of certain records and other operational requirements. In addition to New York’s BitLicense framework for businesses that conduct “cryptocurrency business activity,” the Conference of State Bank Supervisors has proposed a model form of state level “cryptocurrency” regulation and additional state regulators including those from California, Idaho, Virginia, Kansas, Texas, South Dakota and Washington have made public statements indicating that cryptocurrency businesses may be required to seek licenses as MSBs or MTs. In July 2016, North Carolina updated the law to define “cryptocurrency” and the activities that trigger licensure in a business-friendly approach that encourages companies to use cryptocurrency and blockchain technology. Specifically, the North Carolina law does not require miners or software providers to obtain a license for multi-signature software, smart contract platforms, smart property, colored coins and non-hosted, non-custodial wallets. Starting January 1, 2016, New Hampshire requires anyone who exchanges a cryptocurrency for another currency must become a licensed and bonded MT. Washington recently passed legislation requiring that cryptocurrency exchanges be registered as MSBs or MTs, that cryptocurrency exchanges agree to third-party security audits of their transmission systems, and that they post surety bonds to cover the cost of certain customer claims. In numerous other states, including Connecticut and New Jersey, legislation is being proposed or has been introduced regarding the treatment of Bitcoin and other cryptocurrencies. The Company will continue to monitor for developments in such legislation, guidance or regulations.

Regulators in Missouri and New York have brought cases against businesses or individuals for operating unlicensed MSBs or MTs relating to the transmission of cryptocurrency. Additionally, federal regulators have investigated and prosecuted cases in Ohio and Michigan relating to unlicensed MSBs or MTs. FinCEN recently announced that mining and investing in cryptocurrency for personal use does not constitute activity requiring a MSB or MT license.

If we are deemed to be a MSB or MT, the Company may decide to cease operations or may not be capable with complying with certain federal or state regulatory obligations applicable to MSBs and MTs. Any termination of Company operations in response to changed regulatory circumstances or interpretations at the federal or state levels will adversely affect our business and your investment in the Company.

| 11 |

It may be illegal now, or in the future, to acquire, own, hold, sell or use cryptocurrencies in one or more countries, and ownership of, holding or trading in our securities may also be considered illegal and subject to sanction.

Although cryptocurrencies are currently not regulated or are lightly regulated in most countries, including the United States, one or more countries such as China, South Korea or Russia may take regulatory actions in the future that severely restricts the right to acquire, own, hold, sell or use cryptocurrencies or to exchange cryptocurrencies for fiat currency. Such an action may also result in the restriction of ownership, holding or trading in our securities. Some countries such as Kyrgyzstan, Nepal, and Cambodia have banned the trading or possession of cryptocurrencies or have issued reports that possessing cryptocurrencies may not be legal. Such restrictions may adversely affect an investment in us, if we elect to do business outside of the United States.

If federal or state legislatures or agencies initiate or release tax determinations that change the classification of cryptocurrency as property for tax purposes (in the context of when such Bitcoins are held as an investment), such determination could have a negative tax consequence on our Company or our shareholders.

Current Internal Revenue Service (“IRS”) guidance indicates that cryptocurrency such as Bitcoin should be treated and taxed as property, and that transactions involving the payment of Bitcoin for goods and services should be treated as barter transactions. While this treatment creates a potential tax reporting requirement for any circumstance where the ownership of the cryptocurrency passes from one person to another, usually by means of cryptocurrency transactions (including off-blockchain transactions), it preserves the right to apply capital gains treatment to those transactions.

On December 5, 2014, the New York State Department of Taxation and Finance issued guidance regarding the application of state tax law to cryptocurrency such as Bitcoin. The agency determined that New York State would follow the IRS guidance with respect to the treatment of cryptocurrency such as Bitcoin for state income tax purposes. Furthermore, they defined cryptocurrency such as Bitcoin to be a form of “intangible property,” meaning the purchase and sale of Bitcoin for fiat currency is not subject to state income tax (although transactions of Bitcoin for other goods and services may be subject to sales tax under barter transaction treatment). It is unclear if other states will follow the guidance of the IRS and the New York State Department of Taxation and Finance with respect to the treatment of cryptocurrency such as Bitcoin for income tax and sales tax purposes. If a state adopts a different treatment, such treatment may have negative consequences including the imposition of a greater tax burden on investors in Bitcoin or imposing a greater cost on the acquisition and disposition of Bitcoin, generally; in either case potentially having a negative effect on prices in the cryptocurrency exchange market and may adversely affect an investment in our Company.

