EXHIBIT 10.5

Published on May 16, 2019

Exhibit 10.5

SECURITIES EXCHANGE AGREEMENT

This SECURITIES EXCHANGE AGREEMENT (the “Agreement”) is entered into as of this 13th day of May, 2019 (the “Effective Date”) by and between the party on the signature page to this Agreement (the “Investor”), and TimefireVR, Inc., a Nevada corporation (“Timefire” or the “Company”) (collectively, the Investor and Timefire are the “Parties”).

Background

This Agreement contemplates a transaction in which the Investor will exchange all of its derivative securities of the Company including, Series E Convertible Preferred Stock, if any, Notes, if any, Options, if any and Warrants, if any (collectively the “Securities”) for shares of the Company’s Series B Convertible Preferred Stock (the “Series B”) pursuant to the terms contained below;

NOW, THEREFORE, in consideration of the mutual promises contained herein, and for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties hereto agree as follows:

1. Exchange; Convertible Restriction and Proxy.

1.1 Exchange. Timefire agrees to exchange the Securities held by the Investor for shares of the Company’s Series B in the amounts as designated opposite the name of such Investor on Exhibit A attached hereto and incorporated by reference, and the Investor agrees to exchange its Securities for Series B. The Investor hereby agrees to accept from the Company, and the Company hereby agrees to issue to the Investor, at the closing, the Series B in full satisfaction of any obligations due the Investor as set out in Exhibit A. The exchange contemplated by this transaction shall occur immediately prior to the closing of the Share Exchange Agreement by and among the Company, Red Cat Propware, Inc. (“Red Cat”) and shareholders of Red Cat dated the Effective Date (the “Red Cat Agreement”).

1.2 Convertible Restriction. The Series B shares may not be converted into shares of the Company’s common stock until the Company has taken the action to authorize the increase shares of common stock whether by way of a reverse stock split or otherwise.

1.3 Proxy. Upon receipt of the Series B shares and as consideration for the Series B shares, the Investor hereby irrevocably appoints Jeffrey Thompson, or if unavailable, the Chief Executive Officer of the Company to vote the Investor’s Series B shares in favor of the Company’s action to authorize the increase of shares of common stock by way of a reverse stock split or other proposal to increase the Company’s capital. This proxy is irrevocable and expires upon the earlier of (i) the filing of articles of amendment permitting the conversion of all the Series B shares or (ii) December 31, 2019.

2. Representations and Warranties of the Company. As an inducement to the Investor to enter into this Agreement and consummate the transaction contemplated hereby, the Company, subject to beneficial ownership limits, hereby makes the following representations and warranties, each of which is true and correct in all material respects on the date hereof and will be true and correct in all material respects on the closing date:

2.1. Organization, Standing and Power. The Company is duly organized, validly existing and in good standing under the laws of the State of Nevada and has full corporate power and authority and approvals necessary to conduct its businesses as presently conducted, other than such franchises, licenses, permits, authorizations and approvals the lack of which, individually or in the aggregate, has not had and would not reasonably be expected to have a Material Adverse Effect on the Company. “Material Adverse Effect” means any effect which, individually or in the aggregate with all other effects, reasonably would be expected to be materially adverse to the business, operations, properties, financial condition, or operating results of the Company.

2.2. Authority. The Company has full power and authority to execute and deliver this Agreement and to perform its obligations hereunder. This Agreement constitutes the valid and legally binding obligation of the Company, enforceable in accordance with its terms. The execution, delivery, and performance of this Agreement and all other agreements contemplated hereby have been duly authorized by the Company.

2.3. Non-Contravention. The execution and delivery of this Agreement by the Company and the observance and performance of the terms and provisions contained herein do not constitute a violation or breach of any applicable law, or any provision of any other contract or instrument to which the Company is a party or by which it is bound, or any order, writ, injunction, decree, statute, rule, by-law or regulation applicable to the Company.

2.4. Litigation. There are no actions, suits, or proceedings pending or, to the best of the Company’s knowledge, threatened, which could in any manner restrain or prevent the Company from effectually and legally exchanging the Securities pursuant to the terms and provisions of this Agreement.

2.5. Brokers’ Fees. The Company has no liability or obligation to pay fees or commissions to any broker, finder, or agent with respect to the transactions contemplated by this Agreement.

3. Representations and Warranties of the Investor. As an inducement to Timefire to enter into this Agreement and to consummate the transactions contemplated hereby, the Investor hereby makes the following representations and warranties, each of which is true and correct in all material respects on the date hereof and will be true and correct in all material respects on the closing date:

3.1. Authority. The Investor has full power and authority to execute and deliver this Agreement and to perform its obligations hereunder. This Agreement constitutes the valid and legally binding obligation of the Investor, enforceable in accordance with its terms. The execution, delivery, and performance of this Agreement and all other agreements contemplated hereby have been duly authorized by the Investor.

