EXHIBIT 3.3

Published on May 16, 2019

Exhibit 3.3

______________________________________

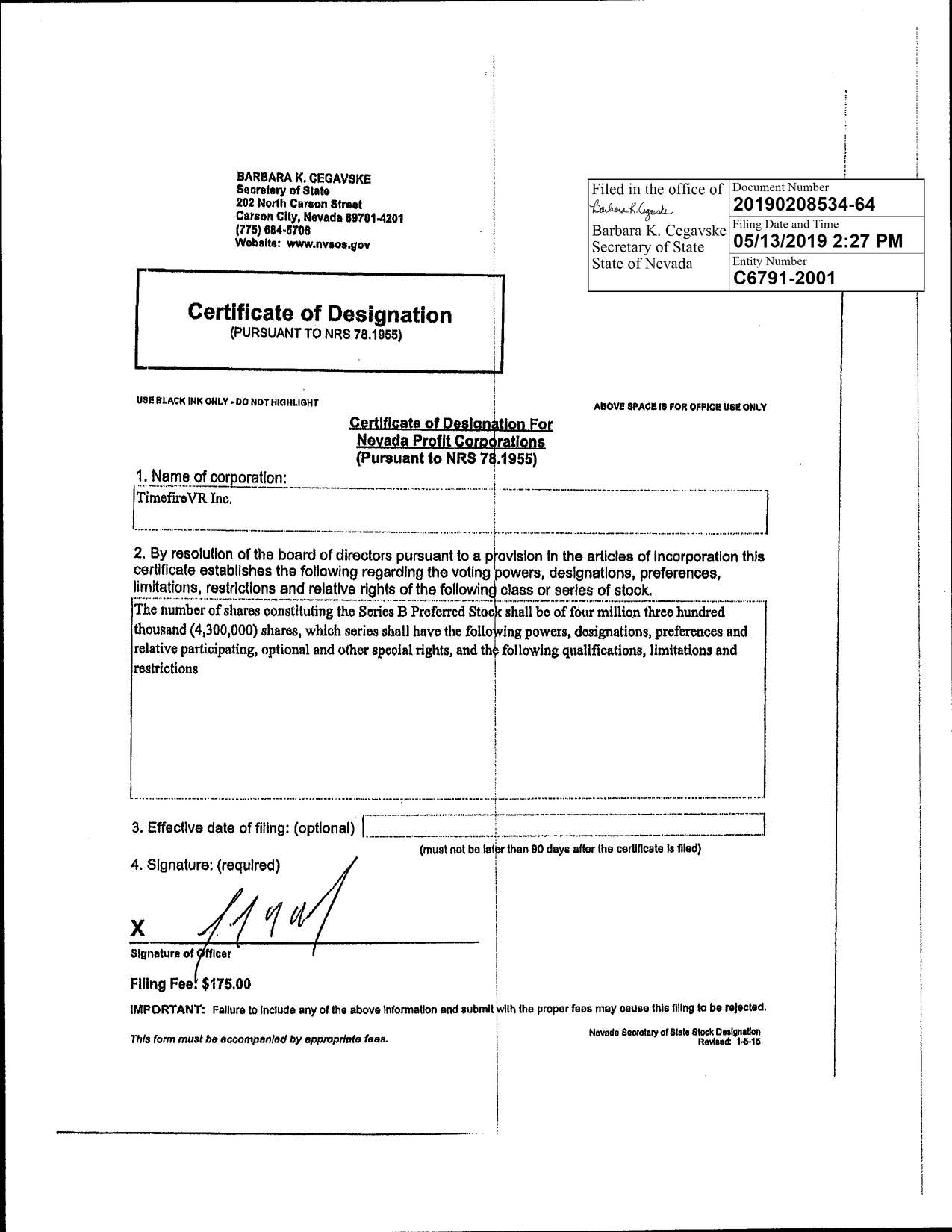

CERTIFICATE OF DESIGNATION

OF

TimeFireVR, Inc.

Pursuant to Section 78.1955 of the

Nevada Revised Statutes

______________________________________

SERIES B PREFERRED STOCK

On behalf of TimeFireVR, Inc., a Nevada corporation (the “Company”), the undersigned hereby certifies that the following resolution has been duly adopted by the board of directors of the Company (the “Board”):

RESOLVED, that, pursuant to the authority granted to and vested in the Board by the provisions of the articles of incorporation of the Company (the “Articles of Incorporation”), there hereby is created, out of the ten million (10,000,000) shares of preferred stock, par value $0.01 per share, of the Company authorized by the Articles of Incorporation (“Preferred Stock”), a series of Series B Preferred Stock, consisting of four million three hundred thousand (4,300,000) shares, which series shall have the following powers, designations, preferences and relative participating, optional and other special rights, and the following qualifications, limitations and restrictions:

1. Designation; Rank. This series of Preferred Stock shall be designated and known as “Series B Preferred Stock.” The number of shares constituting the Series B Preferred Stock shall be of four million three hundred thousand (4,300,000) shares. Except as otherwise provided herein, the Series B Preferred Stock shall, with respect to rights on liquidation, winding up and dissolution, rank pari passu to the common stock, par value $0.001 per share (the “Common Stock”) and any other classes of capital stock of the Company.