Foreign jurisdictions may also elect to treat cryptocurrency such as Bitcoin differently for tax purposes than the IRS or the New York State Department of Taxation and Finance. To the extent that a foreign jurisdiction with a significant share of the market of Bitcoin users imposes onerous tax burdens on Bitcoin users, or imposes sales or value added tax on purchases and sales of Bitcoin for fiat currency, such actions could result in decreased demand for Bitcoin in such jurisdiction, which could impact the price of Bitcoin or other cryptocurrency and negatively impact an investment in our Company.

Since there has been limited precedent set for financial accounting or taxation of cryptocurrencies it is unclear how we will be required to account for cryptocurrency transactions and the taxation of our businesses.

There is currently no authoritative literature under accounting principles generally accepted in the United States which specifically addresses the accounting for cryptocurrency. Therefore, by analogy, we intend to record cryptocurrency similar to financial instruments under ASC 825, Financial Instruments, because the economic nature of these cryptocurrency is most closely related to a financial instrument such as an investment in a foreign currency.

In 2014, the IRS issued guidance in Notice 2014-21 that classified cryptocurrency as property, not currency, for federal income tax purposes. But according to the requirements of the Fair Trade and Accurate Credit Transactions Act, which requires foreign financial institutions to provide the IRS with information about accounts held by U.S. taxpayers or foreign entities controlled by U.S. taxpayers, cryptocurrency exchanges, in the ordinary course of doing business, are considered financial institutions.

On November 30, 2016, a federal judge in the Northern District of California granted an IRS application to serve a “John Doe” summons on Coinbase Inc., which operates a cryptocurrency wallet and exchange business. The summons asked Coinbase to identify all U.S. customers who transferred convertible cryptocurrency from 2013 to 2015. The IRS is trying to get cryptocurrency owners to report the value of their wallets to the federal government and the IRS is treating cryptocurrency as both property and currency.

We believe that all of our cryptocurrency activities will be accounted for on the same basis regardless of the form of cryptocurrency. A change in regulatory or financial accounting standards or interpretation by the IRS or accounting standards or the SEC could result in changes in our accounting treatment, taxation and the necessity to restate our financial statements. Such a restatement could negatively impact our business, prospects, financial condition and results of operation. Further, actions by the IRS or other regulators which impinge on the anonymity of cryptocurrency may adversely affect our future business and prospects and reduce the value of our cryptocurrency.

| 12 |

Risks Concerning Cryptocurrency Mining

Because of a supply shortage, we may be unable to purchase adequate computer equipment to mine cryptocurrency at a competitive level.

Mining cryptocurrency requires running high-end computers which process complex algorithms to add to the blockchain. Because mining cryptocurrency requires large amounts of computer processing power, there is a worldwide shortage for computer components which can successfully mine cryptocurrency. There is a worldwide shortage for high-end graphics cards which can be enabled to function as computer processors for mining cryptocurrency. Further, other types of computer components, which can be used for mining, are in short supply. As more individuals enter the mining business the demand for components rises. Additionally, as more miners engage in mining the ability to successfully mine cryptocurrency requires more powerful components. If we are unable to obtain adequate components to mine cryptocurrency we will be unable to engage in mining. As such, we may be unable to acquire the components we need to successfully mine cryptocurrency which could have an adverse price on our stock.

If we cannot secure affordable electric power, our mining business will not be successful.

Mining cryptocurrency requires a substantial amount of electricity in order to power the computers, commonly referred to as mining rigs, which mine cryptocurrency. Locations offering cheap mining electricity, both within the United States and internationally, have been historically targeted by groups of people interested in mining. The mining industry has witnessed a change from small miners operating from their homes to large mining “farms” operated by companies with substantial capital, computer resources and other capabilities and competitive advantages. The surge in population to these areas caused by new mining activity has caused electricity prices to increase for local residents. In reaction to electricity prices rising, local officials in some areas have taken action to ban or restrict certain aspects of mining. If we are unable to locate areas with cheap electricity costs which are feasible for mining or if the electricity costs where we have a mining rig increase in value or if the area in which we operate a mining rig passes ordinances which restrict our mining activities we may be unable to mine cryptocurrency in a way that is profitable which could have an adverse price on our stock.

If a malicious actor or botnet obtains control in excess of 50% of the processing power active on the Bitcoin network, it is possible that such actor or botnet could manipulate the blockchain in a manner that adversely affects an investment in us.

If a malicious actor or botnet (a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers) obtains a majority of the processing power dedicated to mining on the Bitcoin network, including the Bitcoin network, it may be able to alter the blockchain by constructing alternate blocks if it is able to solve for such blocks faster than the remainder of the miners on the blockchain can add valid blocks and could control, exclude or modify the ordering of transactions, though it could not generate new Bitcoin or transactions using such control.

