IPO Update: Red Cat Holdings Seeks $20 Million Uplisting IPO

IPO Update: Red Cat Holdings Seeks $20 Million Uplisting IPO

Summary

- Red Cat Holdings has filed proposed terms for a $20 million uplisting IPO to Nasdaq.

- The firm sells drones and related software and services to enterprises.

- While the industry is growing quickly, RCAT has grown only due to acquisition, not organic. I'll watch the IPO from the sidelines.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Quick Take

Red Cat Holdings (OTCQB:RCAT) has filed to raise $20 million from the sale of its common stock in an uplisting IPO, according to an amended registration statement.

The company sells drone products and related software and services.

RCAT is pursuing an acquisition approach to expanding its offerings but management has yet to prove it can grow the business organically, so I'll pass on the IPO, but will watch list the stock for future potential.

Company & Technology

Humacao, Puerto Rico-based Red Cat was founded to provide high performance viewing and related products for drone racing and other drone use cases.

Management is headed by president, Chairman and CEO Jeffrey Thompson, who has been with the firm since May 2019 and was previously founder and CEO of Towerstream (OTCPK:TWER), a fixed wireless internet service provider.

Below is a brief overview video of the company's recent acquisition of Fat Shark:

Source: RedChip Companies

The company’s primary offerings include:

-

Race and freestyle products

-

SMB / Drone service providers

-

Platform / enterprise

Red Cat has received at least $4.8 million from investors.

Customer Acquisition

The company sells products to different sectors of the drone market, including first person view products sold to racers and freestyle drone enthusiasts as well as other drone products to industry and government.

Red Cat also offers a data acquisition and storage platform for compliant operations for business and related drone operators.

The firm seeks other acquisition opportunities to expand its offerings to various industry targets.

Sales and Marketing expenses as a percentage of total revenue dropped to 3.1%% for the nine months ended Jan. 31, 2021.

The company’s Sales and Marketing efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Sales and Marketing spend, was a very high 31.7x in the most recent reporting period.

Market & Competition

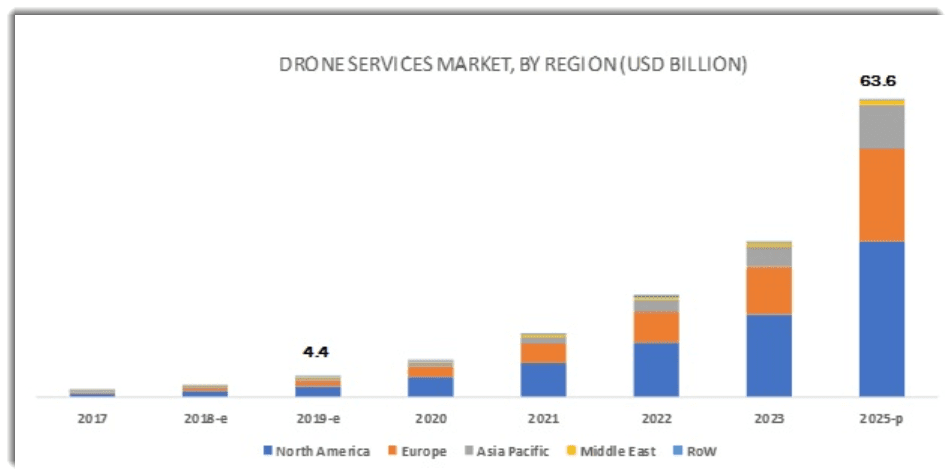

According to a 2020 market research report by MarketsAndMarkets, the global market for drone services of all types is projected to exceed $63 billion by 2025, up from $4.4 billion in 2019.

This represents an extremely strong forecast CAGR of 55.4% from 2019 to 2025.

The main drivers for this expected growth are a growing use of drone services for industry-specific applications, increased need for data about and from operations and an improved regulatory framework.

Also, the North America region will likely account for the greatest demand through 20205, followed by Europe and the Asia Pacific region, as the chart shows below:

Major competitive or other industry participants, whether via products or service offerings, include:

-

DJI (DJII)

-

Parrot SA (OTCPK:PAOTF)

-

Yuneec

-

Lumenier

-

DroneDeploy

-

Identified Technologies

-

Measure

-

Phoenix Drone Services

-

Prioria Robotics

-

Sharper Shape

-

Unmanned Experts

Financial Performance

Red Cat’s recent financial results can be summarized as follows:

-

Increasing topline revenue from a small base

-

Growing gross profit and gross margin

-

Increased operating losses

-

Growing cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

|

|

Nine Mos. Ended Jan. 31, 2021 |

$ 3,122,077 |

|

|

FYE April 30, 2020 |

$ 403,940 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

|

|

Nine Mos. Ended Jan. 31, 2021 |

$ 770,924 |

|

|

FYE April 30, 2020 |

$ 78,561 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Nine Mos. Ended Jan. 31, 2021 |

24.69% |

|

|

FYE April 30, 2020 |

19.45% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Nine Mos. Ended Jan. 31, 2021 |

$ (2,019,988) |

-64.7% |

|

FYE April 30, 2020 |

$ (1,659,146) |

-410.7% |

|

FYE April 30, 2019 |

$ (751,332) |

--% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

|

|

Nine Mos. Ended Jan. 31, 2021 |

$ (10,089,785) |

|

|

FYE April 30, 2020 |

$ (1,601,931) |

|

|

FYE April 30, 2019 |

$ (751,332) |

|

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Nine Mos. Ended Jan. 31, 2021 |

$ (917,016) |

|

|

FYE April 30, 2020 |

$ (811,584) |

|

|

FYE April 30, 2019 |

$ (753,388) |

|

As of January 31, 2021, Red Cat had $471,652 in cash and $12.7 million in total liabilities.

Free cash flow during the twelve months ended January 31, 2021, was negative ($1 million).

IPO Details

RCAT intends to sell 4.9 million shares of common stock at a potential price of $4.10 per share for gross proceeds of approximately $20 million, not including the sale of customary underwriter options.

No existing shareholders have indicated an interest to purchase shares at the IPO Price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (ex- underwriter options) would approximate $142 million.

Excluding effects of underwriter options and private placement shares or restricted stock, if any, the float to outstanding shares ratio will be approximately 14.39%.

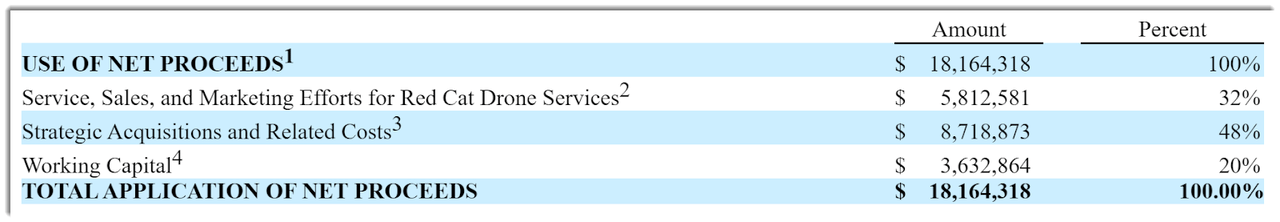

Per the firm’s most recent regulatory filing, the firm plans to use the net proceeds as follows:

Management’s presentation of the company roadshow is not available.

The sole listed underwriter of the IPO is ThinkEquity.

Valuation Metrics

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$138,948,898 |

|

Enterprise Value |

$141,835,524 |

|

Price / Sales |

39.80 |

|

EV / Revenue |

40.62 |

|

EV / EBITDA |

-52.48 |

|

Earnings Per Share |

-$0.31 |

|

Float To Outstanding Shares Ratio |

14.39% |

|

Proposed IPO Midpoint Price per Share |

$4.10 |

|

Net Free Cash Flow |

-$1,023,949 |

|

Free Cash Flow Yield Per Share |

-0.74% |

Source: Company Prospectus

Commentary

Red Cat is seeking to uplist its stock to Nasdaq likely for greater visibility and to take advantage of its recent acquisition of Fat Shark, which promises to sharply increase the firm’s revenue base with its around $7 million in annual revenue.

The firm’s financials are starting to show revenue increases as a result of the acquisition.

Free cash flow for the last twelve months was a negative $1 million.

Sales and Marketing expenses as a percentage of total revenue dropped to 3.1% and its Sales and Marketing efficiency rate was

The market opportunity for providing case-specific drone technologies is large and expected to grow at a very high rate of growth over the coming years, so the firm enjoys positive industry dynamics in its favor.

ThinkEquity is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (11.3%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

As for valuation, management is asking IPO investors to pay an enterprise value / revenue multiple of nearly 41x. Even if forward revenues grow to $7 million, it’s still a 20x EV/Revenue multiple.

RCAT is pursuing an acquisition approach to expanding its offerings but management has yet to prove it can grow the business organically, so I'll watch the IPO from the sidelines.

Expected IPO Pricing Date: April 28, 2021.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

Author of IPO Edge

Get IPO Edge with actionable research on next-generation high growth stocks

IPOs, Tech

Contributor Since 2013

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on all U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Released April 27, 2021