3.2. Non-Contravention. The execution and delivery of this Agreement by the Investor and the observance and performance of the terms and provisions of this Agreement on the part of the Investor to be observed and performed will not constitute a violation of applicable law or any provision of any contract or other instrument to which the Investor is a party or by which it is bound, or any order, writ, injunction, decree statute, rule or regulation applicable to it.

3.3. Litigation There are no actions, suits, or proceedings pending or, to the best of the Investor’s knowledge, threatened, which could in any manner restrain or prevent the Investor from effectually and legally exchanging the Securities pursuant to the terms and provisions of this Agreement.

3.4. Brokers’ Fees. The Investor has no liability or obligation to pay fees or commissions to any broker, finder, or agent with respect to the transactions contemplated by this Agreement.

3.5. Acquired for Own Account. The Securities to be acquired by the Investor hereunder will be acquired for investment for its own account, and not with a view to the resale or distribution of any part thereof, and the Investor has no present intention of selling or otherwise distributing the Securities, except in compliance with applicable securities laws.

3.6. Available Information. The Investor has such knowledge and experience in financial and business matters that it can evaluate the merits and risks of an investment in the Company. The Investor understands that its investment in the Securities involves a high degree of risk. The Investor has sought such accounting, legal and tax advice as it has considered necessary to make an informed investment decision with respect to its acquisition of the Interim Preferred Stock. The Investor has had the opportunity to review the reports the Company has filed with the Securities and Exchange Commission at www.SEC.gov/EDGAR.

3.7. Non-Registration. The Investor understands that the Securities has not been registered under the Securities Act of 1933, as amended (the “Securities Act”) and, if issued in accordance with the provisions of this Agreement, will be issued by reason of a specific exemption from the registration provisions of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of the Investor’s representations as expressed herein.

3.8. Restricted Securities. The Investor understands that the Securities are characterized as “restricted securities” under the Securities Act. The Investor further acknowledges that the Securities may not be resold without registration under the Securities Act or the existence of an exemption therefrom. The Investor represents that it is familiar with Rule 144 promulgated under the Securities Act, as presently in effect, and understands the resale limitations imposed thereby and by the Securities Act.

3.9. Legends. It is understood that the certificates for the Securities will bear the following legend or another legend that is similar to the following:

THE SHARES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SHARES REPRESENTED BY THIS CERTIFICATE HAVE BEEN ACQUIRED FOR INVESTMENT AND MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS, OR AN OPINION OF COUNSEL, IN A FORM ACCEPTABLE TO THE COMPANY, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR APPLICABLE STATE SECURITIES LAWS OR UNLESS SOLD PURSUANT TO RULE 144 UNDER SAID ACT.

and any legend required by the “blue sky” laws of any state to the extent such laws are applicable to the securities represented by the certificate so legended.

3.10. Accredited Investor. The Investor is an “accredited investor” within the meaning of Rule 501 under the Securities Act and the Investor was not organized for the specific purpose of acquiring the Securities.

4. Survival of Representations and Warranties and Agreements. All representations and warranties of the Parties contained in this Agreement shall survive the execution and delivery of this Agreement.

5. Indemnification.

5.1. Indemnification Provisions for Benefit of the Investor. In the event Timefire breaches any of its representations, warranties, and/or covenants contained herein, and provided that the Investor makes a written claim for indemnification against Timefire, then Timefire agrees to indemnify the Investor from and against the entirety of any losses, damages, amounts paid in settlement of any claim or action, expenses, or fees including court costs and reasonable attorneys' fees and expenses.

5.2. Indemnification Provisions for Benefit of Timefire. In the event the Investor breaches any of its representations, warranties, and/or covenants contained herein, and provided that Timefire makes a written claim for indemnification against the Investor, then the Investor agrees to indemnify Timefire from and against the entirety of any losses, damages, amounts paid in settlement of any claim or action, expenses, or fees including court costs and reasonable attorneys' fees and expenses.

6. Post-Closing Covenants. The Parties agree as follows with respect to the period following the closing:

6.1. General. In case at any time after the closing any further action is necessary or desirable to carry out the purposes of this Agreement, each of the Parties will take such further action (including the execution and delivery of such further instruments and documents) as the other Party may request, all at the sole cost and expense of the requesting Party (unless the requesting Party is entitled to indemnification therefore under Section 5).

6.2. Company. Timefire hereby covenants that, after the closing, Timefire will, at the request of Investor, execute, acknowledge and deliver to the Investor without further consideration, all such further assignments, conveyances, consents and other documents, and take such other action, as the Investor may reasonably request (a) to transfer to, vest and protect in the Investor and its right, title and interest in the preferred stock, and (b) otherwise to consummate or effectuate the transactions contemplated by this Agreement.

7. Expenses. Except as otherwise provided in this Agreement, all Parties hereto shall pay their own expenses, including legal and accounting fees, in connection with the transactions contemplated herein.

8. Severability. In the event any parts of this Agreement are found to be void, the remaining provisions of this Agreement shall nevertheless be binding with the same effect as though the void parts were deleted.

9. Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same instrument. The execution of this Agreement may be by actual or facsimile signature.