The approach towards and possible crossing of the 50% threshold indicate a greater risk that a single mining pool could exert authority over the validation of Bitcoin transactions. To the extent that the Bitcoin ecosystems do not act to ensure greater decentralization of Bitcoin mining processing power, the feasibility of a malicious actor obtaining in excess of 50% of the processing power on the Bitcoin network (e.g., through control of a large mining pool or through hacking such a mining pool) will increase, which may adversely impact an investment in us.

If the award of Bitcoin for solving blocks and transaction fees for recording transactions are not sufficiently high to incentivize miners, miners may cease expending hashrate to solve blocks and confirmations of transactions on the blockchain could be slowed temporarily. A reduction in the hashrate expended by miners on the Bitcoin network could increase the likelihood of a malicious actor obtaining control in excess of 50% of the aggregate hashrate active on such network or the blockchain, potentially permitting such actor to manipulate the blockchain in a manner that adversely affects an investment in us.

Bitcoin miners record transactions when they solve for and add blocks of information to the blockchain. When a miner solves for a block, it creates that block. Typically, Bitcoin transactions will be recorded in the next chronological block if the spending party has an internet connection and at least one minute has passed between the transaction’s data packet transmission and the solution of the next block. If a transaction is not recorded in the next chronological block, it is usually recorded in the next block thereafter.

As the award of new Bitcoin for solving blocks declines, and if transaction fees are not sufficiently high, miners may not have an adequate incentive to continue mining and may cease their mining operations. Any reduction in confidence in the confirmation process or aggregate speed of completing transactions on the Bitcoin network (the hashrate) may negatively impact the value of Bitcoin, which will adversely impact an investment in us.

To the extent Bitcoin mining operations experience low profit margins, their operators are more likely to immediately sell their Bitcoin earned by mining in the Bitcoin exchange market, resulting in a reduction in the price of Bitcoin that could adversely impact an investment in us.

Over the past two years, professionalized Bitcoin mining operations have largely replaced individual users mining with computer processors, graphics processing units and first-generation servers. Professionalized mining operations are of a greater scale than prior miners and have more defined, regular expenses and liabilities. These regular expenses and liabilities may require professionalized mining operations to immediately sell Bitcoin earned from mining operations on the Bitcoin exchange market, which is different than individual miners in past years who didn’t face pressures to immediately divest of their Bitcoin. The immediate selling of newly mined Bitcoin greatly increases the supply of Bitcoin on the Bitcoin exchange market, creating downward pressure on the price of each Bitcoin.

The extent to which the value of Bitcoin mined by a professionalized mining operation exceeds the allocable capital and operating costs determines the profit margin of such operation. A professionalized mining operation may be more likely to sell a higher percentage of its newly mined Bitcoin rapidly if it is operating at a low profit margin—and it may partially or completely cease operations if its profit margin is negative. Lower Bitcoin prices could result in further tightening of profit margins, particularly for professionalized mining operations with higher costs and more limited capital reserves, creating a network effect that may further reduce the price of Bitcoin until mining operations with higher operating costs become unprofitable and remove mining power from the respective Bitcoin network. The network effect of reduced profit margins resulting in greater sales of newly mined Bitcoin could result in a reduction in the price of Bitcoin that could adversely impact an investment in us.

| 13 |

To the extent that any miners cease to record transactions in solved blocks, transactions that do not include the payment of a transaction fee will not be recorded on the blockchain until a block is solved by a miner who does not require the payment of transaction fees. Any widespread delays in the recording of transactions could result in a loss of confidence in that cryptocurrency network, which could adversely impact an investment in us.

To the extent that any miners cease to record transaction in solved blocks, such transactions will not be recorded on the blockchain. Currently, there are no known incentives for miners to elect to exclude the recording of transactions in solved blocks; however, to the extent that any such incentives arise (e.g., a collective movement among miners or one or more mining pools forcing Bitcoin users to pay transaction fees as a substitute for or in addition to the award of new Bitcoins upon the solving of a block), actions of miners solving a significant number of blocks could delay the recording and confirmation of transactions on the blockchain. Any systemic delays in the recording and confirmation of transactions on the blockchain could result in greater exposure to double-spending transactions and a loss of confidence in certain or all cryptocurrency networks, which could adversely impact an investment in us.

The acceptance of cryptocurrency network software patches or upgrades by a significant, but not overwhelming, percentage of the users and miners in any cryptocurrency network could result in a “fork” in the respective blockchain, resulting in the operation of two separate networks until such time as the forked blockchains are merged. The temporary or permanent existence of forked blockchains could adversely impact an investment in us.