2. Dividends. The holders of shares of Series B Preferred Stock (each a Holder”) have no dividend rights except as may be declared by the Board in its sole and absolute discretion, out of funds legally available for that purpose.

3. Liquidation Preference.

a. In the event of any dissolution, liquidation or winding up of the Company (a “Liquidation”), whether voluntary or involuntary, the Holders of Series B Preferred Stock shall be entitled to participate in any distribution out of the assets of the Company on an equal basis per share with the holders of the Common Stock. For the purposes of such distribution, Holders of Series B Preferred Stock shall be treated as if all shares of Series B Preferred Stock had been converted to Common Stock immediately prior to the distribution.

b. A sale of all or substantially all of the Company’s assets or an acquisition of the Company by another entity by means of any transaction or series of related transactions (including, without limitation, a reorganization, consolidated or merger) that results in the transfer of fifty percent (50%) or more of the outstanding voting power of the Company (a “Change in Control Event”), shall not be deemed to be a Liquidation for purposes of this Designation.

4. Conversion of Series B Preferred Stock. All shares of Series B Preferred Stock shall be convertible to Common Stock as follows:

a. Conversion. Immediately upon the market effective date of a reverse split of the Company’s common stock, all then issued and outstanding shares of Series B Preferred Stock shall, at the option of each Holder be converted into shares of Common Stock at a conversion rate of one thousand (1,000) shares of Common Stock (the “Conversion Rate”) for every one (1) share of Series B Preferred Stock held.

b. Mechanics of Optional Conversion. To effect the optional conversion of shares of Series B Preferred Stock in accordance with Section 4a. of this Designation, any Holder of record shall send a written notice of conversion to the Company at its principal executive offices setting forth therein the number of shares being converted, the number of shares of Common Stock issuable upon such conversion and the delivery instructions (for purposes of this Designation, the “Optional Conversion Date”). Within two business days after the Optional Conversion Date, the Company shall issue and deliver to such Holder, or its nominee, in book entry or at such Holder’s address as it appears on the records of the stock transfer agent for the Series B Preferred Stock, if any, or, if none, of the Company, a certificate or certificates for the number of whole shares of Common Stock issuable upon such conversion in accordance with the provisions hereof. No stock certificate shall be required to be surrendered unless the Holder have converted all shares of Series B Preferred Stock.

c. No Fractional Shares. No fractional shares of Common Stock or scrip shall be issued upon conversion of shares of Series B Preferred Stock. In lieu of any fractional share to which the Holder would be entitled but for the provisions of this Section 4c. based on the number of shares of Series B Preferred Stock held by such Holder, the Company shall issue a number of shares to such Holder rounded up to the nearest whole number of shares of Common Stock. No cash shall be paid to any Holder of Series B Preferred Stock by the Company upon conversion of Series B Preferred Stock by such Holder.

d. Adjustment of Conversion Rate upon Subdivision or Combination of Common Stock. If the Company, at any time while shares of Series B Preferred Stock are issued and outstanding, subdivides (by any forward stock split, stock dividend, recapitalization or otherwise) one or more classes of its outstanding shares of Common Stock into a greater number of shares, the Conversion Rate in effect immediately prior to such subdivision will be proportionately increased. If the Company, at any time while shares of Series B Preferred Stock are issued and outstanding, combines (by combination, reverse stock split or otherwise) one or more classes of its outstanding shares of Common Stock into a smaller number of shares, the Conversion Rate in effect immediately prior to such combination will be proportionately reduced. Any adjustment pursuant to this Section 4e. shall become effective immediately after the effective date of such subdivision or combination.

e. Reservation of Stock. Following the reverse stock split referenced to in Section 4a., the Company shall at all times when any shares of Series B Preferred Stock shall be outstanding, reserve and keep available out of its authorized but unissued Common Stock, such number of shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of Series B Preferred Stock. If at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all outstanding shares of the Series B Preferred Stock, the Company will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purpose.