10. Benefit. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their legal representatives, successors and assigns. Nothing in this Agreement, expressed or implied, is intended to confer on any person other than the Parties or their respective heirs, successors and assigns any rights, remedies, obligations, or other liabilities under or by reason of this Agreement.

11. Notices and Addresses. All notices, offers, acceptance and any other acts under this Agreement (except payment) shall be in writing, and shall be sufficiently given if delivered to the addressees in person, by FedEx or similar overnight next business day delivery, or by email followed by overnight next business day delivery, as follows:

| If to the Company: | TimefireVR, Inc. |

| 7150 E. Camelback Road, Suite 444 | |

| Scottsdale, AZ 85251 | |

| Telephone: (602) 617-8888 | |

| Attention: Mr. Jonathan Read | |

| Email: jread@QUADRATUM1.COM | |

| With a copy (for informational purposes only) to: | |

| Nason Yeager Gerson White & Lioce, P.A., | |

| 3001 PGA Boulevard, Suite 305 | |

| Palm Beach Gardens, FL 33410 | |

| Telephone: (561) 471-3507 | |

| Attention: Michael D. Harris, Esq. | |

| E-Mail: mharris@nasonyeager.com | |

| If to the Investor: | The address set forth on the signature page attached hereto. |

or to such other address as any of them, by notice to the other may designate from time to time.

12. Attorney's Fees. In the event that there is any controversy or claim arising out of or relating to this Agreement, or to the interpretation, breach or enforcement thereof, and any action or arbitration proceeding is commenced to enforce the provisions of this Agreement, the prevailing party shall be entitled to a reasonable attorney's fee, including the fees on appeal, costs and expenses.

13. Governing Law. This Agreement and any dispute, disagreement, or issue of construction or interpretation arising hereunder whether relating to its execution, its validity, the obligations provided therein or performance shall be governed or interpreted according to the laws of the State of Nevada.

14. Oral Evidence. This Agreement constitutes the entire Agreement between the parties and supersedes all prior oral and written agreements between the parties hereto with respect to the subject matter hereof. Neither this Agreement nor any provision hereof may be changed, waived, discharged or terminated orally, except by a statement in writing signed by the party or parties against whom enforcement or the change, waiver discharge or termination is sought.

15. Assignment. No Party hereto shall assign its rights or obligations under this Agreement without the prior written consent of the other Party.

16. Section Headings. Section headings herein have been inserted for reference only and shall not be deemed to limit or otherwise affect, in any matter, or be deemed to interpret in whole or in part any of the terms or provisions of this Agreement.

17. Effectiveness of this Agreement. This Agreement and the Exchange contemplated by Section 1 shall only occur immediately prior to the closing of the Red Cat Agreement. Counsel for the Company shall hold the signature pages in escrow until all Investors provide written consent to release the signature pages to this Agreement. If the Red Cat Agreement does not close within three business days after such release, the Company shall immediately take action to file a Certificate of Designation for Series E Convertible Preferred Stock, issue new certificates to the Investors which exchanged Series E Convertible Preferred Stock and reissue certificates, a Stock Option Agreement and Notes for the other Securities exchanged under this Agreement so that the Investors have the same Securities they exchanged with all rights and preferences. The Series B shall in that event be null and void.

18. Waiver of Registration Rights. To the extent that any Investors have rights to cause the Company to register any Securities whether under the Registration Rights Agreements or otherwise, such rights are waived effective with the closing of the Red Cat Agreement.

[Signature Pages Attached]

IN WITNESS WHEREOF the parties hereto have set their hand and seals as of the above date.

| TIMEFIREVR, INC.: | |

|

|

|

|

By: /s/ Jonathan Read Name: Jonathan Read Title: Chief Executive Officer |

|

[Signature Page to the Securities Exchange Agreement]

|

INVESTOR:

|

|

| L1 Capital Global Opportunities Master Fund Ltd. | |

|

By: /s/ David Feldman (Print Name and Title) |

|

| Address: 135 East 57th Street Level 23

New York, NY 10022

Email: dfeldman@l1capitalglobal.com

|

|

|

Tax ID of Investor: 981241877

Share Certificate Delivery Instructions: 135 East 57th Street Level 23 New York, NY 10022 |

[Signature Page to the Securities Exchange Agreement]

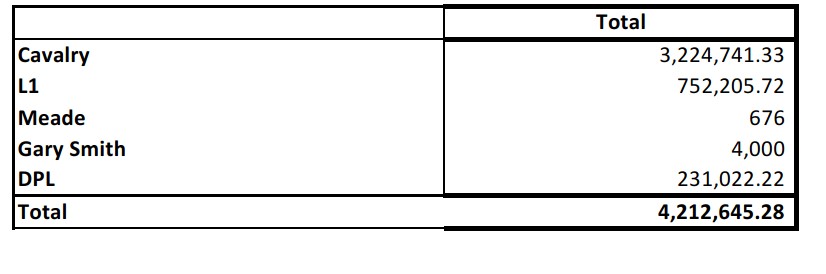

EXHIBIT A

Preferred Series B Share Exchange Amounts