Cryptocurrency networks are open source projects and, although there is an influential group of leaders in, for example, the Bitcoin network community known as the “Core Developers,” there is no official developer or group of developers that formally controls the Bitcoin network. Any individual can download the Bitcoin network software and make any desired modifications, which are proposed to users and miners on the Bitcoin network through software downloads and upgrades, typically posted to the Bitcoin development forum on GitHub.com. A substantial majority of miners and Bitcoin users must consent to those software modifications by downloading the altered software or upgrade that implements the changes; otherwise, the changes do not become a part of the Bitcoin network. Since the Bitcoin network’s inception, changes to the Bitcoin network have been accepted by the vast majority of users and miners, ensuring that the Bitcoin network remains a coherent economic system; however, a developer or group of developers could potentially propose a modification to the Bitcoin network that is not accepted by a vast majority of miners and users, but that is nonetheless accepted by a substantial population of participants in the Bitcoin network. In such a case, and if the modification is material and/or not backwards compatible with the prior version of Bitcoin network software, a fork in the blockchain could develop and two separate Bitcoin networks could result, one running the pre-modification software program and the other running the modified version (i.e., a second “Bitcoin” network). Such a fork in the blockchain typically would be addressed by community-led efforts to merge the forked blockchains, and several prior forks have been so merged. This kind of split in the Bitcoin network could materially and adversely impact an investment in us and, in the worst case scenario, harm the sustainability of the Bitcoin network’s economy.

Because there is a limited supply of Bitcoin, miners may not have an adequate incentive to continue mining Bitcoin and the Company may be unable to use its mining equipment to mine other cryptocurrencies.

The current fixed reward for solving a new Bitcoin block is 12.5 Bitcoin per block; the reward decreased from 25 Bitcoin in July 2016. The reward for adding a block to the Bitcoin protocol is halved every 210,000 blocks and it is estimated that it will halve again in about four years. The current Bitcoin protocol permits a total of 21 million Bitcoin to exist. As the number of Bitcoin remaining for mining decreases the processing power required to record new blocks on the blockchain increases. Eventually the processing power required to add a block to the blockchain may exceed the value of the reward for adding a block. Further, at some point, there will be no Bitcoin to mine.

Once the processing power required to add a block to the blockchain exceeds the value of the reward for adding a block the Company may need to use its mining equipment to mine other types of cryptocurrency. If the Company is unable to successfully mine other types of cryptocurrency, the Company may have to discontinue its mining operations and sell the Company’s mining equipment which may result in a net loss to the Company’s mining business.

Risks Related to Cryptocurrency

The further development and acceptance of cryptocurrency networks and other cryptocurrency, which represent a new and rapidly changing industry, are subject to a variety of factors that are difficult to evaluate. The slowing or stopping of the development or acceptance of cryptocurrency systems may adversely affect an investment in us.

Cryptocurrencies, such as Bitcoin, which may be used to buy and sell goods and services are a new and rapidly evolving industry of which the cryptocurrency networks are prominent, but not unique, parts. The growth of the cryptocurrency industry in general, and the cryptocurrency networks of Bitcoin in particular, are subject to a high degree of uncertainty. There is no assurance that a person who accepts a cryptocurrency as payment today will continue to do so in the future. The factors affecting the further development of the cryptocurrency industry, as well as the cryptocurrency networks, include:

| • | continued worldwide growth in the adoption and use of Bitcoin and other cryptocurrency; |

| • | government and quasi-government regulation of Bitcoin and other cryptocurrency and their use, or restrictions on or regulation of access to and operation of the cryptocurrency network or similar cryptocurrency systems; |

| • | the maintenance and development of the open-source software protocol of the Bitcoin network; |

| • | changes in consumer demographics and public tastes and preferences; |

| • | the availability and popularity of other forms or methods of buying and selling goods and services, including new means of using fiat currencies; |

| • | general economic conditions and the regulatory environment relating to cryptocurrency; and |

| • | the impact of regulators focusing on cryptocurrency and the costs associated with such regulatory oversight. |

A decline in the popularity or acceptance of the cryptocurrency networks of Bitcoin or similar cryptocurrency systems, could adversely affect an investment in us.

| 14 |

Because, there is relatively small use of cryptocurrency in the retail and commercial marketplace in comparison to relatively large use by speculators, it may contribute to price volatility that could adversely affect an investment in us.

As relatively new products and technologies, cryptocurrency and the blockchain networks on which they exist have only recently become widely accepted as a means of payment for goods and services by some major retail and commercial outlets, and use of cryptocurrency by consumers to pay such retail and commercial outlets remains limited. Conversely, a significant portion of demand for cryptocurrency is generated by speculators and investors seeking to profit from the short- or long-term holding of such cryptocurrency. A lack of expansion of cryptocurrency into retail and commercial markets, or a contraction of such use, may result in increased volatility or a reduction in the price of all or any cryptocurrency, either of which could adversely impact an investment in us.

If significant contributors to the Bitcoin network could propose amendments to the network’s protocols and software and the amendments are accepted and authorized by such network, it could adversely affect an investment in us.