f. Limitation on Beneficial Ownership. Notwithstanding anything to the contrary set forth in this Certificate of Designation, at no time may all or a portion of the Series B Preferred Stock be converted if the number of shares of Common Stock to be issued pursuant to such conversion would exceed, when aggregated with all other shares of Common Stock owned by the Holder at such time, the number of shares of Common Stock which would result in the Holder beneficially owning (as determined in accordance with Section 13(d) of the Securities Exchange Act of 1934 (the “1934 Act”) and the rules thereunder) more than 4.99% of all of the Common Stock outstanding at such time (the “4.99% Beneficial Ownership Limitation”); provided, however, that upon the Holder providing the Company with sixty-one (61) days’ advance notice (the “4.99% Waiver Notice”) that the Holder would like to waive this Section 4f. with regard to any or all shares of Common Stock issuable upon conversion of the Series B Preferred Stock Series B Preferred Stock, this Section 4f. will be of no force or effect with regard to all or a portion of the Series B Preferred Stock referenced in the 4.99% Waiver Notice but shall in no event waive the 9.99% Beneficial Ownership Limitation described below. Notwithstanding anything to the contrary set forth in this Certificate of Designation, at no time may all or a portion of the Series B Preferred Stock be converted if the number of shares of Common Stock to be issued pursuant to such conversion, when aggregated with all other shares of Common Stock owned by the Holder at such time, would result in the Holder beneficially owning (as determined in accordance with Section 13(d) of the 1934 Act and the rules thereunder) in excess of 9.99% of the then issued and outstanding shares of Common Stock outstanding at such time (the “9.99% Beneficial Ownership Limitation” and the lower of the 9.99% Beneficial Ownership Limitation and the 4.99% Beneficial Ownership Limitation then in effect, the “Maximum Percentage”). By written notice to the Company, a holder of Series B Preferred Stock may from time to time decrease the Maximum Percentage to any other percentage specified in such notice. For purposes hereof, in determining the number of outstanding shares of Common Stock, the Holder may rely on the number of outstanding shares of Common Stock as reflected in (1) the Company’s most recent Form 10-K, Form 10-Q, Current Report on Form 8-K or other public filing with the SEC, as the case may be, (2) a more recent public announcement by the Company or (3) any other notice by the Company or its stock transfer agent setting forth the number of shares of Common Stock outstanding. For any reason at any time, upon the written or oral request of a holder of Series B Preferred Stock, the Company shall within three (3) business days confirm orally and in writing to such holder the number of shares of Common Stock then outstanding. In any case, the number of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Company, including the Series B Preferred Stock, by the Holder and its affiliates since the date as of which such number of outstanding shares of Common Stock was reported, which in any event are convertible or exercisable, as the case may be, into shares of the Company’s Common Stock within 60 days’ of such calculation and which are not subject to a limitation on conversion or exercise analogous to the limitation contained herein. The provisions of this paragraph shall be construed and implemented in a manner otherwise than in strict conformity with the terms of this Section 4f. to correct this paragraph (or any portion hereof) which may be defective or inconsistent with the intended beneficial ownership limitation herein contained or to make changes or supplements necessary or desirable to properly give effect to such limitation.

g. Waiver of Section 4g. Limitations In Advance. The beneficial ownership limitations set forth in Section 4(h) shall not apply to shareholder who, in advance of being issued any shares of Series B Preferred Stock, specifically waives such limitations in writing.

5. Voting. The holders of Series B Preferred Stock shall have the right to vote as-if-converted to Common Stock all matters submitted to a vote of holders of the Company’s Common Stock, including the election of directors, and all other matters as required by law, subject to the limits on beneficial ownership contained in Section 4g., above. There is no right to cumulative voting in the election of directors. The holders of Series B Preferred Stock shall vote together with all other classes and series of Common Stock of the Company as a single class on all actions to be taken by the Common Stock holders of the Company except to the extent that voting as a separate class or series is required by law.

6. Amendment. Any amendment to this Certificate of Designation shall not be adopted by the Company without the affirmative written consent of the holders of not less than a majority of the shares of Series B Preferred Stock then issued and outstanding.

7. Equal Treatment of Holders. No consideration (including any modification of this Certificate of Designation or related transaction document) shall be offered or paid to any person or entity to amend or consent to a waiver or modification of any provision of this Certificate of Designation or related transaction document unless the same consideration is also offered to all of the holders of the outstanding shares of Series B Preferred Stock. For clarification purposes, this provision constitutes a separate right granted to each holder by the Corporation and negotiated separately by each holder, and is intended for the Corporation to treat all holders of the Series B Preferred Stock as a class and shall not in any way be construed as such holders acting in concert or as a group with respect to the purchase, disposition or voting of the Series B Preferred Stock or otherwise.

8. Severability of Provisions. If any right, preference or limitation of the Series B Preferred Stock set forth in this resolution (as such resolution may be amended from time to time) is invalid, unlawful or incapable of being enforced by reason of any rule of law or public policy, all other rights, preferences and limitations set forth in this resolution (as so amended) which can be given effect without the invalid, unlawful or unenforceable right, preference or limitation shall, nevertheless, remain in full force and effect, and no right, preference or limitation herein set forth shall be deemed dependent upon any other such right, preference or limitation unless so expressed herein.

(Signature Page to follow)

IN WITNESS WHEREOF the undersigned has signed this Designation this 10th day of May, 2019.

| TimeFireVR, Inc. | ||

| By: | /s/ Jonathan Read | |

|

Name: Jonathan Read Title: CEO |

||

[Signature Page to COD Series B]